Pasar saham Asia sebagian besar libur untuk Jumat Agung pada perdagangan Jumat (29/03/2024). Dolar AS juga menguat terhadap euro sebelum data inflasi utama AS

Diperbarui • 2024-01-17

Swiss National Bank (SNB) President Thomas Jordan has expressed that the recent appreciation of the Swiss franc has reached a point where it could significantly influence the inflation outlook. This observation indicates apprehensions regarding the strength of the Swiss franc and its potential consequences for inflation dynamics. The SNB has a track record of intervening in currency markets to prevent an excessive rise in the Swiss franc, as a robust franc can negatively impact the nation's export-focused economy and contribute to deflationary trends. These remarks were made during an interview on Bloomberg Television at the World Economic Forum's annual meeting in Davos, Switzerland.

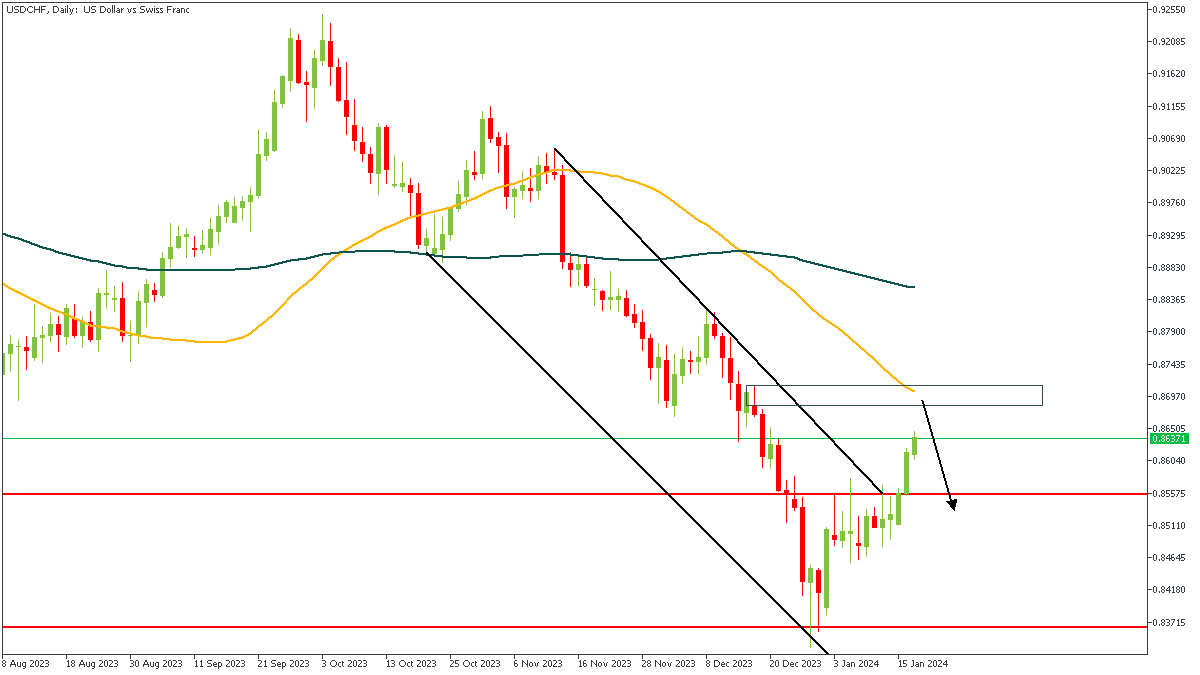

We recently saw a surge in the price action on USDCHF as a result of the rejection from the demand zone on the weekly timeframe. However, since the overall direction of the market is bearish, I see the likelihood of a bearish continuation from the highlighted area of supply as shown on the chart. The 50-period moving average can be considered a confluence in support of the bearish sentiment.

Analyst’s Expectations:

Direction: Bearish

Target: 0.85545

Invalidation: 0.87156

CADCHF recently made a bounce which I consider to be an attempt to retest the supply zone, and possibly the 50-period moving average as well. The convergence of the two resistance trendlines at the supply zone, and the bearish array of the moving averages can be considered a further confirmation of the bearish sentiment.

Analyst’s Expectations:

Direction: Bearish

Target: 0.63608

Invalidation: 0.64810

The price action confirmation on EURCHF is not exactly my best preferred, but I believe it should fall in line with the other two analyses I showed earlier. In the case of EURCHF though, I expect to see a reaction from this supply zone as I have marked out on the chart.

Analyst’s Expectations:

Direction: Bearish

Target: 0.93174

Invalidation: 0.94502

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more trade ideas and prompt market updates on the telegram channel.

Pasar saham Asia sebagian besar libur untuk Jumat Agung pada perdagangan Jumat (29/03/2024). Dolar AS juga menguat terhadap euro sebelum data inflasi utama AS

Dolar Australia menguat tipis di awal perdagangan akhir pekan ini, namun masih dalam tren penurunan. Pasar diperkirakan sepi karena memperingati Jumat Agung. Dolar AS menguat karena data ekonomi AS menunjukkan ekspansi,

Pasar saham Asia memiliki sentimen sideways dengan bias bearish pada perdagangan Kamis (28/03/2024), karena adanya sentimen ketidakpastian menjelang data indeks harga PCE AS..penjualan ritel Australia dirilis lebih kecil dari perkiraannya.

Yen Jepang gagal memikat para investor pada perdagangan Selasa (02/04/2024) meski ada peluang atas kemungkinan intervensi dan..Sentimen penghindaran risiko masih berpotensi memberikan kekuatan pada safe-haven

XAUUSD naik ke rekor tertinggi baru pada perdagangan Senin (01/04/2024), di tengah meningkatnya spekulasi penurunan suku bunga..melanjutkan kenaikan kuat minggu lalu hingga membentuk level puncak baru sepanjang masa

Pasar saham Asia sebagian masih libur dan sebagian lagi menguat pada perdagangan Senin (01/04/2024), karena optimisme data pabrikan Tiongkok mendukung..potensi intervensi otoritas Jepang terhadap yen Jepang diperkirakan berada di zona 152 – 155 yen.

FBS menyimpan catatan data Anda untuk menjalankan website ini. Dengan menekan tombol "Setuju", Anda menyetujui kebijakan Privasi kami.

Permintaan Anda diterima.

Manajer kami akan menghubungi Anda

Permintaan panggilan balik berikutnya untuk nomor telepon ini

akan tersedia setelah

Jika Anda memiliki masalah mendesak, silakan hubungi kami melalui

Live chat

Internal error. Silahkan coba lagi

Jangan buang waktu Anda – tetap awasi dampak NFP terhadap dolar dan raup profitnya!