Oil: coming to six-year highs

The outlook for the oil market is relatively upbeat at the moment. A month ago, OPEC+ decided to raise the oil supply in view of the recovering demand. A week ago, the cartel reaffirmed that decision keeping the same upbeat projection for the oil market for the rest of the year. As a result, WTI oil rose to challenge the March highs of $68 and looks set to reach $70. If that happens, the zone of six-year highs of $70-76 will be open for bulls.

In the meantime, traders need to be ready to see the oil price bounce downwards from those highs or go sideways. Trading below $70, the WTI oil price is already considerably high against the previously announced observers’ expectations for 2021. The resistance above $70 may prove to be stronger than before as the markets are stabilizing, and the recovery, as dynamic as it is in the US, may not push the oil market forever. Therefore, keep an eye on the key resistance of $70 and watch how the oil price behaves around it. Prepare for all scenarios from sudden plunges to prolonged periods of flat horizontal patterns.

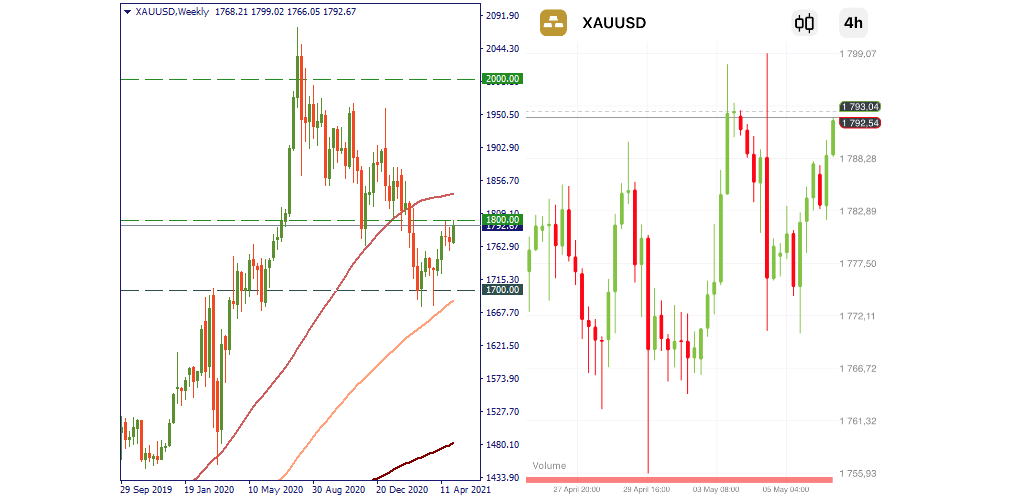

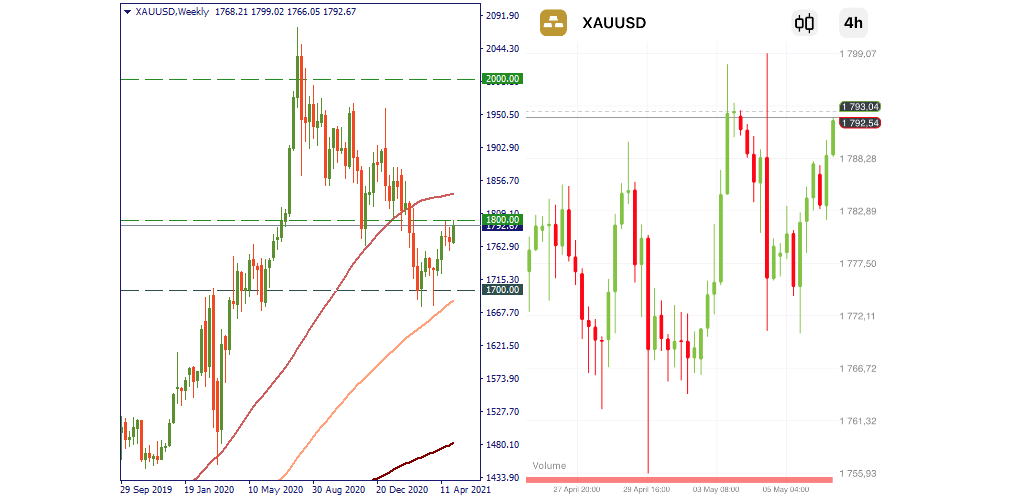

Gold: breaking trend at $1,800?

A weekly chart gives a very clear view of the gold price performance. So that, the nine-month downtrend that started at the highs of August above $2,000 hasn’t seen any change. However, the current resistance of $1,800 may be a turning point. If the gold price crosses it, breaks the resistance of the 50-MA, and manages to stay above these marks, it’ll be a trend change. In this case, bulls will claim the right to go for $2,000.

However, is there a fundamental base for such a move? The gold price reached $2,000 because of the devastating effects of the virus and the pessimism that’s been ruling the markets in the first part of 2020. Now, we’re in recovery mode. Although there are many states where the infection rates are rising, the virus is no longer a novelty. Gold needs a more solid reason to set a new record. May it be another global geopolitical crisis? Given the current trends in the relations between the US, Europe, and China, there is a possibility. If things go bad between those countries, gold will definitely reach $2,000.

LOG IN