33% Virgin Galactic jump is a fake

The well-known space tourism company opened ticked sales to the public. But despite retail traders' frenzy, we think the company still has a murky future. In this article, we're going to crack some of the myths about the company's financial conditions and look for a short- and a long-term prospect.

The past several months of Virgin Galactic

Since November 2021, when we told you about the possible breakout of the ascending trendline, the company has lost 58% of its capitalization. There are several events leading up to such a plunge:

- First, the company owner, Sir Richard Branson, sold $300 million worth of shares, taking the total offloaded this year to $600 million. Then, after pandemic restrictions ease, the unlocked capital is reportedly set to be pumped into Branson's travel and leisure businesses.

- Second, SPCE announced its intention to offer a $425 million aggregate principal amount of convertible senior notes due 2027 with an option for the first purchases to acquire $75 million more notes. These assets are unsecured obligations with semi-annual payments. The reason is quite simple: the company gathers money to fund their development and advertising.

Current actions of the company

What happens when you sell part of your company and then issue $500 million worth of notes? Of course, the soar of uncertainty and a sharp decline in stock price. And with the hopes are fading, SPCE makes a statement. It opens ticket sales with a $450 000 fee and $150 000 initial deposit, with 1000 tickets put on sale. Moreover, the price for the tickets will increase as sales go.

For much of the last decade, the company has had about 600 reservations for tickets on future flights, with those tickets mainly sold between $200,000 and $250,000 each. But as for now, only several people went to space, including Brandson himself.

SPCE plans to start the commercial spaceflights at the end of 2022. However, at the time of their IPO, Virgin Galactic targeted space tourism as their first business to generate a profit. Commercial flights were supposed to begin around this time last year. Additionally, the company expected to have another flight vessel done by the end of last year, capable of bringing passengers along the journey to the edge of space. Neither goal was met.

Virgin Galactic price forecast

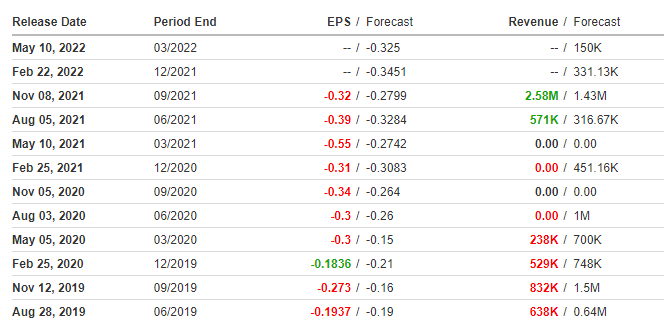

The global Space Tourism market is projected to reach $2.55 billion by 2027, from 0.885 billion in 2020. Fortunately for Virgin Galactic, the market for space tourism is expected to be in a supply constraint, so they will still be able to find customers. However, the company's actions are far from perfect. Delays in spaceflight result in never-ending negative EPS with a net loss of $48 million, considered a good sign (just a quarter ago, net loss was $66 million).

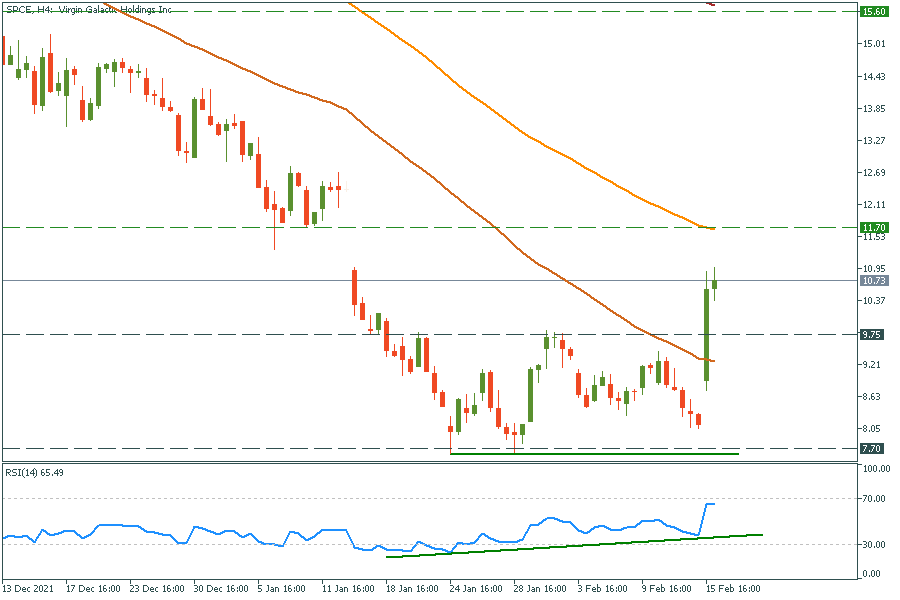

We see a surge in traders' activity on the chart due to positive news and expectations of future earnings. But we wouldn't be so optimistic about substantial further growth; SPCE formed a bullish divergence and, on the positive news, can rise as high as $15.60 per share, which is a 55% gain. Then, we expect a loss of interest and a return to the 8-12 area.

SPCE H4 chart

Resistance: 11.70; 15.60

Support: 9.75; 7.70

Don't know how to trade stocks? Here are some simple steps.

- First of all, be sure you've downloaded FBS Trader app or Metatrader 5. FBS allows you to trade stocks only through this software.

- Open an account in FBS Trader or the MT5 account in your personal area.

- Start trading!