Alibaba: Have You Lost Your Faith in China?

What happened?

Nearly one year later, Beijing started to concern about Alipay, which combines a digital payments platform with other traditional financial products such as loans, wealth management, and insurance. On September 13, Beijing reported that it will force the Ant Group, a subsidiary of Alibaba, to abandon the Alipay payment service and create a separate lending application. The new project will be partially owned by the government.

Alipay is currently used by over a billion people. Service revenue makes up a huge chunk of Ant Group's profits. In addition, ten percent of all consumer loans in the country were disbursed through the application last year.

Alibaba stock fell by 8% as the price reached the $153 level, following the Chinese government announcement. New rules will affect all online lenders in China. The central bank told industry participants that lending decisions should not be based on firms' data but data from a separate authorized company should be used to assess the creditworthiness of customers.

Technical analyses

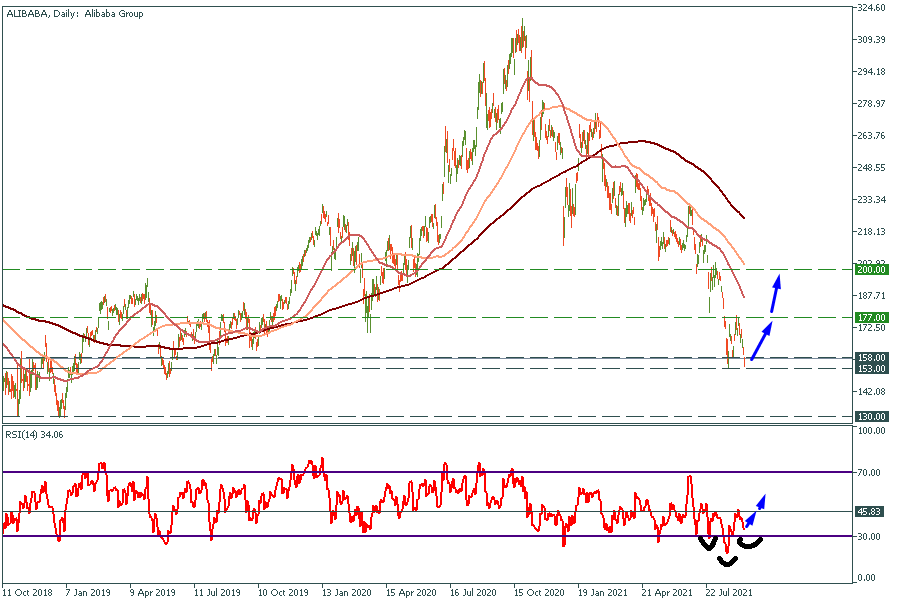

Alibaba, daily chart

Alibaba stock fell by more than 50% since its all-time high in October 2020. It’s a great drop, with was caused by the Chinese government pressure. However, it didn’t affect Alibaba’s financial and fundamental position. Alibaba is still one of the biggest online commerce companies.

That’s why we suppose that some pullback is expected to happen in Alibaba stock. According to the RSI, the price came in the oversold area. The RSI might form reversed "head with shoulders" pattern, which will be a strong bullish sign. If by the end of this week sellers do not push Alibaba under the $153 support level, we will see a pullback up to $177.

In the worst scenario, if $153 support gets broken through, Alibaba stock will dump to $130.