Brexit outlook

Background

The United Kingdom always was a separate part of the European Union and there was not a shock when it decided to leave it. A referendum about Brexit was held on June 23, 2016. UK citizens could decide whether the UK should leave the European Union or not, so 51.9% voted for leaving. From that time negotiations about the most painless way of exit for the UK started.

Brexit negotiations

Officially negotiations started a year after the referendum. It happened on June 19, 2017.

There are three important issues on which the UK and the EU have already agreed: the “divorce bill” – the amount of money the UK will need to pay for leaving; what will be with UK citizens living in the EU and EU citizens living in the UK, what will be with the Northern Ireland border.

The most important for the financial market decision was the “divorce bill” that is $55 billion. Economic experts concluded that this amount of money is appropriate considering losses that the UK can have if there is no deal with the EU, no deal can cost 6.5% hit to GDP by 2030. When Brexit happens, the UK will lose the huge market with profitable terms. Trading under WTO rules will not help the UK to save its economy. The pound will depreciate, currency effects and tariffs will affect inflation, there will be fall in job, consumption and investment rates.

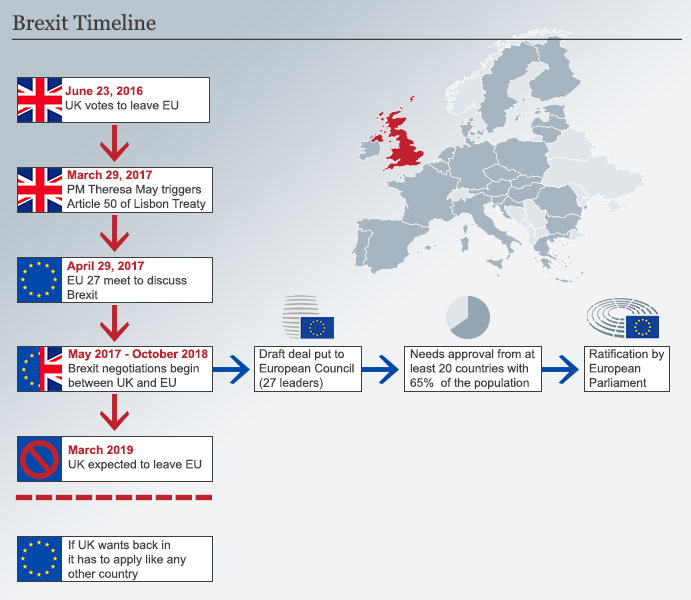

Below you can see the main steps of negotiations that shall lead to the Brexit on March 29, 2019.

However, nowadays, there are doubts that the agreement between the UK and the EU will be ratified at an appropriate time.

Problems

The Financial Times counted the loss that the UK has because of the Brexit. It counted that the UK has already lost more money than it pays in EU contributions, the loss is at around 340 million pounds a week.

If there is no agreement by March, it is more likely that companies will start to set up subsidiaries on the continent as British banks have already started to do.

Currency affection

Since Britain voted to leave the EU its currency has been beset by volatility, and the trend was exactly downwards until recent weeks. The currency market nervously reacted to news about Brexit negotiations.

Nowadays, we can see that the GBP is appreciating against the US dollar, but a lot of factors should be taken into account, firstly, the weakness of the US dollar.

How the negotiations will affect the GBP in the future is unclear. There are several scenarios. It depends if there is “a deal” between the UK and the EU or there is not at all. It is better for the UK to make an agreement with the EU to protect its economy, keep markets and support the rate of the pound.

Conclusion

Nowadays, we can see that the sterling is growing but we should not forget about accompanying factors such as, for example, the US dollar weakness, the success of the Brexit negotiations, and other political issues, it is not so clear that the negotiations will be so successful in the future as well. If the UK loses the chance to make a good deal with the EU, it can have an even worse impact on its economy and the pound in the future.