CAD: NAFTA threats still press

On August 28, the CAD reached the highest level against the USD since the beginning of June 2018. The rise of the CAD was caused by the breakthrough in the NAFTA talks. The US and Mexico ended up with the new trade agreement.

Up to now, the Canadian dollar has been heading higher. But does it mean that all threats have passed? Of course, not. The agreement is reached only between the US and Mexico. Talks between the US and Canada haven’t started yet. As a result, up to now, US-Canada negotiations are the major driver of the CAD.

As usual, there are two options. The first one is when the US and Canada come to a new agreement. Another one is if countries are not able to resolve differences.

- In the first case, there are two options for Canada either it will join the US-Mexico agreement or it will make a new agreement with the US. As a result, the Canadian dollar will be able to appreciate further.

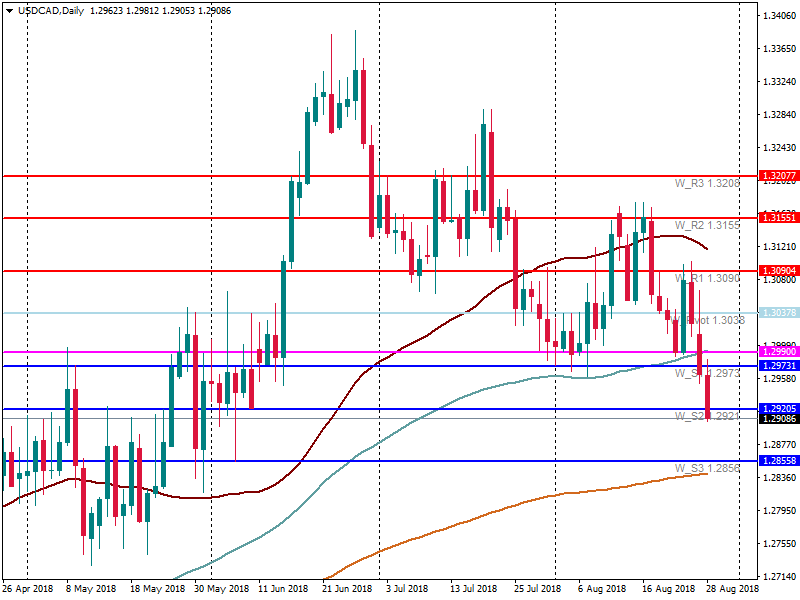

Let’s have a look at the technical side. USD/CAD has already tested below the second pivot support at 1.2921. Until there is no news on the negotiations with Canada or the market is calmed with positive news on the agreement, the pair will be able to stick below 1.2921. The next support is at 1.2856. However, it will be a very strong support for the pair as 200-day MA lies there. Moreover, on the weekly chart, we can see that 1.2921 and 1.2856 are the strong supports for the pair as well as 200-week and 50-week MAs lie there. Therefore, there are odds of the pair’s reversal.

- Another scenario is highly negative for the CAD. Mr. Trump said that he doesn’t want the agreement with Mexico to be called NAFTA anymore. As a result, we are witnesses of the end of the NAFTA. That’s why it’s highly important for Canada to come to an agreement with the US and Mexico. In case of no-deal, not only the lack of agreement will hurt the Canadian economy but also the US actions. Mr. Trump has already said that if Canada denies the agreement, the US will impose tariffs on its autos.

If Canada doesn’t join the agreement, USD/CAD will turn around. The pair will move to resistances at 1.2973 and 1.2990 (100-day MA). A weakness of the US dollar index will stop the pair from the further rise. However, if the USD is able to recover, the pair will break resistances and will exit the pivot support area.

Making a conclusion, we can say that the trade agreement remains the major driver of the CAD this week. The further direction of the USD/CAD pair will depend on the results of the talks between the US and Canada. In case of the agreement, the CAD will appreciate. In case of the disputes between the countries, the CAD will fall.