Dollar pares gains, equities trim losses ahead evening trading

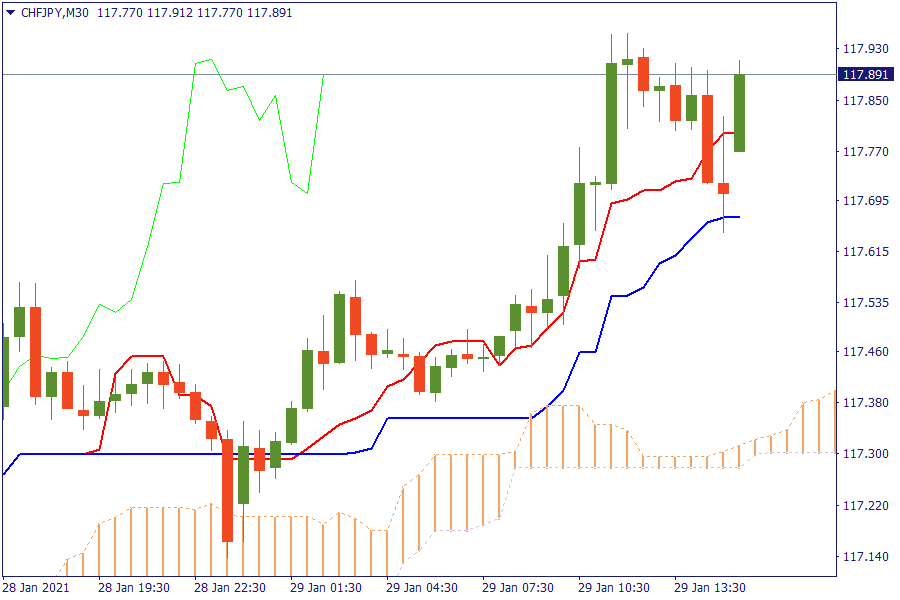

Ichimoku Kinko Hyo

CHF/JPY: The pair is trading above the cloud. An upward pressure would lead the pair to exit further the cloud, confirming a bullish outlook.

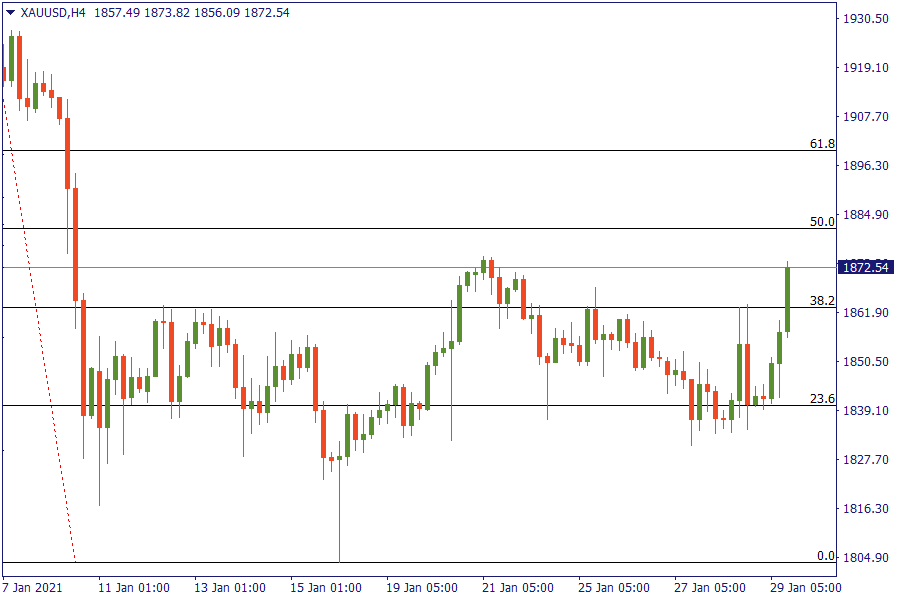

Fibonacci Levels

XAU/USD: Gold after a remarkable rally is trading above 38.2% retracement area.

US Market View

U.S. stocks are seen trading lower Friday, with the week’s volatile trading, sparked by retail traders’ activism, set to continue. The main U.S. equity indices are on course for their worst week since the end of October, amid heightened volatility spurred by speculative trading from retail investors. U.S. stock markets are set to open clearly lower again, amid expectations that hedge funds will again be forced to liquidate long positions to meet margin calls on shorts that are again being squeezed by retail traders.

Oil prices edged higher Friday, boosted by upcoming supply cuts from Saudi Arabia, the largest exporter of oil in the world, as well as falls in U.S. crude stockpiles.

The Eurozone economy may have shrunk less than estimated in the fourth quarter, according to releases from some of its bigger member states on Friday. Germany’s gross domestic product rose by 0.1% in the quarter, a little better than the stagnation implicit in the country’s earlier estimate for 2020 as a whole. French GDP fell by 1.3%, much less than the 4% drop expected,

USA Key Point

- The NZD is the strongest and the JPY is the weakest.

- Johnson & Johnson says its vaccine is 66% effective overall.

- ECB unlikely to cut rates as benefit seen limited.

- Silver in the spotlight