Dollar slightly firmer in European morning Session

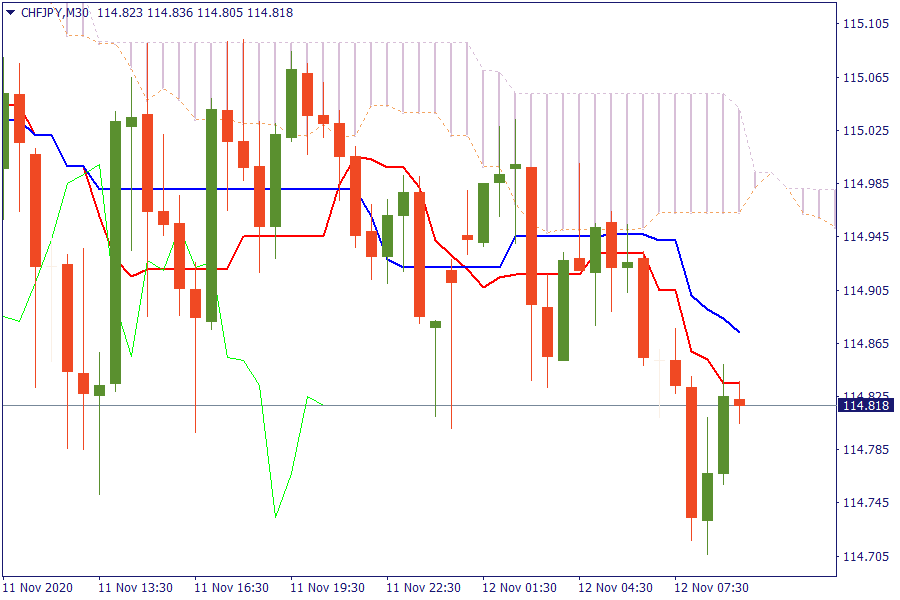

Ichimoku Kinko Hyo

CHF/JPY: The pair is trading below the cloud. Downward pressure would lead the pair to exit further the cloud, confirming a bearish outlook.

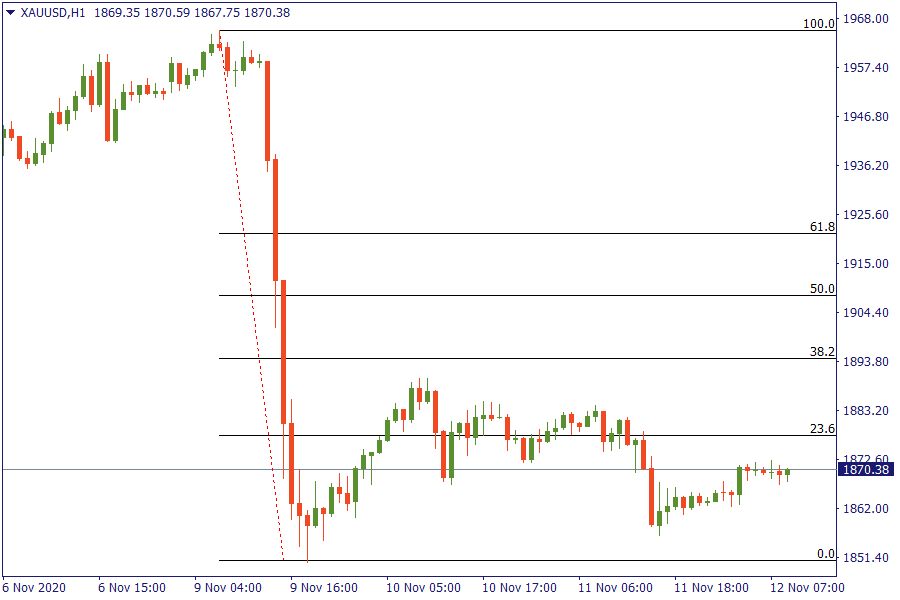

Fibonacci Levels

XAU/USD: Silver after a sell off is trading below 23.6% retracement area. It seems that a bearish flag is formatting.

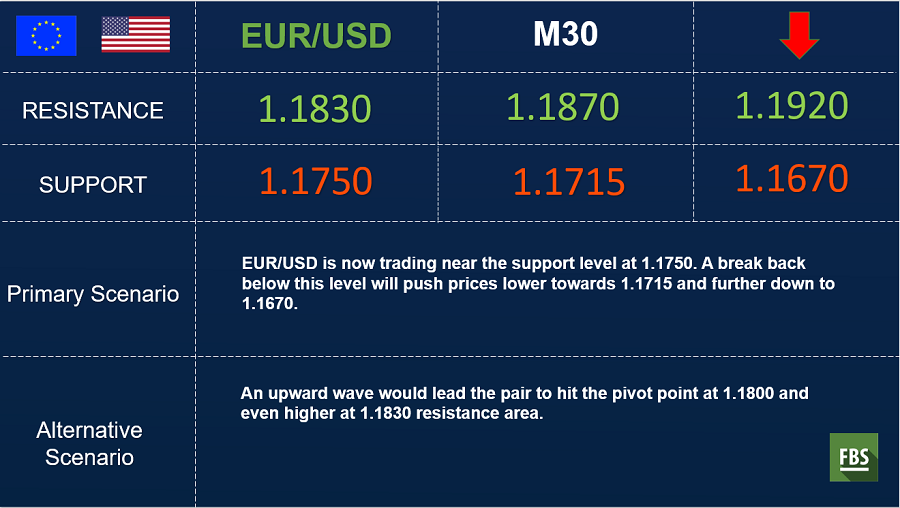

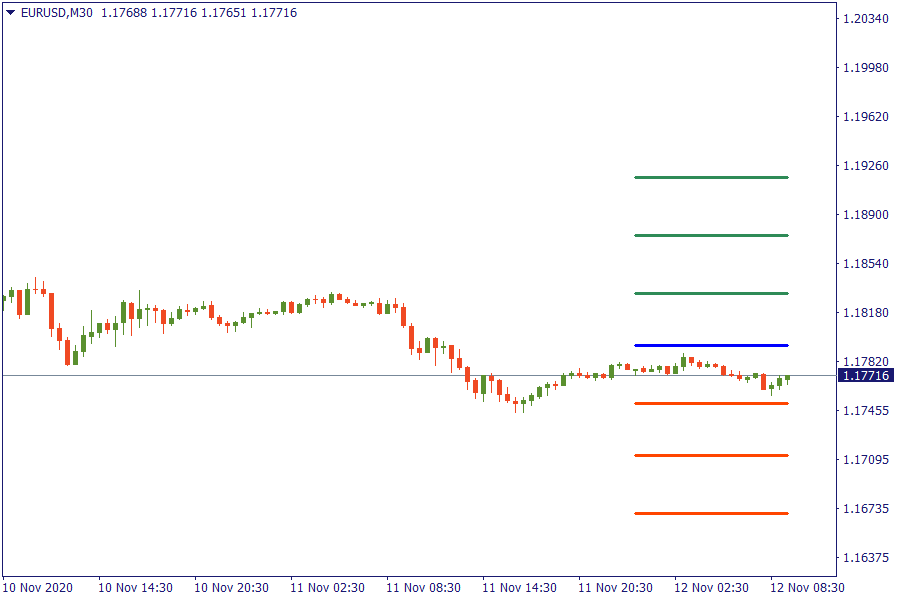

EU Market View

Asian equity markets traded mostly lower as sentiment gradually deteriorated from the mixed performance stateside. Oil futures traded near two-month highs due to hope for a vaccine and a larger-than-expected drawdown in U.S. crude inventories. U.S. stocks were mixed as investors switched back to technology stocks and away from economically sensitive sectors as they weighed COVID-19 vaccine progress and the likely timing of an economic rebound.

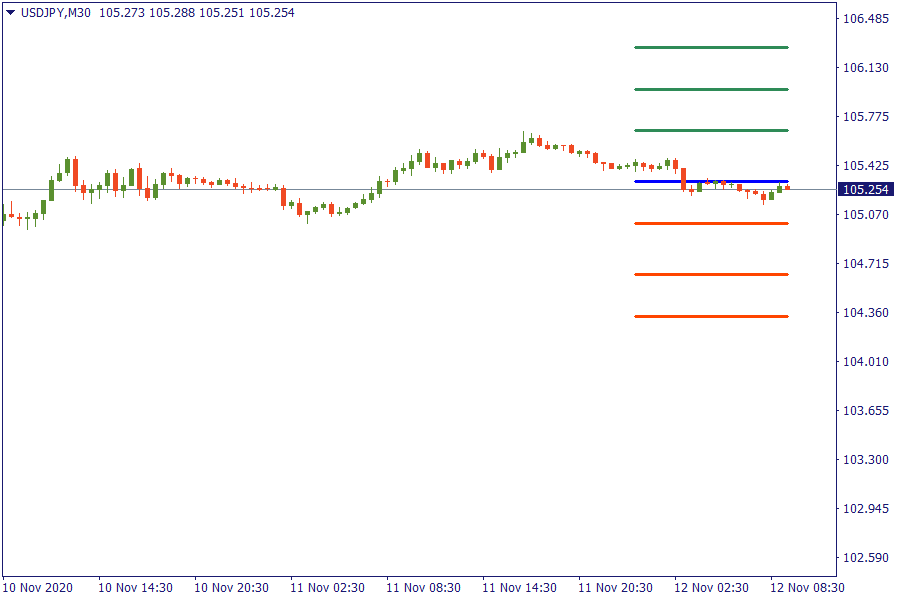

Looking ahead, highlights from the macroeconomic calendar include UK GDP, US CPI and Initial/Continued Jobless Claims, ECB's Lagarde, de Guindos, Mersch Schnabel; Fed's Powell, Williams and Evans, BoE's Bailey speeches. The U.S. dollar edged lower against the yen and yuan as traders adjusted positions before U.S. President-elect Joe Biden takes office next year.

EU Key Point

- UK September monthly GDP comes at +1.1% vs +1.5% m/m than expected

- OPEC reportedly looking to extend current output cuts for another 3-6 months

- Germany reports 21,866 new coronavirus cases in the latest update today