EUR/USD closer to 1.2000 area

Ichimoku Kinko Hyo

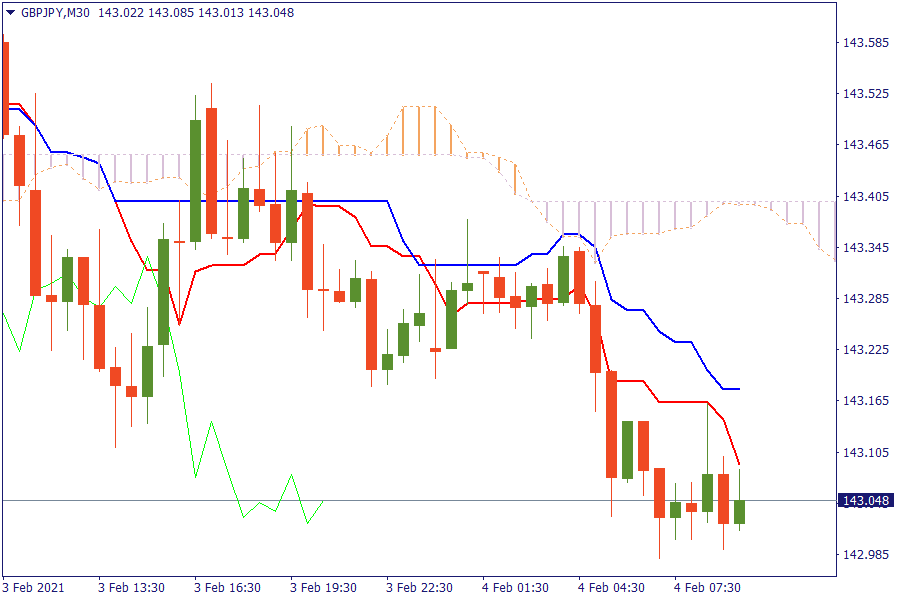

GBP/JPY: The pair is trading below the cloud. Downward pressure would lead the pair to exit further the cloud, confirming a bearish outlook.

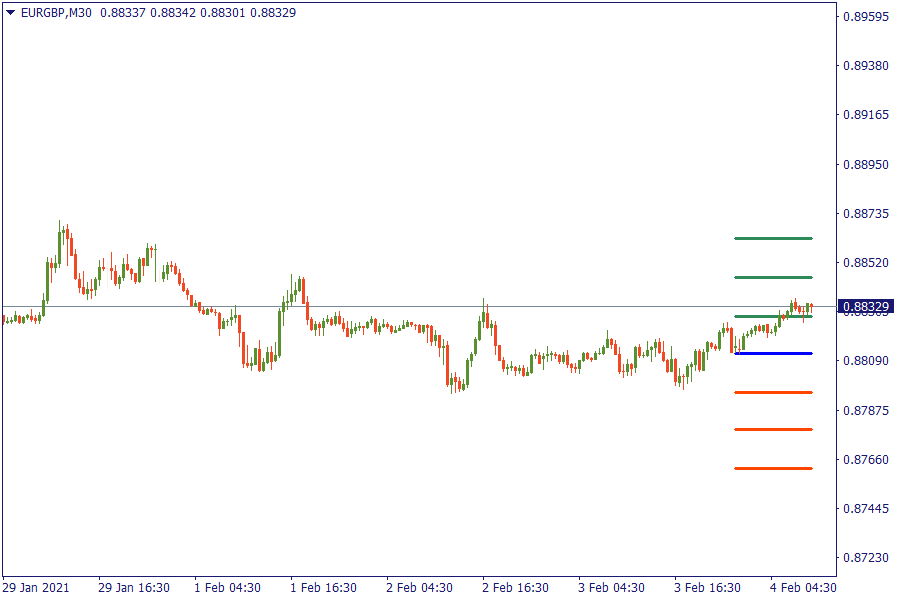

Fibonacci Levels

XAG/USD: Seems that the bullish euphoria has passed away. Silver bulls stands above 61.8% retracement area.

EU Market View

Asian equity markets were mostly lower following a flat lead from the US where focus centered on earnings and stimulus plans. Stocks dipped on Thursday as a spike in short-term Chinese interest rates fanned worries about policy tightening in the world's second-largest economy, although improving corporate earnings and easing market volatility helped stem losses. Expectations of a large U.S. stimulus package underpinned risk assets as the Democratic-controlled Congress sought to pass President Joe Biden's $1.9 trillion COVID-19 relief package without Republican support. While it is unclear how much compromise the Democrats are willing to make with Republicans who are calling for a smaller package, many investors expect additional spending of at least $1 trillion. Looking ahead, highlights from macroeconomic calendar include Eurozone & UK construction PMI, BoE rate decision, factory orders, Fed's Kaplan, Daly speeches.

EU Key Point

- Gold under pressure as technical breakdown puts the spotlight on $1,800.

- Germany reports 14,211 new coronavirus cases, 786 deaths in the latest update today.

- Fuji News Network reports Japan could begin coronavirus vaccinations on February 17.

- Moody's says it expects a lower default rate in the Asia-Pacific region in 2021.