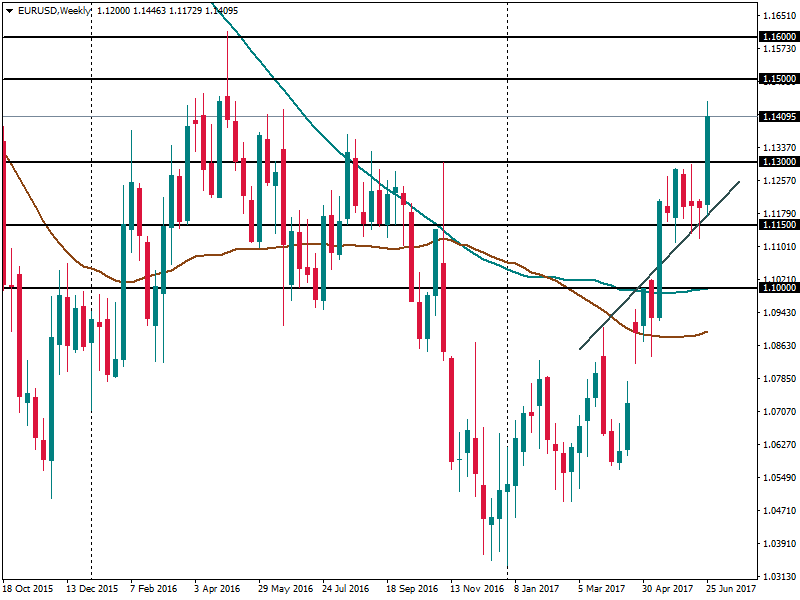

EUR/USD: outlook for July 3-7

After a period of quietness, EUR/USD leaped up to the 1.1450 area, its highest levels in 2017. Tuesday's speech by European Central Bank President Mario Draghi has inspired the euro’s bulls. Draghi downplayed deflation risks and now traders are quite sure that the regulator is getting ready to start reducing its aggressive monetary stimulus later this year. The US dollar, on the contrary, was weakened by the market’s lack of belief in further Federal Reserve’s rate hikes this year.

In the European economic calendar, one will see the data of medium and low importance. The ECB monetary policy meeting accounts stand out as this document has potential to provide more insight into the regulator’s thinking. Apart from this, follow the US data releases as they might be the main short-term drivers of the pair.

Bullish trend in EUR/USD is in place: growth resumed after 5 weeks of consolidation. The pair’s ability to rise above 1.1300 is a serious bullish sign as it used to be a significant obstacle. The next significant levels on the upside are 1.1500 ahead of 1.1600. These levels limited the pair’s upside since the start of 2015. Analysts have started talking about the possibility of a bigger breakout for the euro as there won’t be much of resistance left if it pushes above 1.1700. Support has shifted up to 1.1300, 1.1265 and 1.1150. In our view, the best strategy is to look for the opportunities to buy the euro on its pullbacks to the downside. The main risks for the pair include surprisingly good data out of the US and hawkish comments from the Fed members.