Euro: Will the Bullish Pressure Persist?

The European economy trudged along with meager growth from the first quarter, lacking the oomph needed to gain momentum. As inflation persists and groceries become pricier, people become more reluctant to part with their hard-earned paychecks. The recent 0.1% increase from the previous quarter falls short of expectations, and the United States isn't faring much better, fueling concerns of a potential recession in the world's largest economy. Luckily, the eurozone managed to avoid a winter recession, partly due to mild weather that eased pressure on natural gas supplies. However, with Russia's reduction in gas supply due to its conflict with Ukraine, European governments and utilities are scrambling to find alternative sources to keep homes warm and industries running. It's an interesting dance the European economy is performing, and as forex traders, it's essential to watch these developments.

EURGBP - Daily Timeframe

There’s been a notable steady decline in the exchange rate of the Euro to the Great British Pound, as seen in the chart above. However, the movement still seems to have a long way to go. This means we may see more bearish pressure on the Euro possibility until the price reaches the highlighted pivot zone.

Analyst’s Expectations:

Direction: Bearish

Target: 0.84626

Invalidation: 0.85993

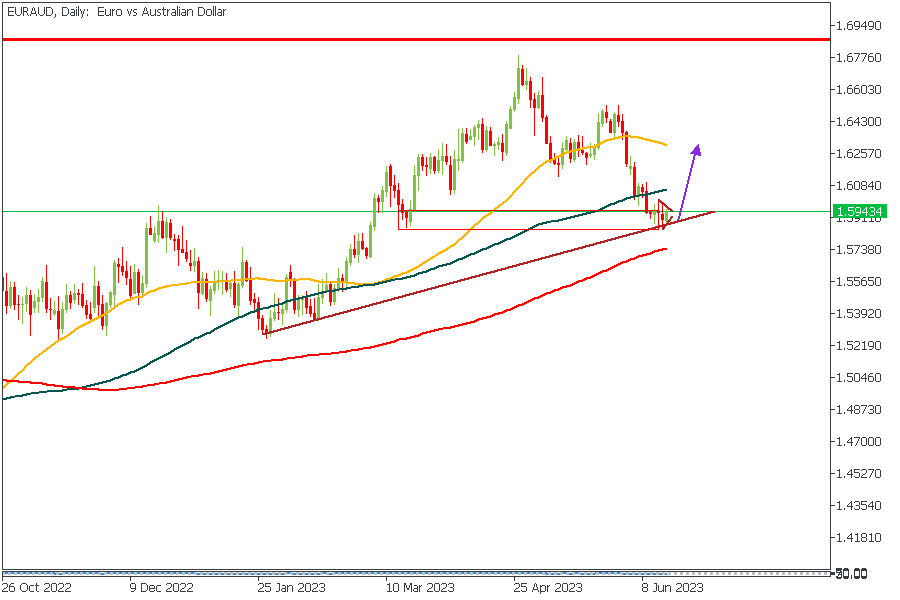

EURAUD - Daily Timeframe

EURAUD has reached an important demand zone and is stalling in hopes of a strong price movement in favor of either direction. At this time, my sentiment on EURAUD is bullish mainly based on the following sentiments;

- Drop-base-rally demand zone

- Support trendline; and the

- Bullish moving average array

Analyst’s Expectations:

Direction: Bullish

Target: 1.60371

Invalidation: 1.58337

EURJPY - Weekly Timeframe

Now this analysis is from a pretty high timeframe - the weekly timeframe. As such, it is important to understand that proper confirmation must be sought from lower timeframes like the 4 Hours and the Daily timeframe. The EURJPY chart shows price trading within a rising wedge while approaching an area of resistance. The bearish sentiment is supported by confluences from the resistance trendline, the pivot zone, and the Fair-Value-Gap (FVG) on the monthly timeframe.

Analyst’s Expectations:

Direction: Bearish

Target: 150.276

Invalidation: 159.208

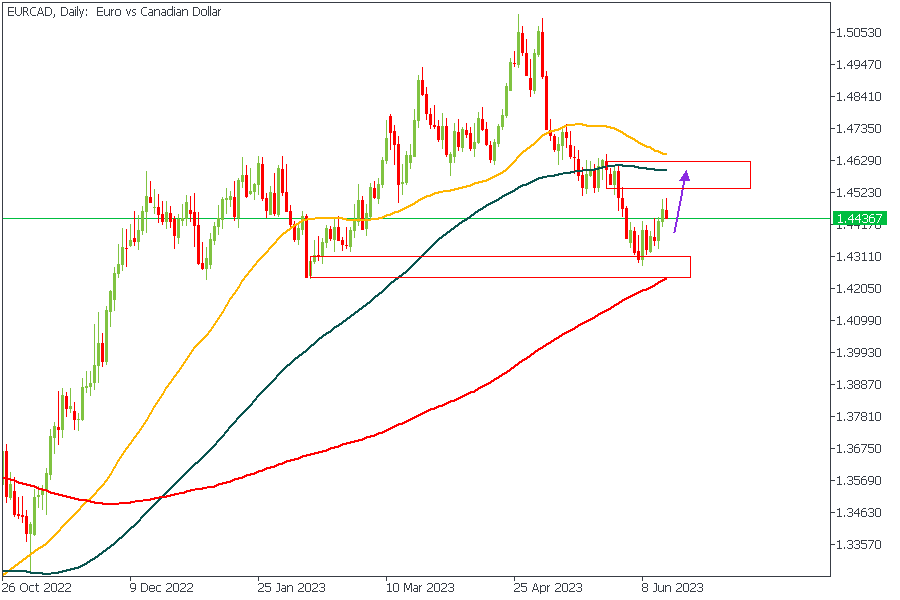

EURCAD - Daily Timeframe

EURCAD started a sluggish bull run a few days ago. The movement is losing some steam at the moment. However, I expect to see a continuation of the bullish movement after the completion of a slight bearish retracement. Though there seems to be just a little to go on, as far as confluences are concerned, the price action on the lower timeframe would judge the final outcome.

Analyst’s Expectations:

Direction: Bullish

Target: 1.45455

Invalidation: 1.43289

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.