European Currencies Ahead of the Banks' Statements

The Backstory

On Thursday, the 2nd of February, the Bank of England will publish its report concerning interest rates and inflation data for the Eurozone. Professionals and investors anticipate that Andrew Bailey’s lead team of policymakers will likely raise interest rates to 4%; the highest in over a decade, for the tenth time in a row.

How does this affect the Forex market?

If the ECB raises interest rates, it makes borrowing more expensive, which can increase the demand for the euro and cause its value to appreciate. Conversely, if the ECB lowers interest rates, borrowing becomes cheaper, which can decrease the demand for the euro and cause its value to depreciate.

What do the charts have to say?

Considering the fundamental breakdown above, we will draw our conclusions from the outlook of price on the charts using price action.

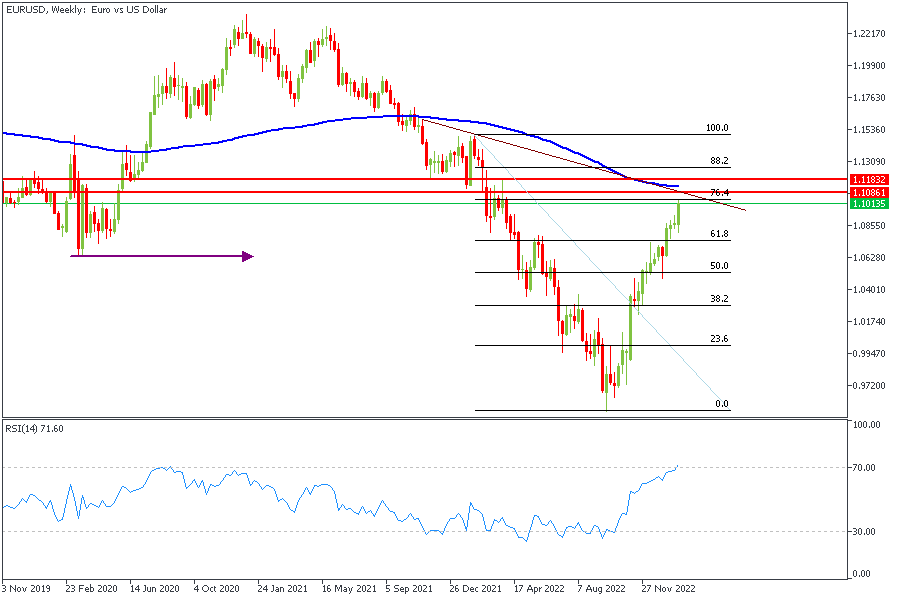

EURUSD - Weekly Timeframe

On the weekly timeframe as seen from the chart above, EURUSD is currently keying into a key resistance area. The 200-day moving average can also be seen aligning perfectly with a trendline resistance to serve as added confluence. We can also mention the Fibonacci retracement level, and the RSI (Relative Strength Index) which is in the overbought position (above 70). All these points are at the likelihood of a continuation of the overall downtrend on the weekly timeframe.

Analysts’ Expectations:

Direction: Bearish

Target: 1.07100

Invalidation: 1.11840

EURGBP - Daily Timeframe

EURGBP from the chart is trading within a rising wedge whilst trading above the moving average array. Though the direction here is not crystal clear, our expectation is that price will likely continue bullish until it rides into the induced wick of the swing high (highest high on the chart).

Analysts’ Expectations:

Direction: Bullish

Target: 0.90250

Invalidation: 0.87500

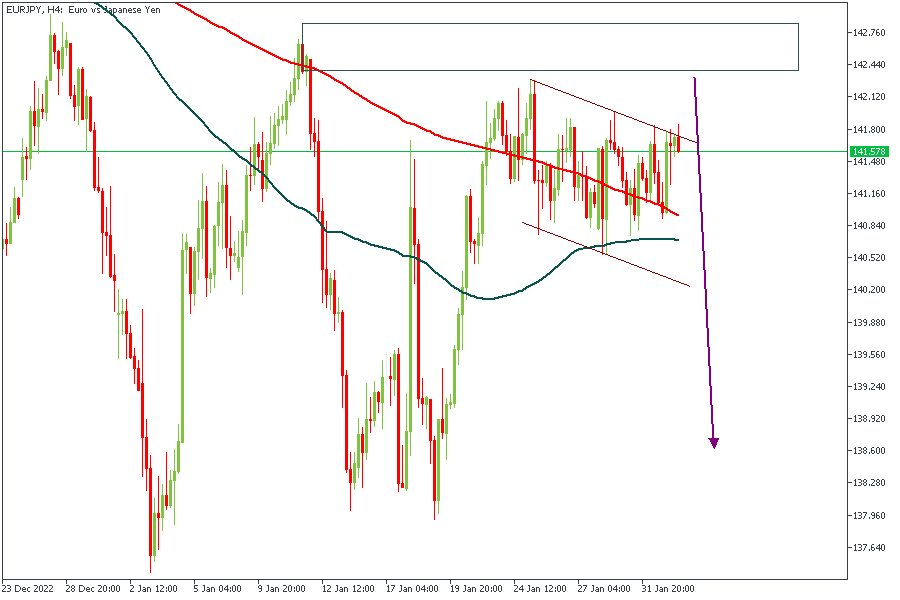

EURJPY- 4Hour Timeframe

The price action on the EURJPY chart shows an interesting area of accumulation (inside the downward channel). The marked rectangle is an area of supply that price is likely to tap into before giving the actual bearish impulse according to the trend based on the 100- and 200- day moving averages.

Analysts’ Expectations:

Direction: Bearish

Target: 140.200

Invalidation: 142.820

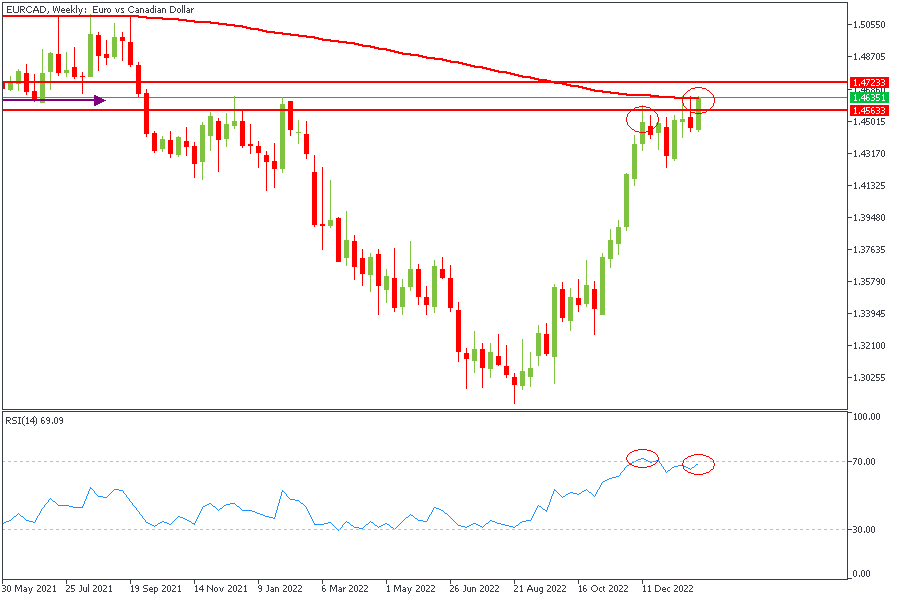

EURCAD - Weekly Timeframe

This EURCAD chart has a real potential of providing some good movement. The reason for this is because of the divergence on the RSI (Relative Strength Index) in the overbought position. The 200-Period Moving Average is also a formidable area of resistance, and considering how it overlaps the weekly pivot zone, we can expect some real action shortly.

Analysts’ Expectations:

Direction: Bearish

Target: 1.71450

Invalidation: 1.47250

Important

The trading of CFDs comes at a risk. Thus, to succeed, you must manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.