EURUSD: Scenarios Ahead of December CPI in the U.S.

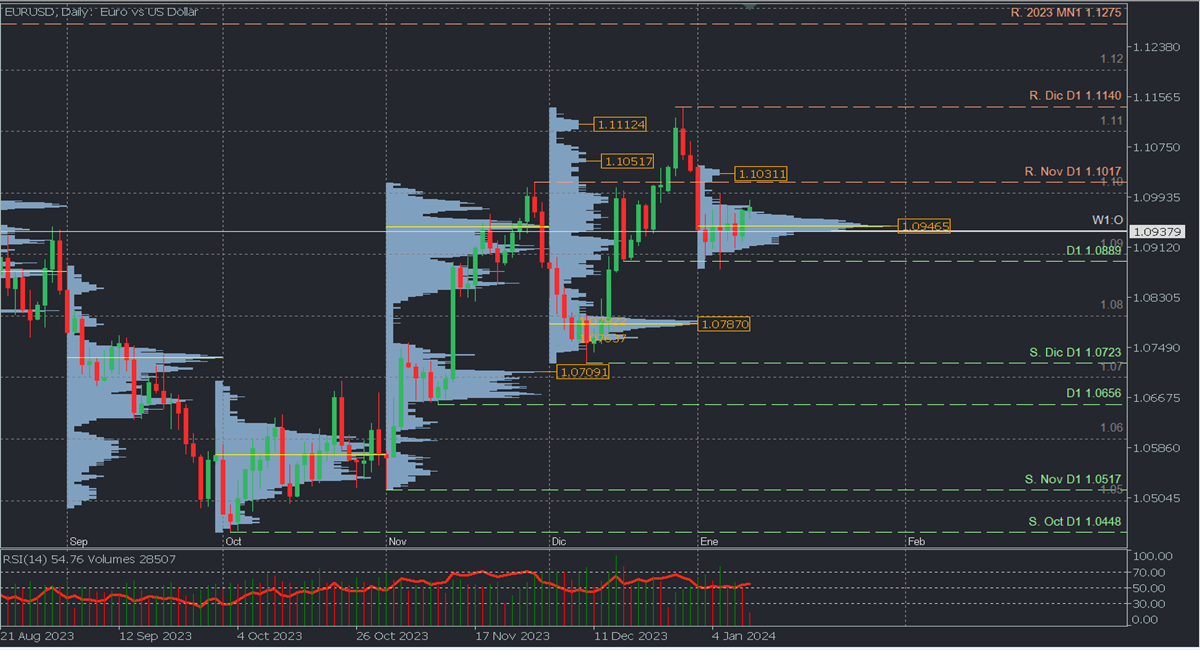

- Bearish Scenario: Sales below 1.0978 with TP1: 1.0950, TP2: 1.0938, and TP3: 1.0920 with S.L. above 1.0990 or at least 1% of the account capital*.

- Bullish Scenario: Buys above 1.0932 (wait for a retracement towards the weekly opening) with TP: 1.0978, TP2: 1.10, and TP3: 1.1017 with S.L. below 1.0920 or at least 1% of account capital*. Apply a trailing stop.

Fundamental Outlook

This Thursday, January 11, the U.S. Bureau of Labor Statistics releases the CPI data for December, with the overall annual figure expected to increase to 3.2% from November's 3.1%. However, the core measurement, which excludes food and energy prices, is anticipated to decrease to 3.8% from November's 4%. For monthly figures, a general increase of 0.2% is estimated from November's 0.1%, with the core figure expected to remain stable at 0.3%. These figures could provide insight into the Fed's potential rate cut in Q1.

After robust labour data and weak ISM PMI data, the CPI will serve as a new catalyst for market expectations, confirming the Fed's intention to start easing in the spring with only a 75- bpoint reduction throughout the year.

Macro Scenario from Daily Chart: Price Action and Volume Profile Analysis.

EURUSD the technical structure of the pair remains bullish, despite the tepid break of the key support at 1.0889 last week. A new lower low is needed to confirm a trend reversal. The November resistance at 1.1017 may act as a pivot level in forming a bearish reversal pattern, a scenario that will be confirmed with another low below 1.0889.

This scenario will be invalidated with a decisive breakout above the 1.1017 level, opening the door to continue the ascent above 1.1140.

Volume Profile: There is consolidation in the first two weeks of the year with a high volume concentration around 1.0946 (POC)*. While the month is still active, this may change, but it's essential to consider that as long as the price is above this POC, the price may continue bullish towards the next liquidity zone around 1.1031 - 1.1050.

Below the high-volume zone, one can expect sales towards the December buying zone around the uncovered POC* 1.0787.

*Uncovered POC. POC = Point of Control: It is the level or zone where the highest volume concentration occurred. If there was a downward movement from it, it is considered a selling zone. If there was an upward impulse, it is considered a buying zone.

Intraday H1

The consolidation of the week leaves uncovered buying zones at 1.0932, so sales are expected below 1.0979, and a possible breakout will extend the decline towards 1.09 and support at 1.0889, a new rebound until broken. A further rebound will be on the table if the buying zone between 1.0936 and 1.0938 acts as a pivot, in which case we will see a rise above the high-volume node of the early sessions of the day at 1.0978, with targets at 1.10, 1.17, and the average bullish range at 1.1028. The RSI in positive territory shows a bullish momentum that could be reversed by the day's data.

**Consider this risk management suggestion**

It is crucial to base risk management on capital and traded volume. A maximum risk of 1% of capital is recommended. Using risk management indicators such as Easy Order is suggested.

Disclaimer:

-----------------------------------------------------------------------------

This document does not constitute a recommendation to sell or buy financial products and should not be considered as a solicitation or an offer to engage in a transaction. This document is economic research by the author and is not intended to constitute investment advice, solicit securities transactions, or any other type of investment by FBS.While every investment involves some risk, the risk of loss from trading forex and other leveraged assets can be substantial. Therefore, if you are considering trading in this market, you must be aware of the risks associated with this product to make informed decisions before investing. The material presented here should not be interpreted as advice or trading strategy. All prices stated in this report are for informational purposes only.