GBP: Retail Sales Likely to Calm GBP

The Bank of England (BoE) is facing criticism for being slow to respond to the marked decline in UK price growth. The latest official data revealed a significant drop in consumer price growth to 3.9% in November, down from 6.7% in September. This unexpected decrease has prompted market reactions, with investors betting that the BoE will begin easing policy sooner than indicated in its official communications. Despite lower readings for core inflation and services price growth, the BoE's Monetary Policy Committee has insisted on readiness to raise rates above 5.25%. Analysts warn that the BoE might be waiting too long to pivot on monetary policy. The market is already pricing in a quarter-point cut by May, anticipating a total 1.38 percentage points cut in 2024. The BoE is cautious about relaxing monetary policy too early, considering potential risks like disruptions in shipping due to geopolitical events.

GBPUSD - D1 Timeframe

GBPUSD at the moment, as deduced from the chart, is approaching a drop-base-rally demand zone. It is worth noting that this demand zone enjoys complimentary support from other confluence factors including; trendline support, the 200-day moving average support, 88% Fibonacci retracement level, and the bullish market structure. My expectation here is bullish.

Analyst’s Expectations:

Direction: Bullish

Target: 1.27217

Invalidation: 1.24943

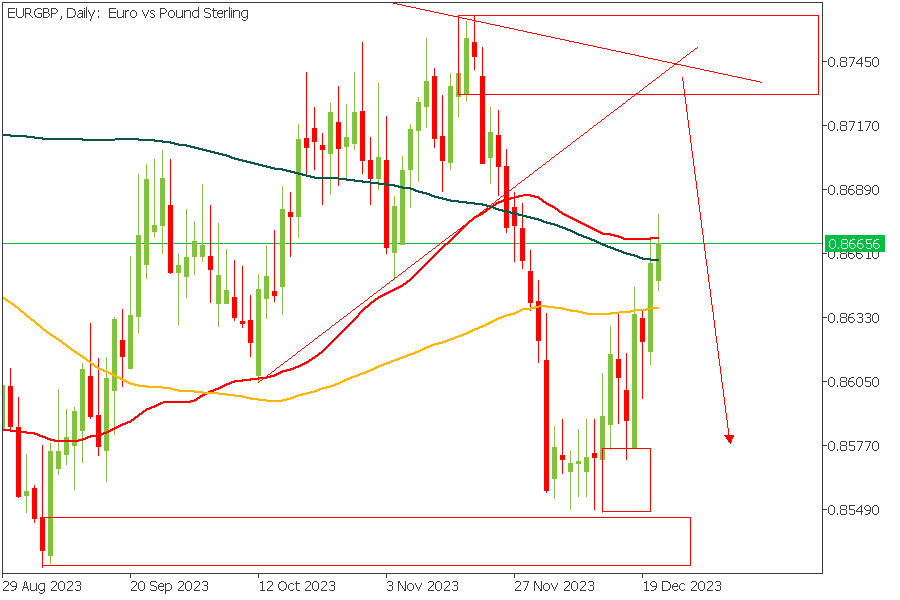

EURGBP - D1 Timeframe

EURGBP continues its bullish rally for the third week in a row, which begs the question; “when will the bullish momentum end?” As seen in the chart, I have highlighted the likely target of the bullish momentum, which is a supply zone that overlaps the intersection of two resistance trendlines, as well as the formation of a possible head-and-shoulder pattern. This gives me confidence of a bearish reaction from the supply zone once price reaches it.

Analyst’s Expectations:

Direction: Bearish

Target: 0.89529

Invalidation: 0.87678

GBPCHF - D1 Timeframe

Carrying on its bearish momentum which kicked off as a result of a rejection, and head-and-shoulder pattern from the 100-day moving average resistance, I believe GBPCHF is yet to reach its intended destination. In my opinion, I expect GBPCHF to create a new lower low, however, this is simply my thought, the price action will determine in the end whether I was right or wrong.

Analyst’s Expectations:

Direction: Bearish

Target: 1.06382

Invalidation: 1.07824

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.