GOLD: pills against uncertainty

Reversed world

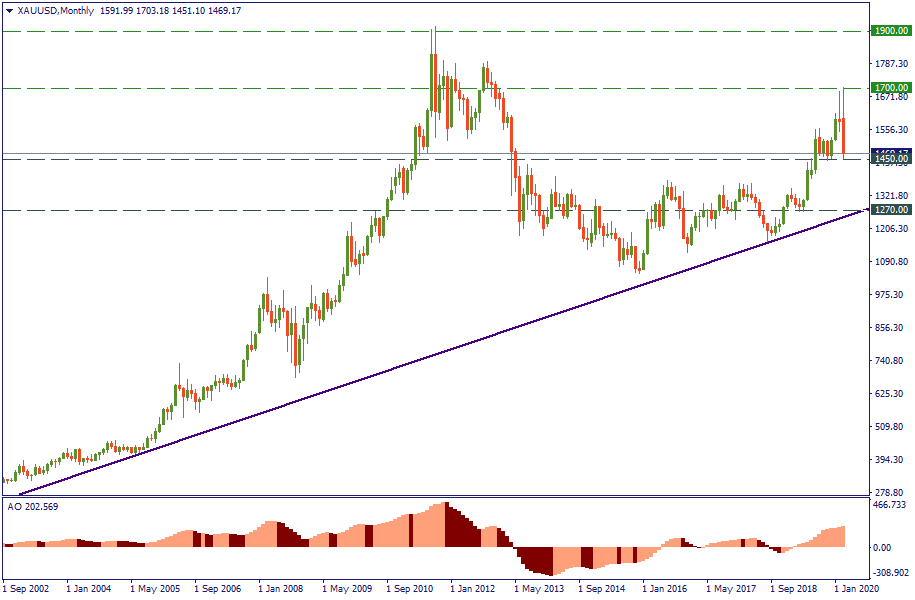

“Hey, gold, what are you doing over there at $1470? You are supposed to aim at $1900 – we are in a crisis here!” – that’s your righteous question to the precious metal. Although it did show an elevated trajectory for a while until recently, none of that seems “worthy” of the severity of the moment.

Especially, if you zoom in and see the most recent move of the shining metal. By falling to the support of $1450, it completely erased all the coronavirus-related gains and got back to where it was at the end of the year 2019.

Then, the US and China seized tariff fire and eventually announced that they were finally closing the theater of trade war and were on the way to sign the trade agreement. That was promising peace and prosperity to the nations, and the year was ending well, full of moderately optimistic expectations for 2020. Not for gold though. “Well”, - gold thought – “there is no place for me in such a confident and economically expanding riskless world”. Eventually, its price gave room to the calmness of the market and continued its usual trajectory of mildly gaining value.

The interesting thing is that when the virus came – that is marked by the red vertical line – gold did not change its trajectory. If you remove the last move it did - that brick-like drop from $1700 to $1450 – and ignore that the virus is now reigning the globe, you would have little ground to suspect that something unusual is happening in the world. At least, from gold’s point of view: according to the chart, it didn’t seem to worry about states bent into recession and tens of thousands sick or dead. Not more than before that, at least. The curve of the price performance did not change before and after the outbreak – the straight green line confirms that. Visually, until the second half of February, when China was in flames of the coronavirus, gold felt exactly like it did in December when the US and China were cheerful of each other’s commitments to the trade deal.

And there is another interesting thing – the very last episode of gold price performance. The said drop. It is absolutely extraordinary because it is – in theory – supposed to be reversed. A millennia-long-living asset bringing joy to the eye of its owner, gold normally gets multiplied attention from investors seeking to secure and guard their funds when troubles kick in. Now, it is all the contrary: it plunges like a fraudulent security of a third-grade bank.

What’s happening?

Red pill

First, a very superficial but a very fair conclusion is: gold is not a “yes-sir” safe-haven commodity and does not react to the world of events as such. Nor does it react “on time”. Therefore, second, it is not as predictable as, say, oil prices are in their response to the KSA-Russia oil price stalemate.

Does it mean that gold should be disregarded as a refuge to the money of scared investors? No. But we have to delineate gold as a physical asset owned by individuals and organizations and guarded in, say, Fort Knox and gold traded in multiple market platforms as a virtual asset through, including, derivatives such as CFDs. It is exactly the latter that we have in Forex. And these, although they do have a correlation to the price of the physical gold nuggets traded across the world, are largely affected by speculations and price manipulations, whatever they may be.

That’s why you cannot rely on gold 100% as on a safe haven all the time in your trade. You have to weigh it against other assets, measure its reaction to the events and elaborate your judgment about it. The general guidelines are there – gold rises in the times of crises – but that alone is not enough to make successful trades. You need tactical information on its movement and tactical levels to watch. And its recent drop from $1700 to $1450 is another justification for that. If you bought gold even at the lows of $1600 expecting it to reverse upward on the spooked market mood, you would lose your funds by the current moment.

So again, what’s happening?

Red pill #2

First, you have to factor-in market unpredictability into your general trading methodology. More precisely, you have to factor-in the fact the sometimes you will see prices move the way you cannot predict and do not understand. And that has nothing to do with available information: in hindsight, you can explain almost any phenomenon on the Forex market, regardless of your level of situational awareness. For example, how can we explain the recent performance of the gold price? Observers’ opinions vary from blunt references to omnipresent panic that nullifies the safe-haven immunity of gold to sophisticated schemes that advocate selling off this metal to suppress its automatically increasing equity share fueled by other assets’ reduction. While both may be relevant, for you that means one honest confession cited by Bloomberg after US Fed’s failure to make markets happy by the rate cut:

"The traditional rules are out of order and there is nothing which can be classified as a safe haven – not even gold".

Note: this “even” underlines that fundamentally, gold has an undisputed recognition as a reserve asset, but at the moment, it does not function as it normally would.

Blue pill

Steel started gaining value as it seems to be a “newly-founded” safe-haven asset as seen from the perspective of the Chinese market. But we are not suggesting you piling up steel rods in your backyard.

The suggestion is: be flexible. Treat gold as your usual currency pair. Don’t take it for granted that it is “supposed” to rise in bad times. It is not, as you have already learned. Not always, at least. And one apparently cannot really know when it follows the default rule, and when it doesn’t. But one can always apply the same rules of observation and market interpretation which are applied to the rest of the Forex market. Follow the trend, reinforce it with fundamentals. If these don’t work, go technical. Once you have indications for upward reversal – buy. Once you have a downward move anticipated – short. Currently, from a purely technical perspective, a short-term upward correction is likely to happen because there is no fundamental reason to press on for a non-stop plunge while the Awesome Oscillator and the hesitation at the current level of $1470 indicate an upward-sideways mood.

Blue pill #2

No pain no gain. But as Warren Buffet said, Mr. Market doesn’t force you to trade. If you feel like you are confident to do it, you are welcome – you have all the instruments, and FBS is all but available to help you. If not – come any other minute, hour or day – he will always be glad to serve you with opportunities to make profits.

P. S.

However, keep in mind that Mr. Market, although happy to serve you endless chances of benefit, doesn’t decide when the next coronavirus comes. Therefore, don’t lose your chance to use this once-in-a-decade strike of nature to your financial advantage.