How the Brexit deal affects EUR/GBP

The pound exchange rate remains a highly discussed topic, nowadays. We can see the big volatility of the pound since the Brexit referendum. So it is too difficult to forecast what will happen to the pound. Recent events created even more doubts and predictions.

So let’s look at events that affected the EUR/GBP rate and what financial experts predict.

On last Thursday the BOE Governor Mr. Carney announced the possibility of the soon interest rates hike based on the February Inflation Report projections. After the statement of the Governor, analysts raised forecast from two to three hikes in 2018.

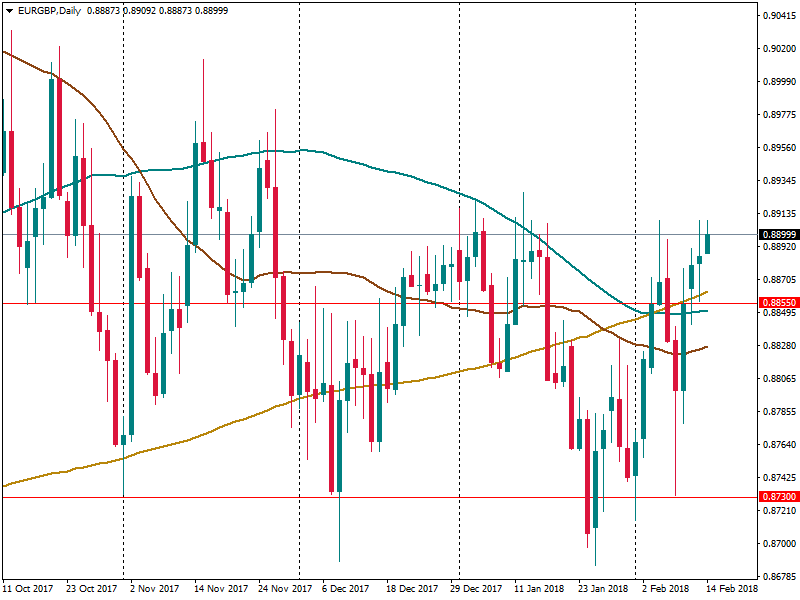

As a result, the pound jumped and the EUR/GBP rate reached 0.8730. A day before GBP was depreciating against the euro, trading at the level of 0.8854.

However, the significant growth of the pound was not long. The GBP plunged next day after the comment of the Brexit negotiator Mr. Barnier. He said that a deal on transitional arrangements is “not a given” if PM Theresa May will not agree to Brussel’s demands. (The agreement of a transitional period is quite important for the British currency because it will let the UK economy and financial market to enter the final Brexit state smoothly and orderly).

As the small comment could affect the GBP rate a lot, it means that the pound highly depends on Brexit risks and until risks will not be removed, the sterling will be under pressure.

Let’s move to forecasts

As usual, there are two opposite views on the future of the pound.

FX strategists at ING Group noticed that the pound falls after negative comments about the Brexit deal. But if we look at the whole picture, we can see that the British economy and interest rate are supportive factors nowadays and supposed to be more supportive in 2018.

So it means that Brexit negative talks create an artificial situation that affects the pound.

That is why strategists see the solution of the problem in a transition agreement. Although ING Group analysts admit the fall of EUR.GBP towards the lower-end of the broad 0.85-0.90 trading range because of the results of the transitional agreement, in the long-term they suppose a move towards the upper end of this range.

Another group of strategist at TD Securities believes that hawkish sounding speech of the BOE about its monetary policy gives reasons to believe in strong Sterling. They also see risks in the next phase of Brexit negotiations. But they open a short EUR/GBP position at 0.8750.

Analysts at Danske Bank upgraded their forecast for Sterling as well. Now they expect EUR/GBP at 0.87 in three months instead of 0.88, 0.86 in 6 months instead of 0.87 and 0.84 in one year instead of 0.86. Despite the important influence of Brexit negotiations, they suppose that the UK data is more important for the sterling.

Another supportive factor for the growth of the pound against the euro can be the euro weakness because of the uncertainty of the Italian March elections and the German coalition deal. Both these events can shake the euro rate.

On the other side, there are experts who suppose that it does not matter what, the pound will be affected by Brexit deal and we should expect the fall of the British currency.

Strategists at global investment bank Morgan Stanley think that it does not matter if there are any strengthens in the pound, the Brexit risks will play the main role. They forecast EUR/GBP at 0.9523 by the middle of 2018 and 0.9433 by the end of the year.

Making a conclusion, we cannot say exactly what will happen to the pound and the EUR/GBP pair in the future. Nowadays, the pound suffers from the high volatility. The Brexit deal highly influences it, so while there is so much noise around the Brexit negotiations, the pound will not be able to hold its positions. As soon as the UK will find a better opportunity to arrange a deal with the EU, the UK economy and the pound will start to grow.