How will Gold and USD react to NFP?

Oh, look at that! NFP is coming up shortly, and while some predict that XAU/USD could reach new heights in 2023, reports from other analysts reveal that the price of Gold has dropped to around $1,950 due to the US Treasury bond yield bouncing back. So, while we watch for potential buying opportunities, we must also exercise caution as we position ourselves to follow whatever immediate move the market presents us first. Let's see what the charts are saying!

XAUUSD - Weekly

Gold, on the weekly timeframe, is trading within a descending channel. The trendline resistance fits into the order block created by the rally-base-drop supply. The price has also created a 'turnkey' trendline resistance that aligns with the supply zone. Based on the confluence of the Fibonacci retracement tool and the other factors mentioned, we would see some bearish retracement from Gold in the coming days, possibly due to the NFP figures.

Analysts’ Expectations:

Direction: Bullish

Target: $1888

Invalidation: $2062

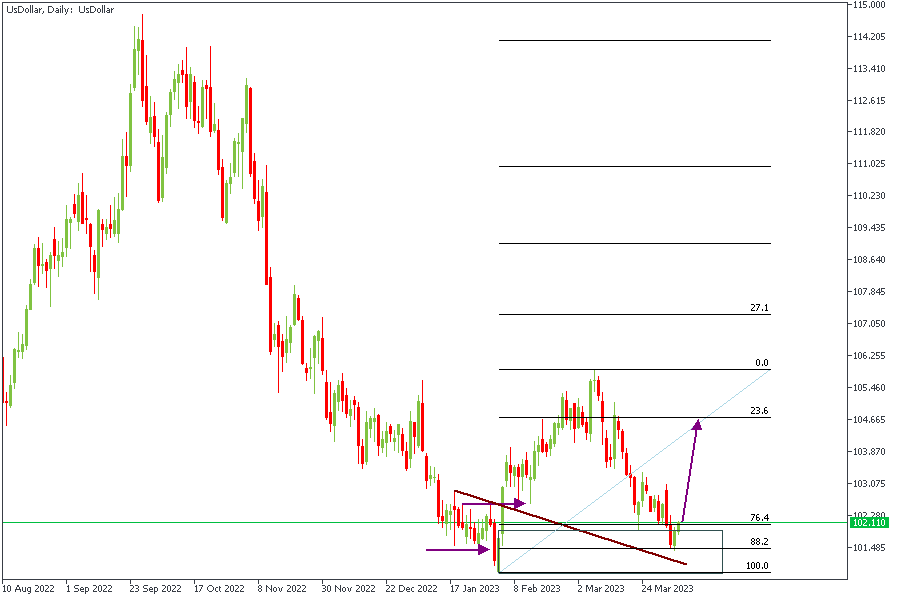

US DOLLAR - Daily

Based on the chart attached, we can see a clear AMD pattern created by price on the Daily timeframe. Moreover, there is a clear reaction of price away from the 88% of the Fibonacci retracement zone. The confluence of factors points solidly towards a potential bullish move, which I expect to be triggered by the NFP release.

Analysts’ Expectations:

Direction: Bullish

Target: 104.399

Invalidation: 100.815

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.