Apakah reli minyak sudah berakhir?

Pada hari Kamis, 2 Juni, Organisasi Negara Pengekspor Minyak Plus (OPEC+) sepakat untuk meningkatkan produksi sebesar 648.000 barel per hari (bph) pada bulan Juli dan Agustus. Keputusan tersebut menggantikan rencana yang diterima sebelumnya untuk meningkatkan produksi minyak sebesar 432.000 bph. Terlepas dari langkah aliansi yang jelas untuk mengekang harga minyak yang melonjak, pasar tidak terlalu terkesan olehnya. Baik WTI (XTIUSD) dan Brent (XBRUSD) ditutup saat hijau setelah pengumuman pada hari Kamis. Apa alasan di balik perilaku pasar minyak ini dan apa yang harus kita harapkan selanjutnya?

Alasan dibalik reaksi minyak

Momentum kenaikan harga minyak tetap utuh karena beberapa alasan. Yang pertama terkait dengan fakta bahwa Rusia masih menjadi anggota aliansi OPEC+. Meskipun beberapa panggilan oleh importir minyak utama untuk mengecualikan Rusia dari daftar anggota, kelompok tersebut memutuskan untuk tidak melakukannya. Akibatnya, aliansi menjadi lebih sulit untuk memenuhi targetnya. Produksi dari Rusia telah turun 1 juta barel per hari sejak dimulainya perang dengan Ukraina dan kemungkinan akan terus menurun. Selain itu, paket sanksi baru oleh Uni Eropa yang disampaikan pada hari Jumat, 3 Juni, termasuk embargo minyak Rusia.

Kedua, Angola dan Nigeria, anggota serikat OPEC+ memiliki masalah dengan output mereka. Dengan cara ini, perubahan pasokan minyak saat ini dianggap tidak mencukupi. Karena kenaikan dibagi secara proporsional di negara-negara anggota, Angola dan Nigeria akan menjadi pihak luar dalam reli pemompaan minyak ini.

Ketiga, Tiongkok melonggarkan pembatasan Covid-19 di kota-kota terbesar pada akhir Mei. Pemerintah Tiongkok berjanji akan mendukung perekonomian. Pemulihan permintaan dari Tiongkok kemungkinan akan melebihi pasokan jika tidak ada perubahan dalam output. Akibatnya, harga minyak memiliki semua peluang untuk menembus lebih tinggi.

Terakhir, angka yang disajikan oleh Administrasi Informasi Energi pada 2 Juni menunjukkan bahwa persediaan minyak mentah AS turun 5,1 juta barel pekan lalu. Ini juga mendorong harga minyak naik.

Apa yang bisa mendorong harga minyak turun?

Satu-satunya hal yang dapat mengubah tren minyak saat ini adalah permintaan Tiongkok. Jika 'lockdown' baru diberlakukan, harga minyak akan terkoreksi lebih rendah. Selain itu, berita dari Rusia dan Ukraina juga dapat memengaruhi harga minyak.

Level untuk XBRUSD dan XTIUSD

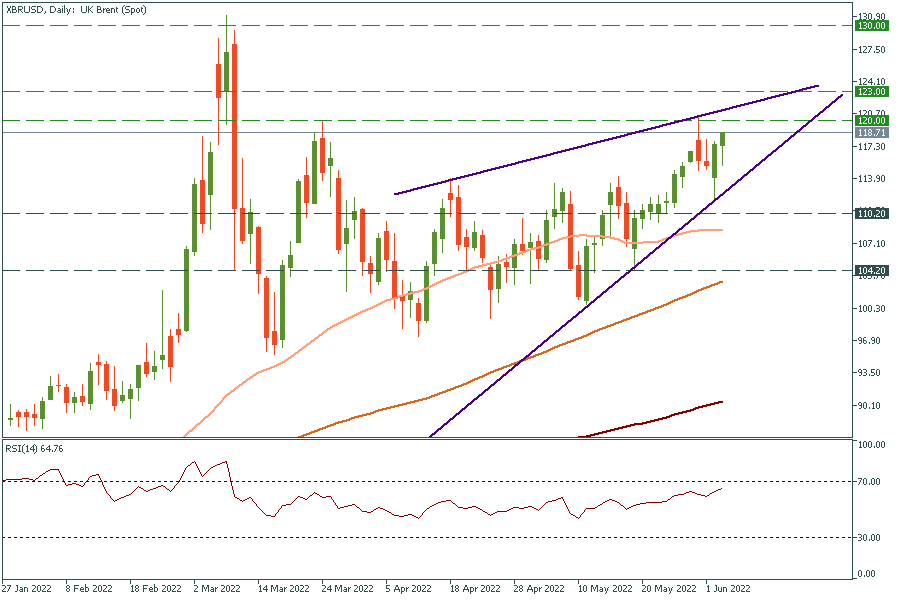

Harga Brent (XBRUSD) telah diperdagangkan dalam irisan naik. Jika tembus di atas level $120, target berikutnya akan berada di $123. Setelah melewati level ini, para pembeli memiliki potensi penuh untuk menguji ulang level tertinggi 8 Maret di $130. Pada sisi negatifnya, support pertama terletak di $110,20.

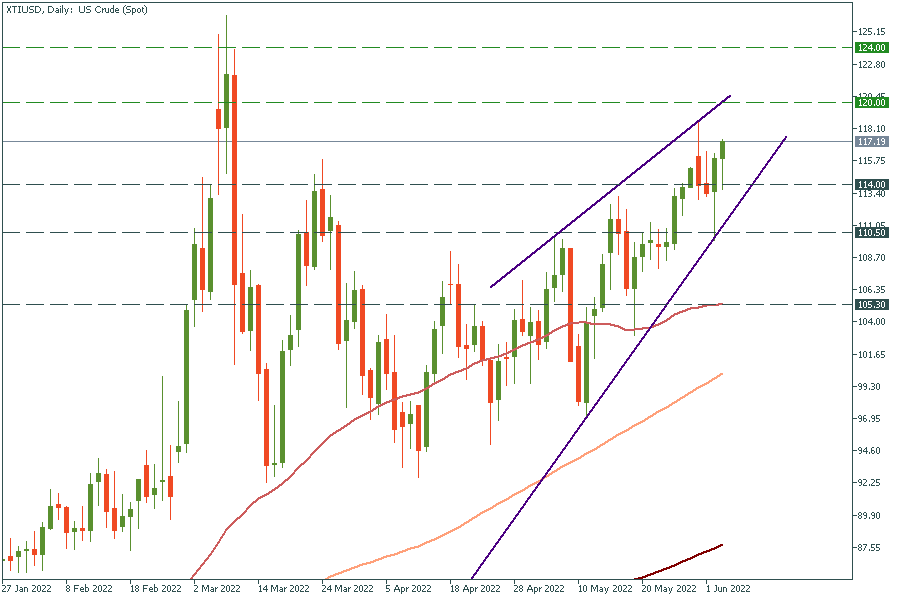

Adapun XTIUSD, target pertama untuk mereka pada grafik harian terletak di $120. Level penting berikutnya terletak di $124. Level support untuk WTI ditempatkan di $120.

Jika Anda ingin trading minyak dengan FBS, ikuti langkah-langkah sederhana ini:

- Pertama-tama, pastikan Anda telah mengunduh aplikasi FBS Trader atau Metatrader 5.

- Buka akun di FBS Trader atau akun MT5 di personal area Anda.

- Mulai trading!