Many Reasons to Buy Disney Stock

People all over the world love kind and colorful Disney cartoons. What if we say that you can both adore the pictures and trade stocks of the company that creates them?

The Walt Disney Company is set to report the earnings data for Q3 on Wednesday at 23:05 GMT+3. Analysts anticipate the EPS (earnings per share) at $1 and revenue at $20.68 billion. At the same time, investors will follow the trend of subscriber growth. If the metrics are better than the forecasts, this would be blasting results in the third quarter of 2021. Should we trust them?

What Is Affecting the Disney Stock?

Last quarter, the earnings results beat expectations with a firm number of joined subscribers. The data left Disney's competitor, Netflix, far behind the rally. This time, the company is set to repeat its success. Let's list the main reasons why this can happen.

First, the sites that track website traffic notice a substantial rise in activity over the previous quarter. Secondly, the company is genuinely excited about its 100th-anniversary celebration, which will begin during its annual D23 Expo fan event in September. That is, Disney's customers can expect more mind-blowing announces. It includes fresh Disney+, Pixar, Marvel Studios, and Lucasfilm updates. Thirdly, the company announced the start of the 2022 Disney Accelerator that will sponsor innovative companies worldwide this month.

The speculation around Disney’s Chief Executive Bob Chapek this year was probably the news that shook investors' confidence. He was widely criticized among Disney's LGBTQ employees and Republicans for his attitude towards Florida's 'Don't Say Gay' bill. Still, the board has extended Bob Chapek’s contract as he managed to support the company throughout the tough pandemic times.

The grim economic situation and rising inflation may be the next thing that the management of Disney will react to. The more uncertain the data, the weaker the stock will be. In the upcoming earnings report, we highly recommend you follow the company's strategy on entertainment parks and its outlook.

Technical Analysis of Disney Stock

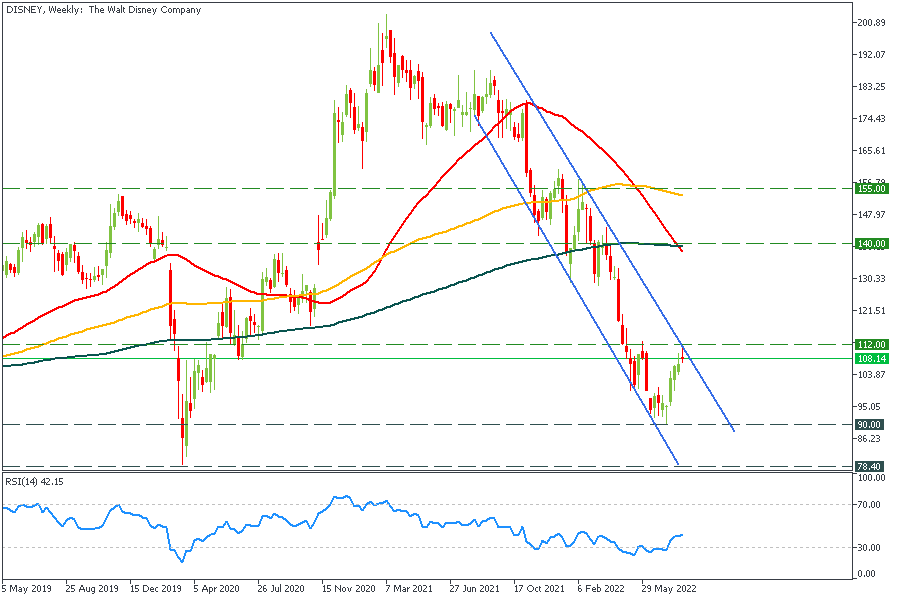

On the weekly chart, the stock tested the upper border of the descending trading channel at $112. The breakout will signal further upside momentum with 50- and 200-week MA crossover at $140 in focus. On contrary, the support lies at $78.40.

On the daily chart, the stock has successfully crossed the psychological level of $100 and tested $112. The worrying factor for bulls is that the price formed a "Shooting Star" pattern confirmed by the bearish candlestick afterward. That is, the price may go lower to $100 before making another attempt to reach the $112 level. If it crosses $112, the next target will be $132.

How to trade DISNEY stock with FBS?

1. Open an account in Personal Area or FBS Trader.

2. Learn how to trade on earnings reports.

3. Start!

Join FBS Analytics Telegram Channel for trade ideas and fresh announcements!