Non-farm payrolls: the forecasts

The first Thursday of the month is going to be an unusual one, as the United States releases Non-farm payrolls at 15:30 MT time. The American Bureau of Labor Statistics moved the date of the monthly update on employment due to holidays in the United States.

Previous results

Last month, US job data surprised traders. While analysts expected a fall in NFP by 7 750K, the actual level increased by 2 509K. At the same time, the unemployment rate declined to 13.3% (vs. the forecast of 19.4%). The only negative data was the average hourly earnings. The change in the price businesses pay for labor slid by 1% despite the forecast of a rise by 1%.

Forecasts

Analytical companies anticipate the US labor market to continue stabilizing. Let’s see the forecasts by some of the famous ones.

According to Goldman Sachs, the headline NFP increased by 4 250K in June with the unemployment level at 12.7%.

Merrill Lynch is anticipating less encouraging, but still promising results with the NFP increasing by 2 800K and the unemployment rate at 12.5%.

TD set its NFP estimates at +4 000K. The company notes, that the fundamental background is different this time compared to May’s one, as the cases of COVID-19 are surging.

Finally, Scotia predicts a rise of NFP by 4 000K. At the same time, it says that due to the fundamental changes and volatility, the actual figures may be lower but still in the positive territory.

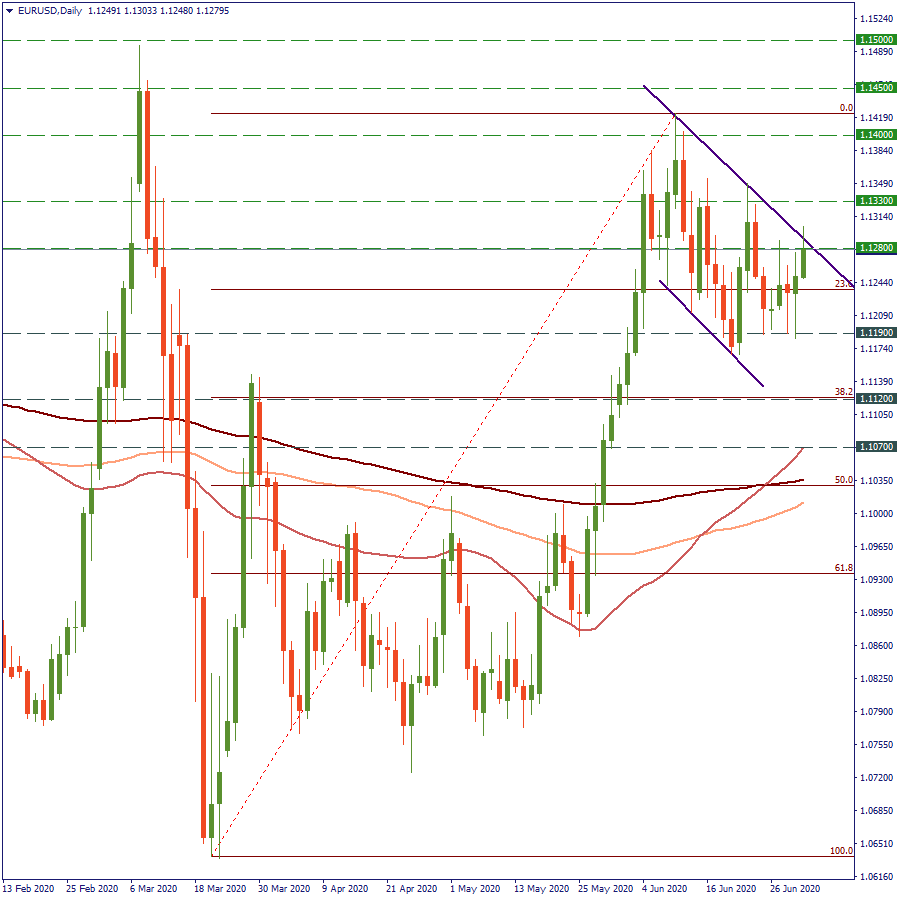

Key levels for EUR/USD

At the moment, EUR/USD is trading near the 1.1280 level, close to the upper border of the descending channel. Positive NFP will pull the pair down towards 1.1230 (23.6 Fibo level). On the other hand, if the official data disappoints, EUR/USD will break 1.1280 and target the next resistance at 1.1330.

Key levels for USD/JPY

The volatility of the pair has been very low since the start of the day. At the moment, USD/JPY is well-supported by 107.4 (50-day SMA). A lower-than-expected outcome of NFP will pull the pair below this level to the next support at 106.9. A Strong NFP will encourage bulls to push the pair to the 107.9 level (100-day SMA).