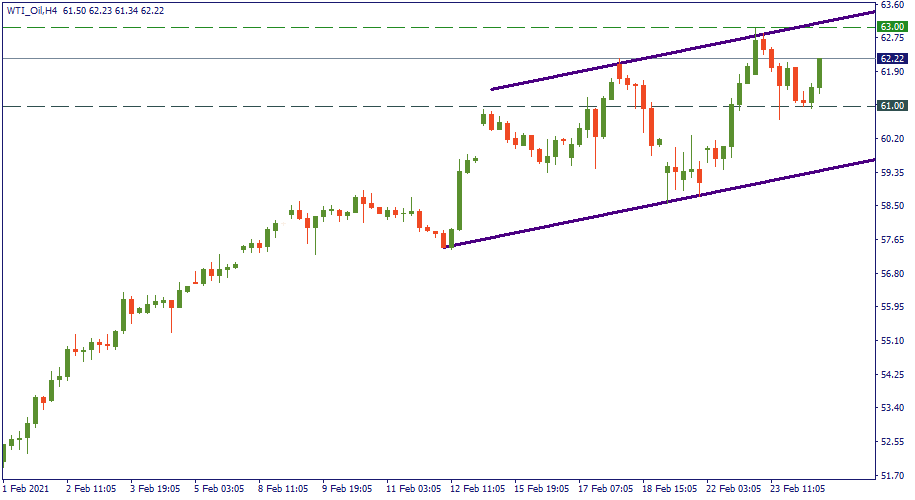

Oil: about to beat $63?

After reaching $63, WTI oil bounced downwards. Partly, that was due to the news that the US oil reserves turned to be more than expected - that's still the echo of the virus preparations that made many oil producers stockpile oil in case of an emergency deficit. However, as the demand is picking up, it seems those stockpiles may be no longer needed: the recovering global economy needs more oil. Therefore, the demand side of the equilibrium is on the good track now. The supply is what may have bigger concerns: we are yet to see how Russia and Saudi Arabia resolve their issues during a new round of OPEC+ talks on March 4. Technically, the channel indicated in the below chart appears to be valid in the short-term: after crossing $63 into the upside, the price is expected to make another correction - possibly, to $62, and then will pick up again. Watch it closely as the closer it is to the OPEC+ meeting, the more the volatility of the oil price may become.