The oil market is under threat

Do you want a fascinating trading? The oil market is just perfect for you as it never stays calm. There are a lot of factors that affect oil prices.

Only this week, oil was influenced by such events as an escalation of the US-Turkey tensions and the melting Turkish lira, crude oil inventories data, and easing of trade tensions between the US and China.

The beginning of the week started with the escalation of tensions between the US and Turkey that caused a great fall not only of the Turkish lira but also of the other emerging market currencies. It seems like there is no strong connection between the oil market and emerging market currencies but you should remember that any tensions that can lead to the economic slowdown, affect the oil prices, as it will cause a decline in the oil demand.

Wednesday crude oil inventories data shocked the market with a significant rise by 6.81 million barrels a week (the forecast was -2.6 million). It was the greatest rise since 2017. Therefore, oil prices significantly plunged.

On Thursday, trade war tensions between the US and China eased but it could support the oil market just a little. However, a little is better than nothing.

What to expect from the oil market.

As you already could understand, the oil prices highly depend on the news releases. As a result, there can be two forecasts: optimistic and pessimistic.

The optimistic forecast. Factors that can lead to the rise of the oil market are the further easing of trade tensions, the decline in the crude oil inventories data and news on the fall of the supply from OPEC countries (sanctions).

The pessimistic forecast. In case the US will impose more tariffs on trading partners or the number of US inventories will increase, the oil prices will plunge.

Technical setups.

When it’s difficult to make a forecast based on the fundamental analysis, it’s worth looking at the technical side.

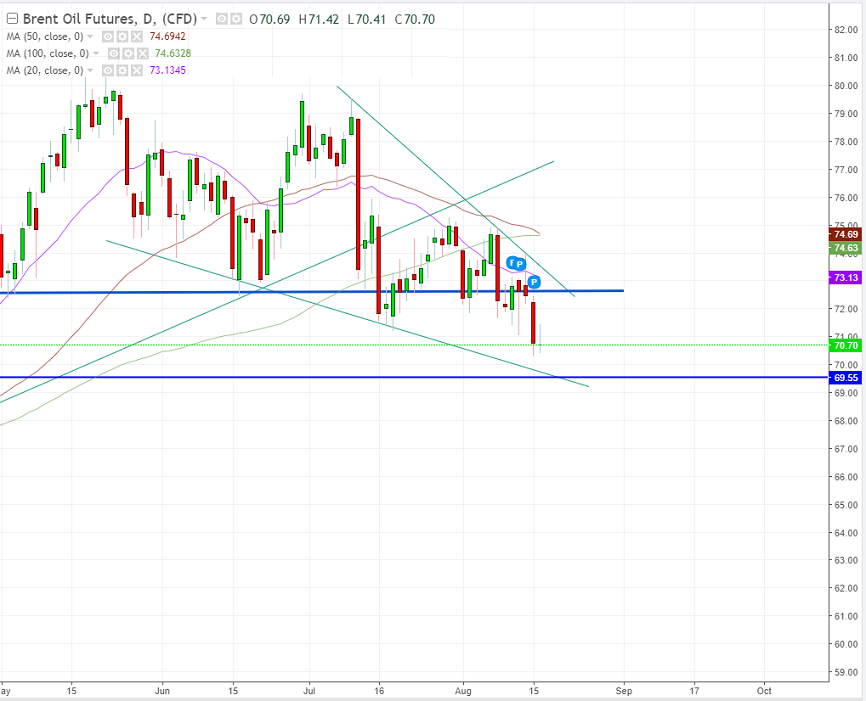

Let’s have a look at the Brent chart.

The picture isn’t optimistic for Brent prices. First of all, 20-day MA has crossed the 100-day MA upside down, 50-day MA is near to cross the 100-day MA upside down as well. It’s a negative signal for the price. Secondly, on the weekly chart, we can see the double top pattern. Up to now, Brent has been trading below the neckline. That’s already signaled its weakness. If Brent closes this week below $71 (highs of previous weeks), a risk of its fall will significantly increase.

What about levels? If there is the negative news for the oil market, the first support is at the trend line near $69.55. If there is no shocking news, the prices will go to $72.65. But this level will become the strong resistance for the prices as the trendline and the neckline are crossed there. So the rebound is likely.

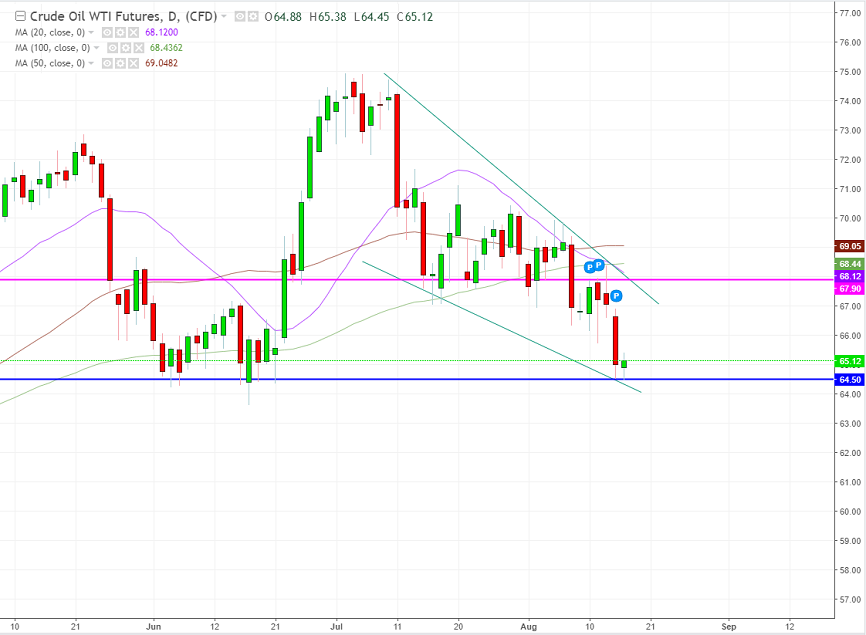

What about WTI.

The picture for WTI is almost the same as for Brent. Moves of both oil benchmarks are often the same. 20-day MA has already crossed 50-day and 100-day MAs upside down. That is the negative signal for prices. The support lies at $64.50. If there is positive news, prices will be able to recover. The resistance lies at $67.90 (the trendline).

Making a conclusion, we can say that perspectives for the oil market are cloudy. Technical indicators signal a fall of the prices. However, the news will play a great part in the future direction of the oil benchmarks. Follow news on the oil market with FBS!