The RBNZ rate statement: three scenarios

Today at 5:00 MetaTrader time the Reserve Bank of New Zealand will publish the rate statement. This is a wonderful opportunity for traders of the New Zealand dollar. Let’s consider the main expectations from the regulator.

What to expect?

The interest rate is expected to remain unchanged at 0.25%. As for quantitative easing measures, the Bank expanded the Large Scale Asset Purchase program (LSAP) to 60 billion New Zealand dollars during its May’s meeting. At the same time, we should keep in mind that the Reserve Bank of New Zealand prefers the weak NZD due to the export-oriented economy. Therefore, the RBNZ Governor may point out once again about the possibility of negative interest rates in order to make the currency weaker. The other thing we need to follow is the outlook of economic conditions by the bank. New Zealand has already opened up its economy due to the absence of coronavirus cases. However, as global risks related to the second wave of Covid-19 remain, policymakers may add comments about them as well.

Keep in mind that in the current economic conditions monetary stimulus can be positive for the national currency.

Let’s look at three scenarios.

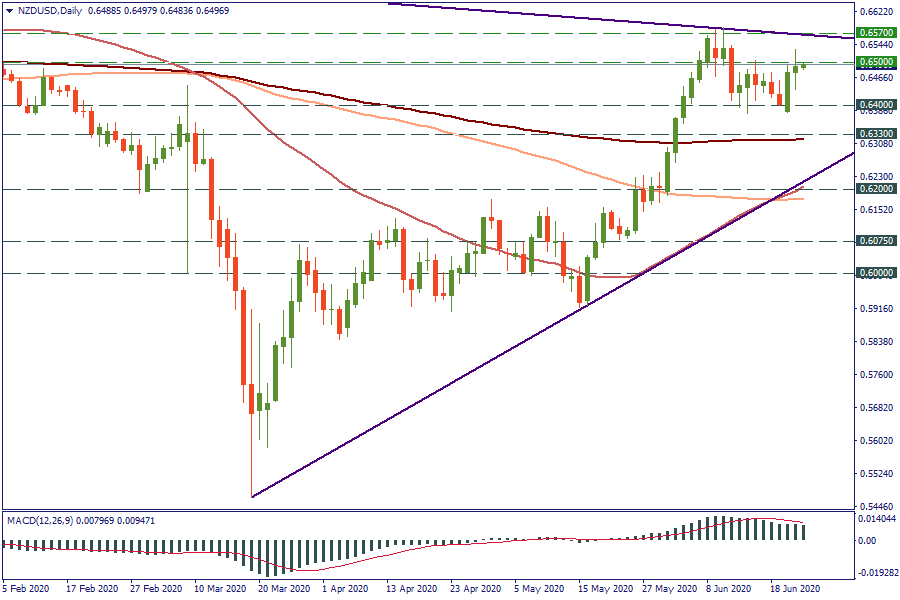

Upbeat scenario. If the regulator confirms better conditions of New Zealand’s economy and do not throw any threats on negative interest rates, the NZD will get stronger. In that case, NZD/USD will rise towards 0.6570. Most likely, bulls will make an attempt to break this level and target 0.6680.

Neutral scenario. In this situation, the bank will make no major changes. The LSAP program will remain intact and the bank will take the wait-and-see attitude. In case of this scenario, NZD/USD will continue moving within a range between 0.64 and 0.65.

Negative scenario. The RBNZ will see the high NZD as a big threat to the NZ economy. At the same time, it will demonstrate readiness to the negative rates and hint for more quantitative measures ahead. The comments on the worsening global situation are NZD-negative as well. Here, we will expect the slide down, where bears will face the 0.64 level at first. In case of a breakout, the next support will lie at 0.6330.