Too much pessimism about the NZD?

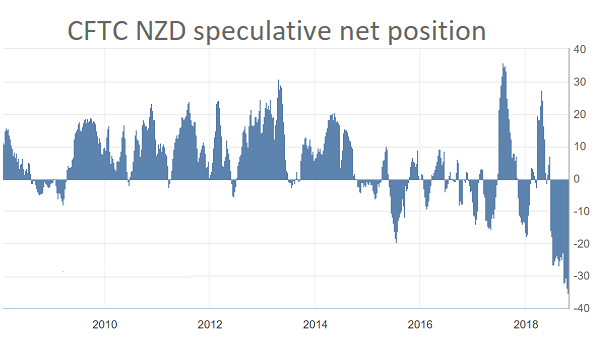

The New Zealand’s dollar has long ago fallen out of traders’ favor. Have a look at the CFTC data and you’ll see that positioning in the NZD has been extremely short. The latest release showed that net short positions on the New Zealand’s currency have actually reached record levels:

Usually, when the market gets this one-sided a correction comes. This is what might have happened last week: speculators covered their excessive short positions on the NZD and the currency recovered. Will the recovery continue?

Problems of the NZD

First of all, let’s see what made the NZD decline in the first place. There are 2 sets of reasons: external (trade wars that may hurt New Zealand’s key trading partner, China) and domestic (low inflation, declining consumer confidence).

The Reserve Bank of New Zealand started warning in July that it could cut interest rates over coming quarters if the economy does not pick up sufficiently to support a return of the consumer price index (CPI) growth rate closer to 3% target. Such an approach is in sharp contrast with the policy of the US Federal Reserve which is engaged in a rate hike cycle. As a result, there’s nothing surprising in the downtrend we see in NZD/USD.

To be fair, the latest releases from New Zealand haven’t been too bad. The nation’s GDP rose by 1% in Q2, the fastest increase in two years. CPI growth accelerated to 0.9% in Q3 from 0.4% in the previous period (bringing the annual inflation rate to 1.9%). Such an increase in prices may be largely explained by the rise in petrol cost which pushed transport prices higher.

So, even though New Zealand’s economy is showing signs of improvement, it’s too early to expect the RBNZ to acknowledge these developments. In addition, external risks remain and are as evident as ever as China’s economy is not experiencing the best of times.

Short-term picture and course of action

It seems that in the medium term, the USD will still prevail over the NZD. On the shorter horizon, though, the NZD has a chance. Traders may keep covering their short positions thus making the NZD exchange rate go up. Improvements in the market’s risk sentiment, as well as the disappointing data releases in the US, could also offer cues for recoveries.

Support for NZD/USD lies at 0.6540 and 0.6500. A decline below the latter will open the way down to October low at 0.6420. The pair’s in a general downtrend. There’s a strong resistance around 0.6585 (50-day MA, daily Ichimoku Cloud) ahead of 0.66 (trendline resistance). Only a rise above 0.66 will allow a retracement up to 0.6650, 0.6675, and 0.67.

Pay attention to AUD/NZD. Australia's ruling coalition lost its majority in the House of Representatives. This brings some uncertainty for the AUD. A decline below 1.0750 will bring the pair down to 1.0640.

Upcoming events

NZD:

Oct 25 - New Zealand’s trade balance

Oct 31 - ANZ business confidence index

USD:

Oct 25 - Durable goods orders

Oct 26 - Q3 GDP growth

AUD:

Oct 31 - CPI