Top reasons to trade on the Fed meeting

The Federal Open Market Committee is releasing its monetary policy statement today at 21:00 MT time. As usual, policymakers will provide the decision on the interest rate and possibly announce forecasts for the future of the regulator’s monetary policy. The meeting will be followed by the press conference with the Fed Chair Jerome Powell at 21:30 MT time.

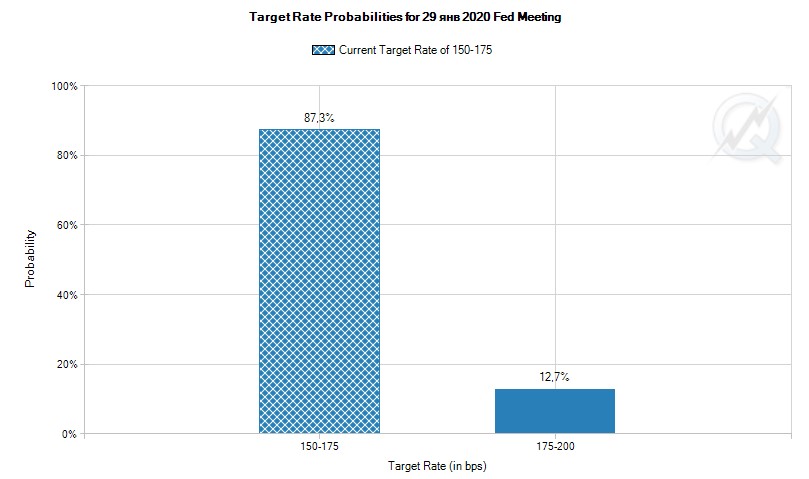

The interest rate remains on hold

The market expects no changes to the current interest rate, which is held within a range of 1.5-1.75%.

Sourced by: CMEGroup

Despite yet another attempt by the US President Donald Trump to call for the lower interest rates yesterday, the Federal Reserve is not likely to listen to him for now. The interest rate is seen as appropriate amid the current economic conditions of the United States.

The Fed inflation review: time to shift?

Many economists recommend keeping an eye on the comments by Mr. Powell concerning inflation. According to them, the Fed Chair may suggest taking more serious steps to meet the 2% inflation objective. That’s not a surprise, though, as the Fed members have recently forecasted the inflation to exceed its target in three years. That means that the Federal Reserve may announce additional measures to boost the current low inflation level. Thus, the tone of the Fed may change.

The balance sheet: more purchases to come?

The meeting will be important not only for inflation comments but also for the fresh updates on the balance sheet’s expansion. The Fed has been conducting the expansion of its balance sheet since October, buying $60 billion worth Treasury bills per-month and lending the billions of dollars into the short-term money market. It boosted the stocks and weakened the USD. Though the Fed Chair pointed out that the current re-adjustment of the balance sheet has nothing to do with the quantitative easing, analysts think that the policy has similar effects to it. Economists widely expect the end of the expansion in spring, but the comments regarding it may affect the markets.

The global effects: coronavirus, trade wars, etc.

The markets will be closely watching the opinion of Jerome Powell on the coronavirus spreading and the uncertainties surrounding the next steps of the US-China trade deal. If the effects of these risks on the economy are acknowledged, they will have a negative impact on the USD.

What to trade?

Of course, the FOMC meeting tends to affect the USD pairs. Among the most volatile, we can highlight EUR/USD.

If we look at the H1 chart of EUR/USD during the previous meeting, the pair rose by 46 pips right after the release of the statement.

This time, the case may be different. Right now EUR/USD is sliding towards the 1.0980 level on H4. If the Fed is optimistic, there is a high chance of breaking this level and falling towards the next support at 1.0968. In case of a breakout, look at the 1.0945 level. On the other hand, if the Fed disappoints, we expect the retest of the 1.1022 level. After that, bulls may focus on reaching the 1.1040 and 1.1056 levels.

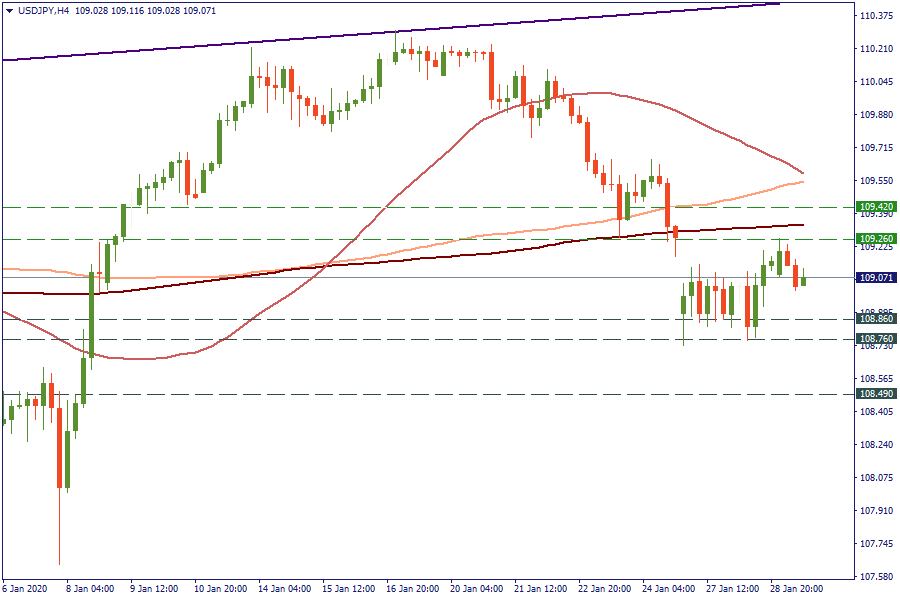

If you’re tired of EUR/USD, take a look at USD/JPY, which may move even lower on the dovish Fed, while the pair is well pressured by the 50-day SMA on the daily chart.

On H4, the dovish Fed may pull the pair to the 108.86-108.76 levels. The next support will lie at 108.49. The USD strength will help bulls to retest the 109.26 level. The next one will be placed at 109.42.

Now, while you’re waiting for the outcome of the meeting don’t forget to press