UK: No Longer a Leading Economy

The current situation is terrible, and the future is worse for the United Kingdom. Will the British pound withstand the challenges that await the UK economy, or will it collapse?

The problems of the UK are plentiful: inflation crisis, political instability after the departure of Prime Minister Boris Johnson, trade turmoil due to Brexit and the COVID-19 pandemic, and the unpredictable rise in energy prices due to the Russian invasion of Ukraine. According to Saxo Bank analysts, the negative factors listed above make the British economy look like one in a developing world rather than the sixth largest economy in the world.

Negative factors for the UK economy

1. Britain is on the cusp of a deep recession

The Bank of England has warned that the British economy will enter its most prolonged recession since the 2008 global financial crisis in the fourth quarter of 2022, with GDP dropping 2.1%. Inflation will also peak and exceed 13% in October.

To make it worse, the central bank doesn't anticipate a sharp recovery from the recession and sees GDP growth under 1.75% until mid-2025.

2. Inflation did to the UK what Brexit didn't

The BoE sees UK inflation peak at 13.3% in October, well above the previously expected 11%. Inflation will remain elevated through most of 2023 before falling back towards its 2% target in 2025.

So far, the BoE has raised rates six times in a row in a desperate attempt to control inflation. The latest increase of 50 points was the most significant hike since the bank became independent from the British government in 1997.

3. Political instability haunts Britain

A new British Prime Minister will be announced on September 5, after the resignation of Boris Johnson due to a series of scandals and mass resignations within his government. Conservative candidates Liz Truss and Rishi Sunak are now competing for the position.

4. Surging energy prices due to the war in Ukraine

UK energy prices cap is set to rise another 70% in October, increasing energy bills to more than £3,400 ($4,118) a year.

The rise in oil and gas prices is the primary driver of the inflation crisis in Britain. Gas prices have reached record levels due to supply disruptions caused by Russia's invasion of Ukraine and Russia's cutting off gas supplies to Europe.

5. Trade turmoil

There’s a risk of a trade war between Britain and the EU over the Northern Ireland Protocol. If the Northern Ireland Protocol bill becomes law in the UK, Europe will fight back. As a result, this will aggravate the negative effects of Brexit.

Sterling saves Britain despite its weakness

The only thing preventing the British economy from fully transforming into an emerging economy is the absence of a currency crisis.

A currency crisis is a type of financial crisis followed by a sharp devaluation of a country's currency. However, the sterling has remained stable through recent major economic events, notably Brexit and the coronavirus pandemic.

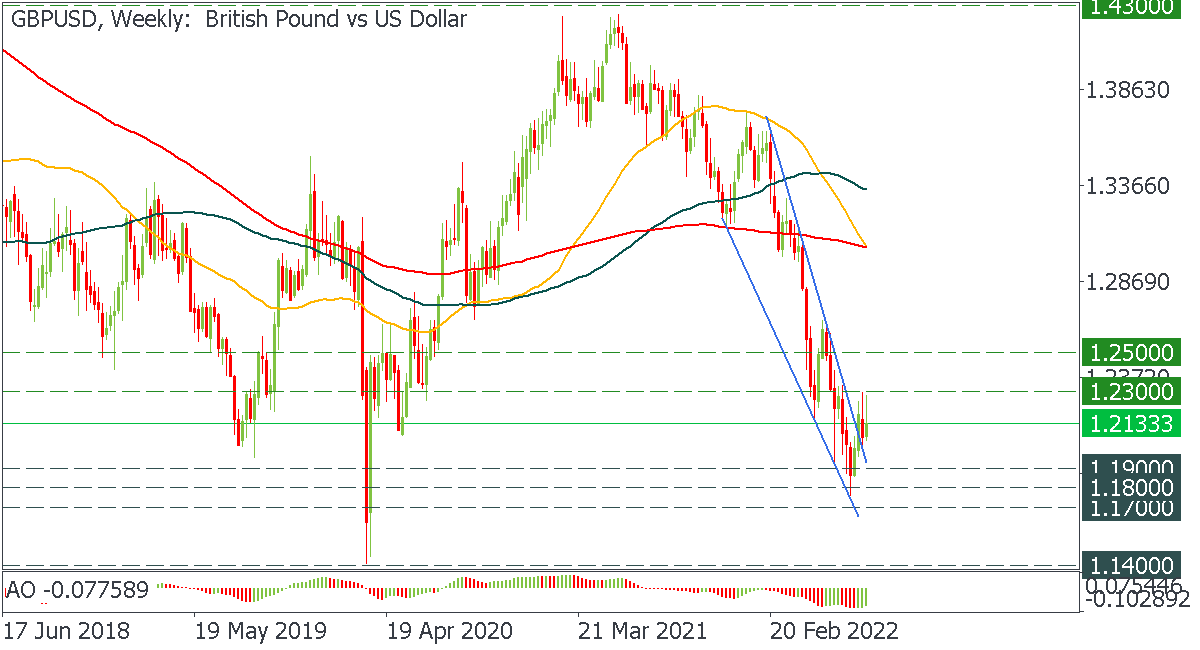

Still, the pound may return to its lowest level against the US dollar since March 2020, dropping below $1.20 soon. Sterling will struggle against the dollar as the economic outlook for the UK grows bleak, while the US has a strong labor market and easing inflation. For now, GBPUSD is consolidating between 1.23 and 119.