USD/JPY: OUTLOOK FOR AUGUST 25 - SEPTEMBER 1

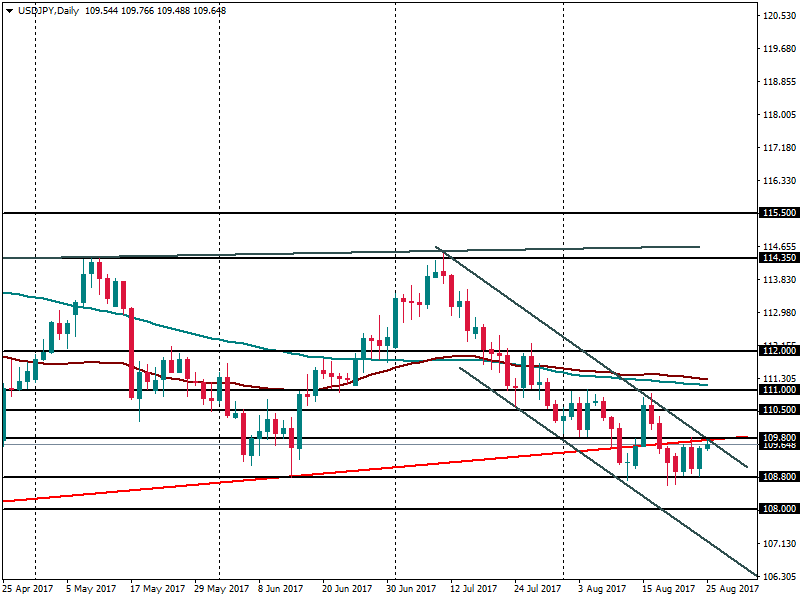

USD/JPY consolidated within the downtrend channel drawn from July highs. The pair has now approached the resistance line of this channel and we are soon to see a breakthrough to the either side.

Tokyo CPI for August was encouraging: inflation accelerated from 0.2% to 0.5% y/y. The 2% inflation target is still very far away, but some progress has been made.

Next week Japan will release unemployment rates, retail sales, industrial production, consumer confidence and other indicators. Remember though that USD/JPY depends more on the figures out of the United States. The US will release consumer confidence on Tuesday, ADP employment report and preliminary GDP for the second quarter on Wednesday, core PCE price index and personal spending on Thursday and NFP together with ISM manufacturing PMI on Friday.

The current resistance line at 109.80 is reinforced by the former support and now resistance line connecting April and June lows. Support is at 108.80. A decline below this level is needed to bring the pair down to 108.00 and 107.50.