USD: reflation trade

“There is no standalone bill without a bigger bill”, - said recently Nancy Pelosi, the US White House Speaker from the Democrats camp. They want a nation-wide all-inclusive big stimulus to fight off the second wave of the COVID-19. Specifically, they want $2.4 Trillion dollars for that. In the meantime, Donald Trump’s Republicans offered a $1.6-trillion stimulus for airlines and small businesses - that was rejected by the Democrats. So he walked away from the negotiations postponing them to November once he – hopefully wins. In any case, the very fact of this discussion means that US authorities are having another stimulus on their agenda. Whether a new stimulus gets approved or not (more probably not, as Donald Trump shut down negotiations on it) – let’s analyze how that affects the world economy and your way to trade it.

Stimulus basically means more money printed and injected into the economy. More money circulating in the economy means higher inflation. At the same time, more money in the economy means financial capabilities and maneuvers for businesses that start expanding as well – that is economic growth. So inflation plus economic growth both boosted by the stimulus is a situation of reflation. As usual, when everything goes well in the case of economic expansion, the market is optimistic, the risk is on, stocks rise, the USD falls. That would be your reflation trading in this scenario.

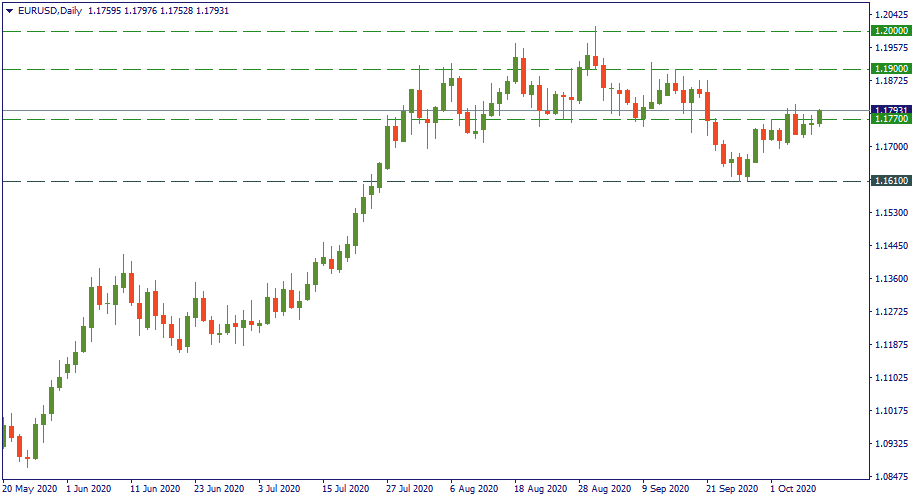

Hence, with the USD, you would be betting on the bullish direction in EUR/USD. Specifically, you would be looking at 1.19 and 1.20 as potential targets of the reflation trade. Whether it will take place – we are yet to discover.