USD/ZAR awaits the Moody's rating

South Africa anticipates the Moody's review of the country's debt. The release was scheduled on Friday, October 12, however, it was postponed. Some analysts expect it to be released after the Medium-term budget policy statement (MTBPS) on October 24.

The last release of Moody's in the first half of 2018 placed South Africa on the Baa3 credit rating at investment grade with a stable outlook. Baa3 means average credibility. This could happen due to president Cyril Ramaphosa's medium-term budget plan, which was designed to recover the South African economy.

However, the South African economy has fallen into the recession since that time. The level of GDP decreased by 0.7% in the second quarter, while the leading economic index decreased by 0.9% in July. This made the government continue expenditures in order to meet the markets deficit targets. That is why Moody's investment grade of the country can be downgraded for the current period.

The overall economic situation is heated by the scandal around the former finance minister of South Africa Nhlanhla Nene and his connection to the state capture scandal and the Gupta family. The Gupta family was financed through tenders and influenced the government decisions during the Jacob Zuma presidency. This scandal is also the reason for Mr. Zuma resignation. The new president Cyril Ramaphosa appointed the new finance minister Tito Mboweni just a week before the Moody's rating release.

How these events affect the South African Rand?

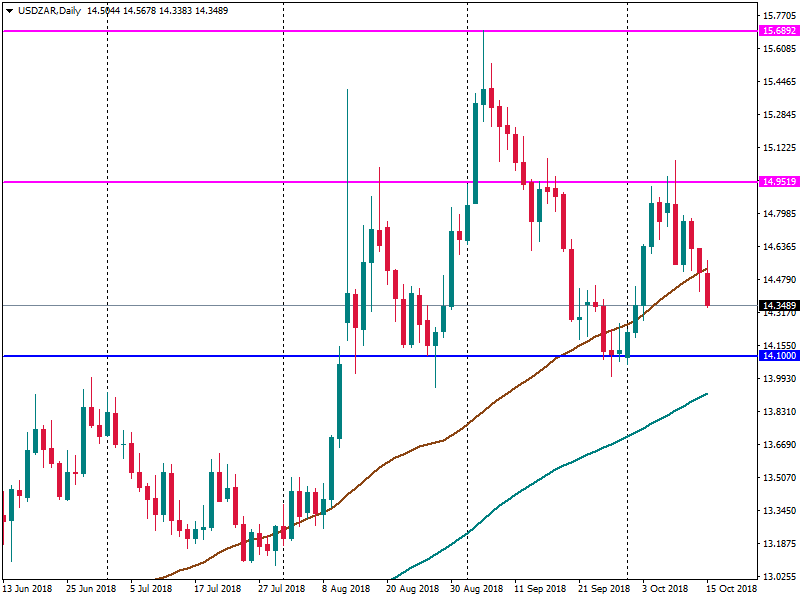

The Tito Mboweni appointment as a finance minister was warmly welcomed by the markets. Since the decision was made, USD/ZAR fell below the support at 50-day MA (14.52). The Moody's delay also brings some positivity to bears. For now, the pair is moving downwards the support at 14.2660.

If we look at the technical side, there is a Head and Shoulders formation on the chart with the support at 14.1. If the finance minister’s statement is hawkish and the USD is weak, the pair can continue falling to the support at 12.99 (200-day MA).

If Moody's places the country on a lower investment grade, it will be a destructive move not only for the economy but also for the ZAR. The instability will force the international investors to get rid of the government bonds from their portfolios. This move will create the capital outflow from the country. If the rand weakens, the pair can reach the resistance at 14.9570. After that, the next target resistance for the pair is 15.6935.

To conclude with, the key events for the ZAR are the medium term policy statement by the new finance minister Tito Mboweni and the Moody's rating release. Possibly, the financial policy statement by Mboweni will influence the Moody's decision as well.