USDCAD to Rise as Crude Oil Prices Weigh on the Canadian Dollar

Oh, the poor Canadian Dollar. It's been underperforming against the US Dollar lately, extending its losses from last week. What's causing this unfortunate turn of events? Well, it's none other than crude oil - a key export of Canada. The black gold has been taking a beating lately, with WTI down almost 7 percent in recent times. This has been caused by fears of a global growth slowdown, as highlighted in the Federal Reserve's beige book. And as if that weren't enough, China's economy is also playing a role, with industrial production falling behind, which is more sensitive to the health of the global economy. It's no wonder USDCAD has been climbing higher recently, marking its best week since March. So, where is USDCAD headed in May? Let's see what the Price Action has to say.

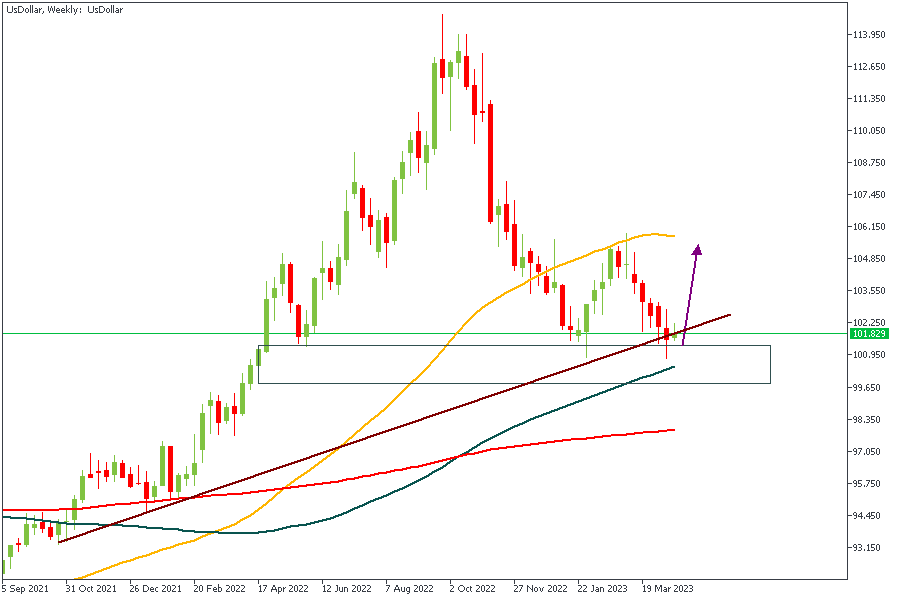

US DOLLAR - Weekly Timeframe

Most things have stayed the same on the US Dollar chart since my initial article. The close of the previous candle on the weekly timeframe only added even further confirmation to the sentiment from last week. The basic confluences are; a rally-base-rally demand zone, trendline support, 100-Period Moving Average, and the alignment of the Moving Averages in a proper ascending manner.

Analysts’ Expectations:

Direction: Bullish

Target: 103.933

Invalidation: 99.629

USDCAD - Weekly Timeframe

Last week, I indicated a bullish intent on USDCAD based on the price action confluences I had seen, and true to the analysis, we ended the week with a bullish reaction from the rally-base-rally demand zone with the help of the other contributing factors; the trendline support, 50-Period Moving Average, and the Fibonacci retracement level. I believe this sentiment will play out for a while.

Analysts’ Expectations:

Direction: Bullish

Target: 1.38220

Invalidation: 1.31822

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.