Why did gold turn down? And did it really?

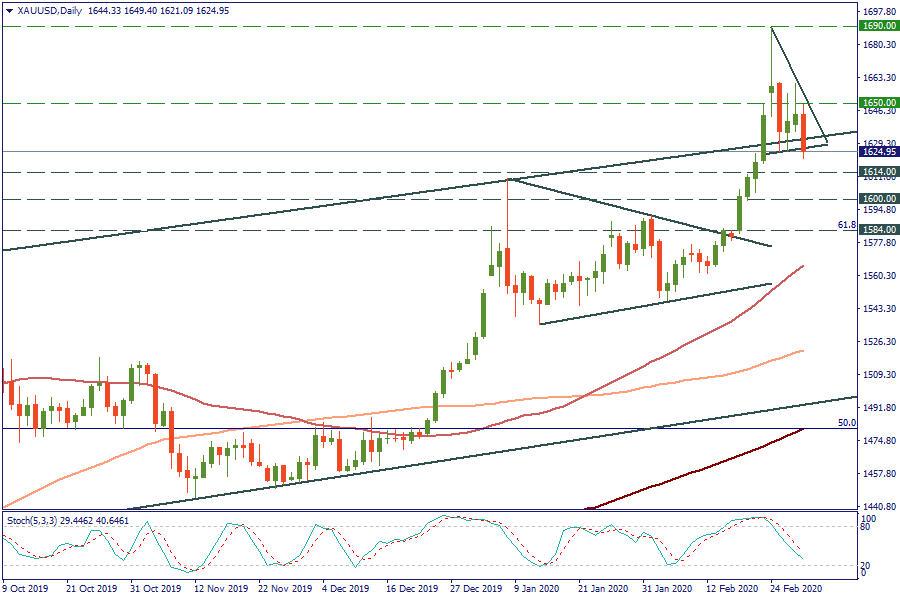

XAU/USD is consolidating after spiking to the 7-year high at $1,689. If we compare the current price action on the D1 with what was seen in January (the price spiked up and then consolidated without declining much), we’ll see that there are more candlesticks with long upper shadows – a sign that there are sellers of gold in the $1,650 area.

Technically, there is a big chance of a correction to the downside: gold simply rose too fast, too far. Market players are probably taking profit in gold to offset losses in other markets, so they are closing the previous buy positions in XAU/USD.

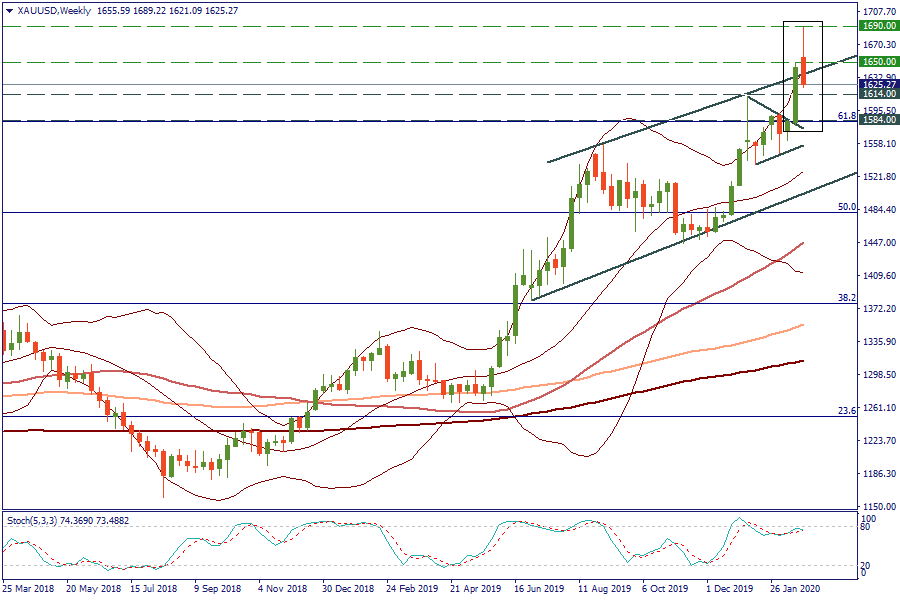

On the W1, there was a bullish gap after the previous big green candlestick. The current candlestick is at the upper Bollinger band and far away from the Moving Averages. For the general outlook to stay positive, the current weekly candlestick has to close above $1,614 (the middle of the previous candlestick). A close below this level will lead to the formation of the “Dark cloud cover” pattern and a more substantial retracement to the downside.

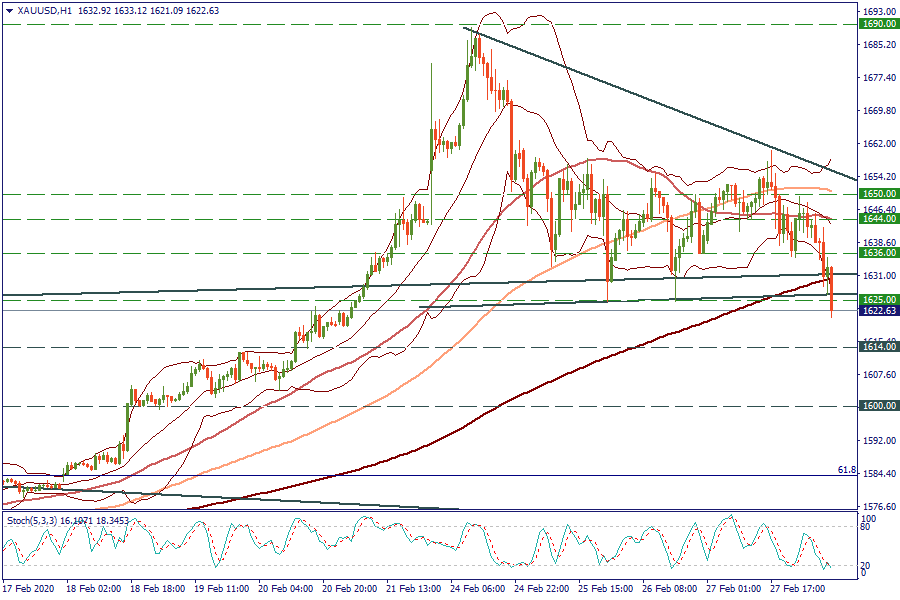

On the H1, the price is at the lower Bollinger band and the Stochastic Oscillator is at the oversold area. Still, that doesn’t mean that the decline is over. An advance above $1,636 is needed to open the way up to $1,644 and $1,650.

The price is testing support in the $1,625 zone. The next support levels lie at $1,613, $1,600 and $1,584. It will be logical to look for buying opportunities at these levels.

Keep in mind the idea that apart from this short-term profit taking, there are fundamental reasons to buy gold: it’s a safe haven in a world hit by a coronavirus. As Deutsche Bank strategists put it, “Until the virus data says otherwise, the trading strategies should probably still err (towards safety). Buy gold, short oil”.