As the market had expected, the Reserve Bank of Australia cut its interest rate from 0.75% to 0.5%. The Australian dollar rallied versus its US counterpart on the news as the decision had been priced in. In addition, the RBA didn’t signal further rate cuts.

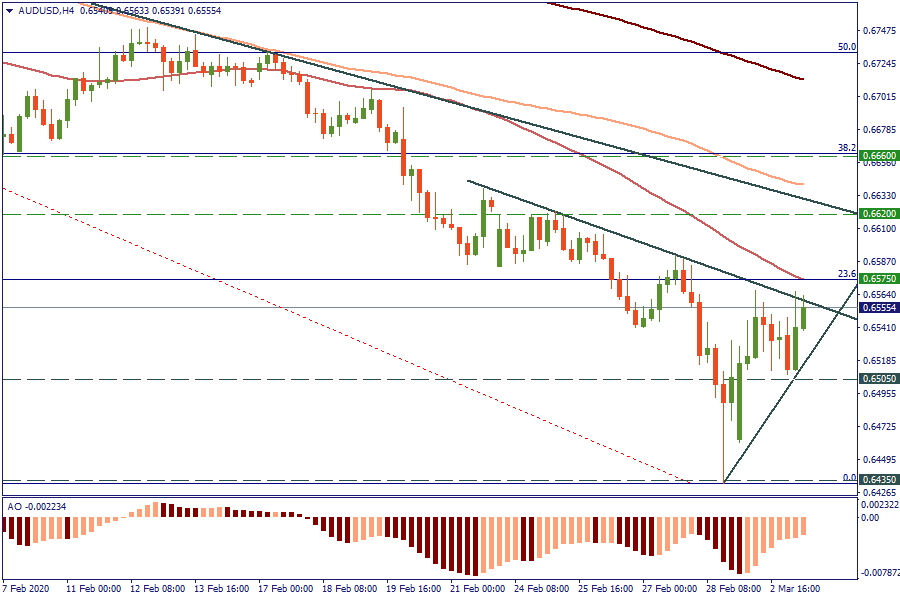

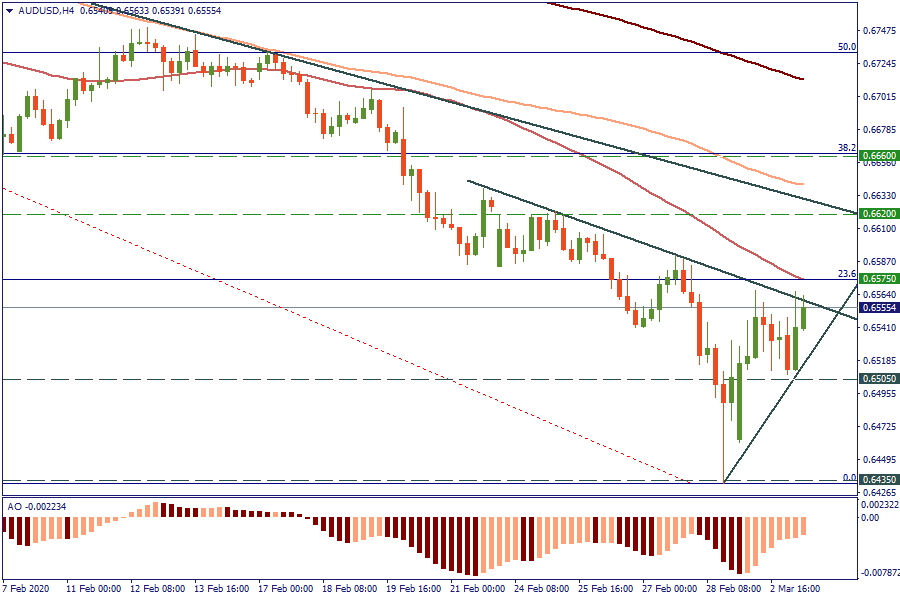

On the D1, AUD/USD formed an inside bar on Monday. As long as the pair is staying above the support at 0.6505, it has a chance to rise above 0.6575 (23.6% Fibonacci retracement of the 2020 decline). The targets are at 0.6620 (downtrend resistance line) and 0.6660 (major support of 2019 and now resistance, 38.2% Fibo).

The decline below 0.6500 will reopen the way down to 0.6450.

Trade idea for AUD/USD

BUY 0.6580; TP 0.6620; SL 0.6560

LOG IN