Trade idea

BUY 1.7230; TP 1.7280; SL 1.7215

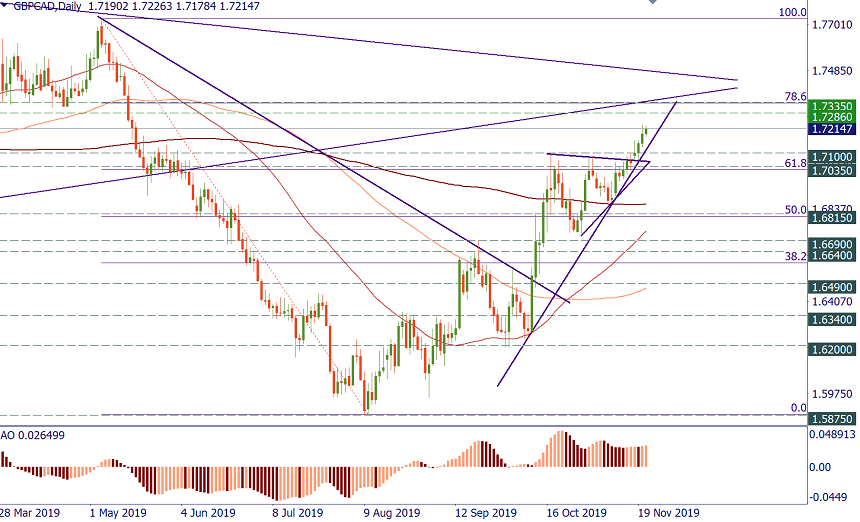

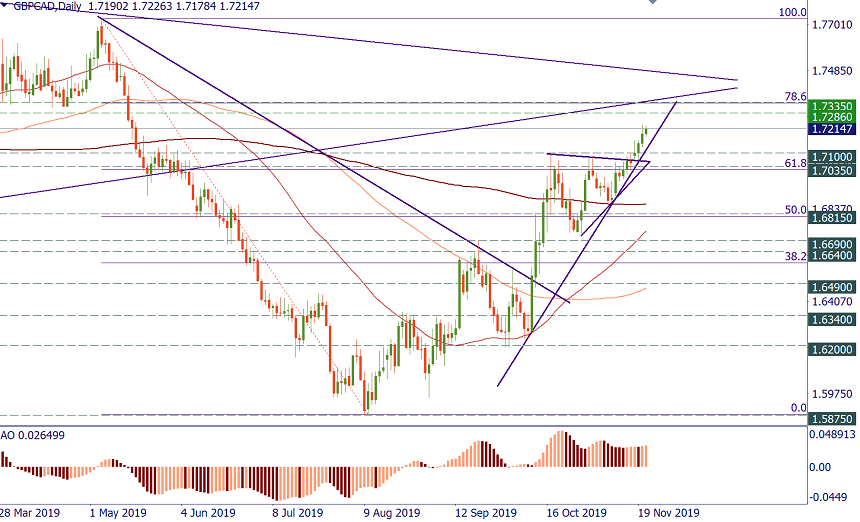

GBP/CAD has been rising since the start of September. In November, it has broken above the ascending triangle, which is now providing support in the 1.7100/1.7060 area. This week the price is above the 100- and 200-week MAs at 1.71 and 1.7155 respectively. The weekly candlestick hasn’t closed yet, so there are reasons to worry that the breakout to the upside is a false one.

At the same time, there’s still some space on the upside until GBP/CAD hits the next major resistance: there’s a 100-month MA at 1.7285 and the 78.6% Fibo retracement of the May-August decline at 1.7335. These levels may attract the market. As a result, short-term buying with there targets looks possible. It will be necessary to be careful, though, when the price reaches the resistance and consider selling if signals from price action like pin bars arrive at this point.