For the third time in a row, Apple reports a dip in sales as it releases its report for Q2 2023. The announcement led to a 7% drop in stock prices as more investors seemed to lose confidence in the stock’s performance.

2021-09-28 • Updated

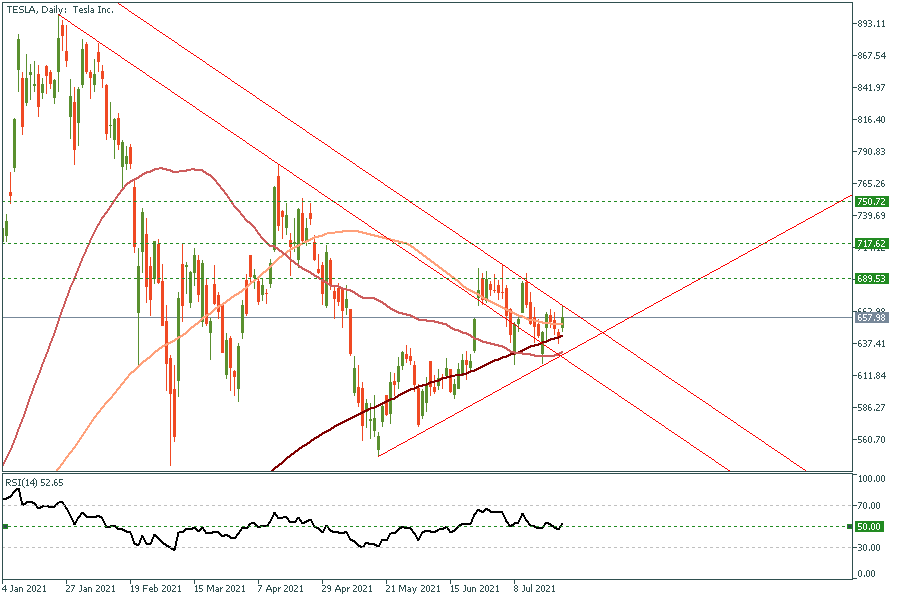

Tesla surprised the markets again with record earnings. The positive report keeps the momentum for a better-than-expected earnings season in the US. Tesla's Q2 EPS came in at $1.45 vs. 97C estimated. Revenues also showed another surprise with $11.96B vs. $11.36B estimated. The biggest surprise came in from the Free Cash Flow which posted $619M vs. a deficit of $319M. The company still sees 50% average annual growth in deliveries, while the biggest challenge ahead remains in the supply of microchips.

Overall, Tesla’s earnings represent a new positive factor despite all the challenges of the Covid19 era and it looks like the company has entered a new phase or possible sustainable profits in the coming years.

TSLA soared to $695 after hours and trimmed it back to $664. The conference call also was balanced with no hiccups from Elon Musk. With that being said, dips are for buyers this week, and expecting the stock to retest $750 in the coming weeks could be reasonable.

For the third time in a row, Apple reports a dip in sales as it releases its report for Q2 2023. The announcement led to a 7% drop in stock prices as more investors seemed to lose confidence in the stock’s performance.

It was an intense week across all the markets! We saw decent movements of major pairs, gas, stock indices, and oil prices. What should we trade this week? Time to check!

Are you searching for trade opportunities for December 6-10? Here you go!

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!