Below the surface

Whenever there is a slightest wind blow in the economic environment, investors run for safety and end up with piles of the USD in hand. The world is used to perceive the US dollar as a universal safe haven and doesn’t seem to doubt the reliability of the American currency in this sense. But what if this was to end soon? There are opinions that this is one of the very possible scenarios in the nearest future.

Behind the curtain

Fundamental changes do not come just out of the blue, they “suddenly” emerge as a result of fundamental processes. Therefore, to estimate the probability of any fundamental change, one has to estimate the strength of factors possibly leading to that change. Now, what makes the USD the global reserve currency? The same what keeps any currency running – demand. If people need a currency for transactions, reserves, payments, loans, etc., it will enjoy high value. Otherwise, a low-demand and a barely used currency may not only lose value but fall to non-existence.

Therefore, it is the global demand that keeps the USD on its throne. And why there is global demand for the American currency? First of all, there is an undeniable global presence of the American products of any kind, for which, logically, their American producers demand payments mostly in American currency. Second, to make this currency available to international entities, American and international banks are generous enough to provide loans and all kinds of credit facilities in USD so that the world has enough USDs for their use. Third, the American economy is in fact the first-ever precedent of a truly global economy, also being the biggest and the mightiest. So basically, the US economic machine is perceived as too big to fall, and hence utterly reliable in the long-term by the people and institutions around the world. Combined together, these three main factors make it clear that there is no other currency possibly comparable to the USD. Or is there?

Beyond the ocean

Truly challenging the global domination of the American economy and the USD was impossible for China just some 20-30 years ago. Now, on the other hand, not only Chinese products are in all parts of the world pressing on American production, the latter itself is now reliant on China. American companies often locate their production and supply chain hubs in China and use its labor force. Consequently, the USD gets pressed by the CNH.

In addition to that, with the presidency of Donald Trump, the American global economic strategy became more defensive rather than offensive. In other words, the US is slowly withdrawing from the international arena – and not only economically, but politically and militarily, although it seems otherwise at times.

Thus, while China is openly expanding, the US is gradually withdrawing. Add to that a hugely increased fiscal deficit resulting from the anti-virus financial measures, eroded savings, recession – and here you are with reasonable doubts about the supremacy of the USD.

Beget the shoots

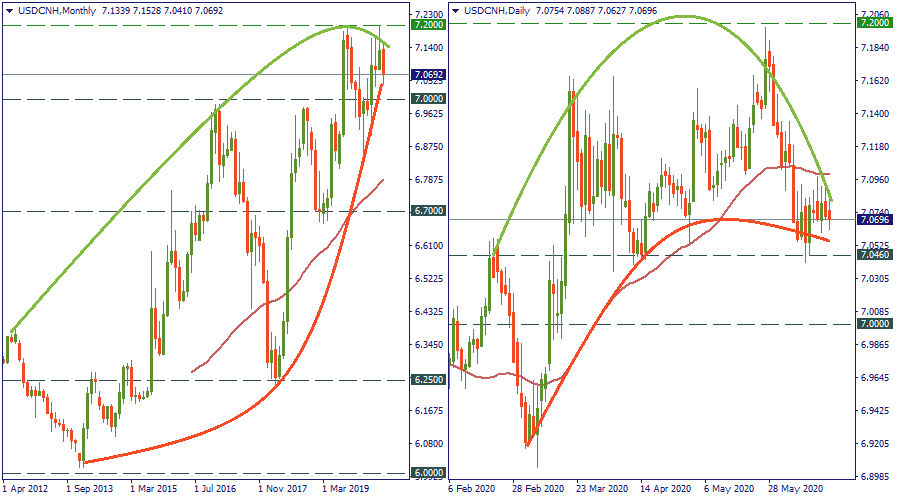

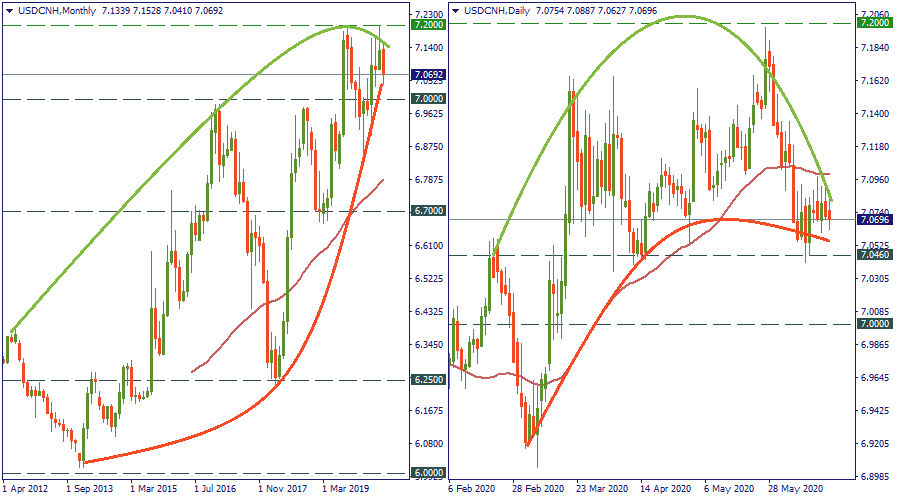

The technical perspective for the USD/CNH doesn’t look like necessarily reversing downwards. However, neither does it offer sure signs of upside or even sideways. The very long-term perspective shows how the USD shifted upwards from costing 6 CNH to 7 during the last decade, with sharp (from the strategic point of view) fluctuations on the way. The very last episode in the monthly chart shows a rounding curve with the latest high lower than the previous one – that should suggest a possible continuation of a downtrend.

The daily chart shows a similar likelihood of bearish movement – probably, the support of 7.00 will eventually be tested for further downwards potential. As per Donald Trump, weak USD is beneficial for the US exporters – that increases to the possibility of USD/CNH getting down to and below 7.00. However, going much lower than that may damage the US economy more than support it. As these moves may result from fundamental shifts discussed before, these factors should become more visible in the coming months. Therefore, follow news and prepare for possible downturns with USD/CNH.

LOG IN