The yen was one of the biggest losers in the past week mainly due to stronger USD which got traction on the upbeat economic releases out of the US. An additional drag on Japan’s currency came on Friday as the country’s central bank signaled its decision to buy an unlimited amount of bonds to keep 10-year yields at around zero percent level. As a result, USD/JPY spiked above 113.90 at the end of the past week.

Next week will start with Japan’s core machinery orders, economic watchers’ sentiment, and current account figures. Then, traders will be mostly focused on the US economic releases. The US producer price index and unemployment claims will the released on Thursday. On Friday, we will receive inflation and retail sales figures out of the US at 3:30 pm MT time. The key event of the week is Fed Chair Yellen’s testimony scheduled for 5:00 pm MT time Thursday.

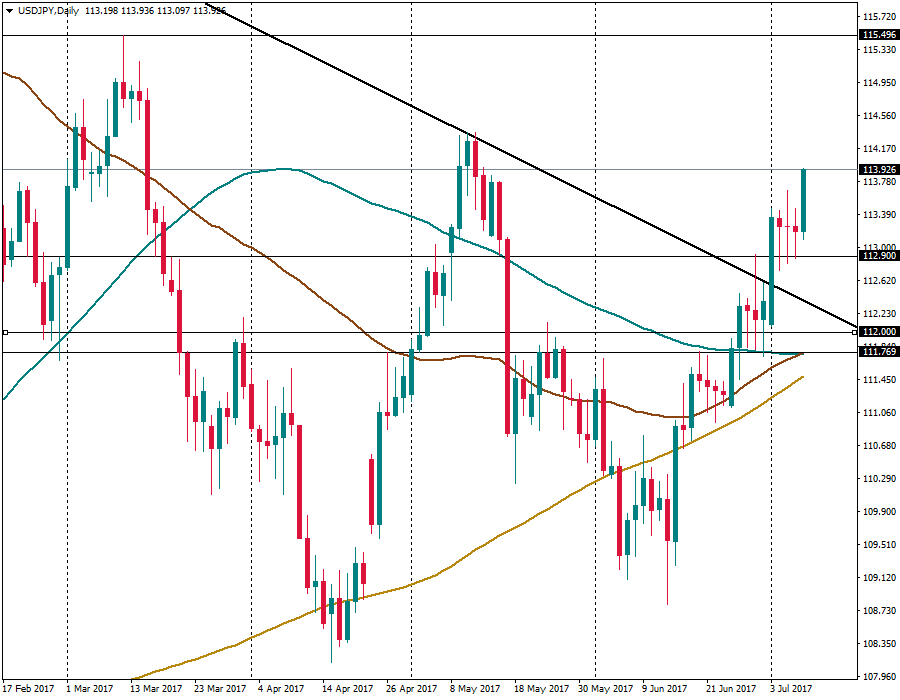

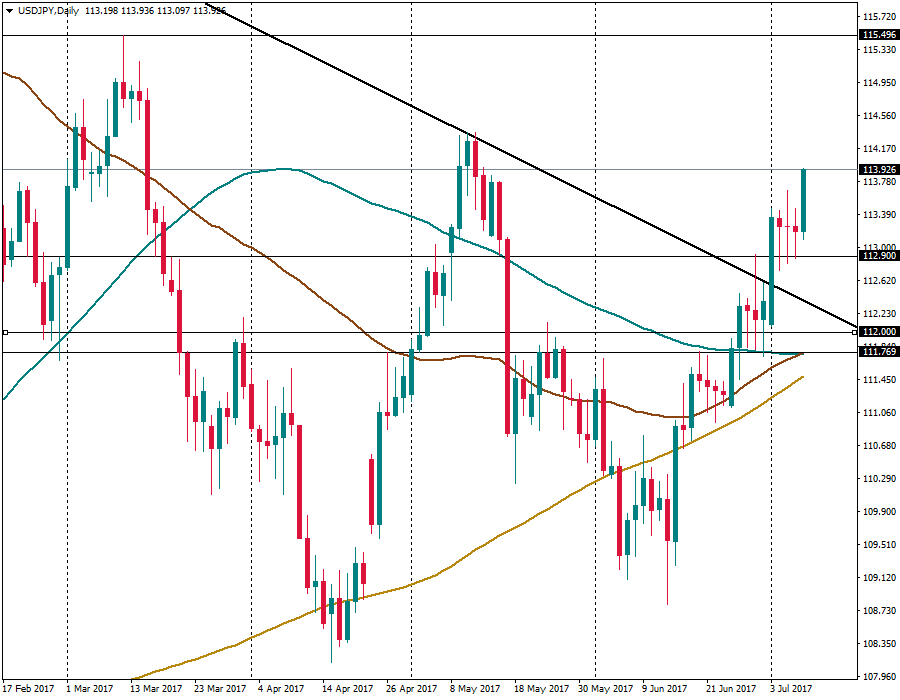

Regardless of the recent gains of the US dollar, the current technical outlook is still neutral. USD/JPY is trading in the broad range of 108.80 – 114.35 levels. A break of the upper limit of the range will open the way towards resistance at 115.50 last touched on March 10. On the downside, there are some supports at 112.90, 112.75 ahead of the psychologically important level of 112.00.