This week is full of important news, starting with PMIs in the key economies, with Jackson Hole Symposium as a cherry on the top.

2021-02-03 • Updated

A Super Thursday is coming! The Bank of England will hold a monthly meeting on Thursday, at 14:00 MT time. Despite recent rumors on negative interest rates, analysts widely anticipate the regulator to leave its policy unchanged with the rate at 0.1% and the bond-buying scheme. The Bank is expected to publish the Monetary Policy Report additionally to the rate decision. This report will contain the economic outlook and projections for 2021.

Let’s analyze the main outlines of the meeting that may have an impact on the Forex pairs.

For sure, the most important thing we will focus on during the meeting is the update on negative interest rates. According to Mr. Bailey, interest rates would affect the struggling British economy and push lenders to increase mortgage costs in response. This news comes right before the meeting on Thursday, where the Old Lady plans to reveal the findings to assess the UK’s readiness for negative interest rates. Here comes the main intrigue by the bank. If the review confirms a possibility of interest rates below zero, it may add pressure to the British pound. However, analysts doubt that the BOE would embrace this tool at least in the near-term.

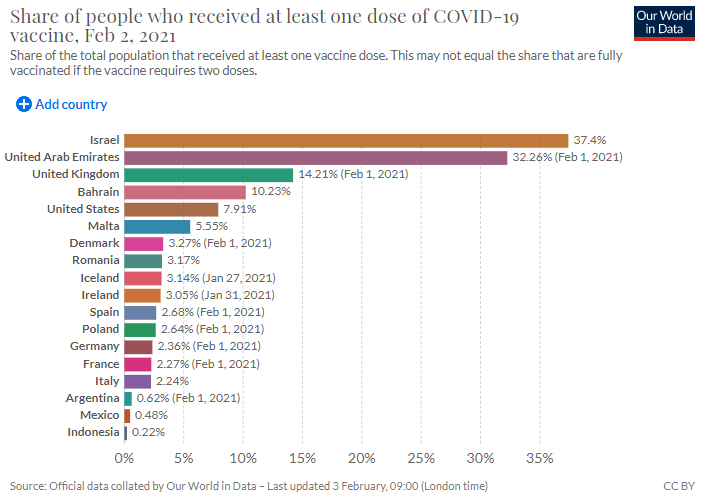

Great Britain is surviving its third national lockdown amid a spread of a new Covid-19 strain. The unstable situation around coronavirus remains a big threat to the British economy. At the same time, successful vaccine rollout boosts risk sentiment and raises hopes in a rebound of economic conditions. The UK has already vaccinated around 14% of the population, the third-highest in the world.

We expect the BOE to be cautiously optimistic here, as risks still exist.

Whether we like it or not, the post-Brexit trauma may add uncertainties to the BOE’s outlook as well. The trade deal between the UK and the EU does not seem “ideal” for many analysts. Therefore, barriers to trade may limit the recovery.

To sum up, the addition of negative interest rates to the BOE's toolbox and uncertain outlook will pull the GBP down. Alternatively, a focus on optimistic improvements will strengthen the pound.

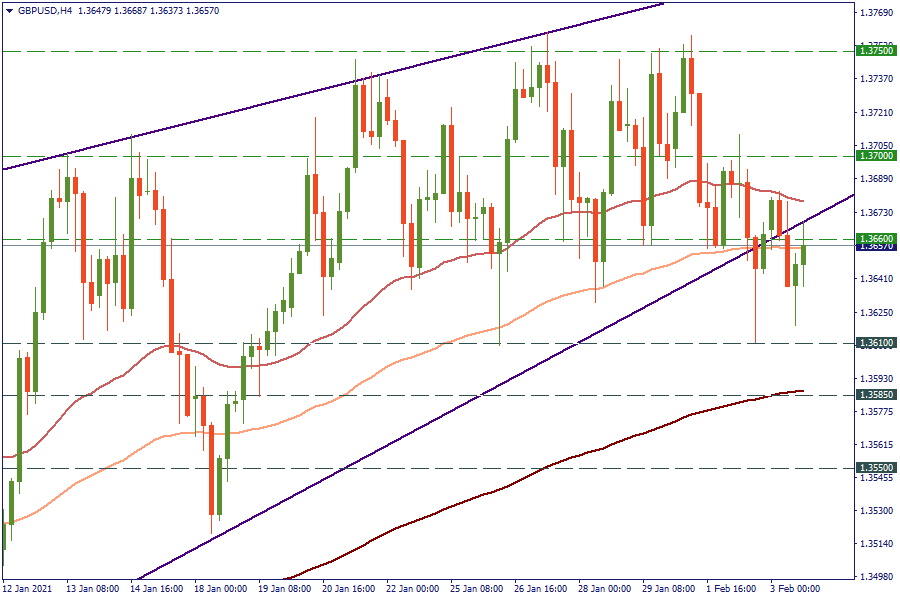

On H4, the cable managed to break below the lower border of an ascending trading channel. On Wednesday, the pair tried to recover the losses and tested the border by the higher shadow of the candlestick at around 1.3660. Bulls need to return within the channel to continue moving to the upside. In that case, the first obstacle on their way will lie at 1.37. The breakout of this level will increase the chance of a retest of the recent resistance of 1.3750. An alternative scenario would mean a strong bearish performance with a fall to 1.3610. The next support will lie at 1.3585.

Don't forget that you can trade EUR/GBP, GBP/CAD, GBP/JPY, and other currency pairs!

This week is full of important news, starting with PMIs in the key economies, with Jackson Hole Symposium as a cherry on the top.

Weaker recoveries were seen in both the UK manufacturing and service sectors, with the latter recording the greatest loss of momentum since July.

What will happen? The Bank of England will present a monetary policy statement on Thursday, August 4 at 14:00 MT (GMT+3)…

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!