Trend strategies are good—they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Apr 21, 2023

Strategy

ADX Trend-Based Strategy

Strategy setups

Instruments: any

Indicators: Average Directional Movement Index (ADX), Parabolic SAR with the default settings.

Detrended Price Oscillator (DPO) with a 0 line level.

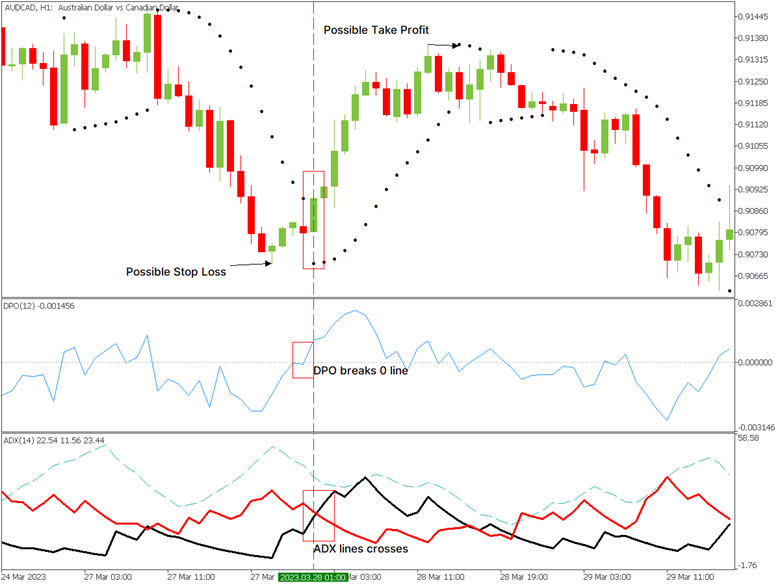

ADX is a trend indicator that consists of three lines. +DM and -DM compare prior highs and lows and the ADX, which measures the difference between them. ADX line itself is not used in this strategy. When the +DM line is higher than the -DM line, the trend is bullish; otherwise—bearish. The intersection of lines gives signals to buy or sell.

Detrended price oscillator helps eliminate the trend to find price cycles. It fluctuates around zero level. When it crosses its zero line—it gives a signal to trade.

Timeframe: >30M

Risk management rules: Fixed trade volume with 0.1 lot.

Rules for a long entry

- Wait for the DPO to cross the Zero line up.

- Simultaneously, the +DM line should cross -the DM line up.

- Parabolic SAR should grow.

It is recommended to use the Stop Loss at the level of the nearest local minimum before receiving the signal.

Rules for a short entry

- Wait for the DPO to cross the Zero line down.

- Simultaneously, the +DM line should cross -the DM line down.

- Parabolic SAR should fall.

It is recommended to use the Stop Loss at the level of the nearest local maximum before receiving the signal.

Rules for a Take Profit

- The choice of Take Profit is possible based on the ratio 3:1, i.e., a trade should bring 3 points of profit for one lost profit point.

- The trade may be closed when Parabolic SAR reverses and starts moving into the opposite direction.

Trade with FBS using Detrended Price Oscillator and ADX indicator and become a true professional!