There are many concepts in trading, and beginner traders can easily be overwhelmed by them. We’ve prepared a universal guide to the main trading definitions and their application to help you feel more confident about Forex.

What are a lot and its size?

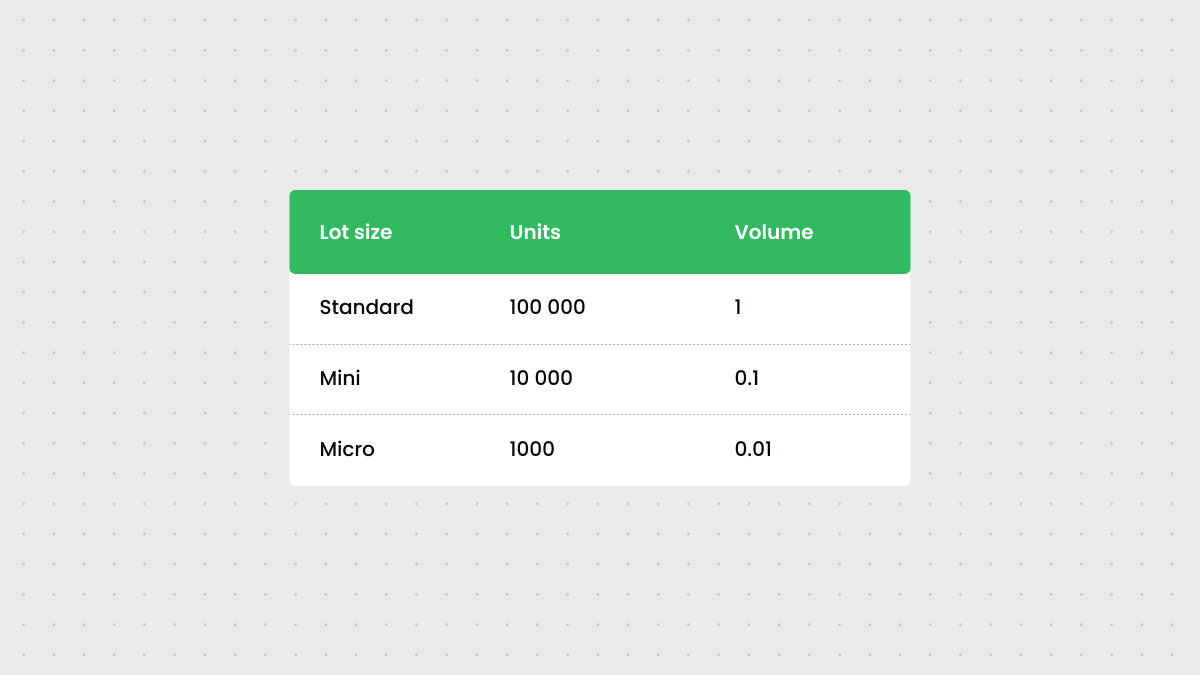

Everything is simple. A lot is just some currency units. To know the size of a lot, you should understand that one standard lot equals 100 000 base or account currency units.

Alongside a standard lot, there are two more types – mini and micro. A mini lot equals 10 000 units, micro – 1000 units. Before opening a trade, you must decide how much money you can spend.

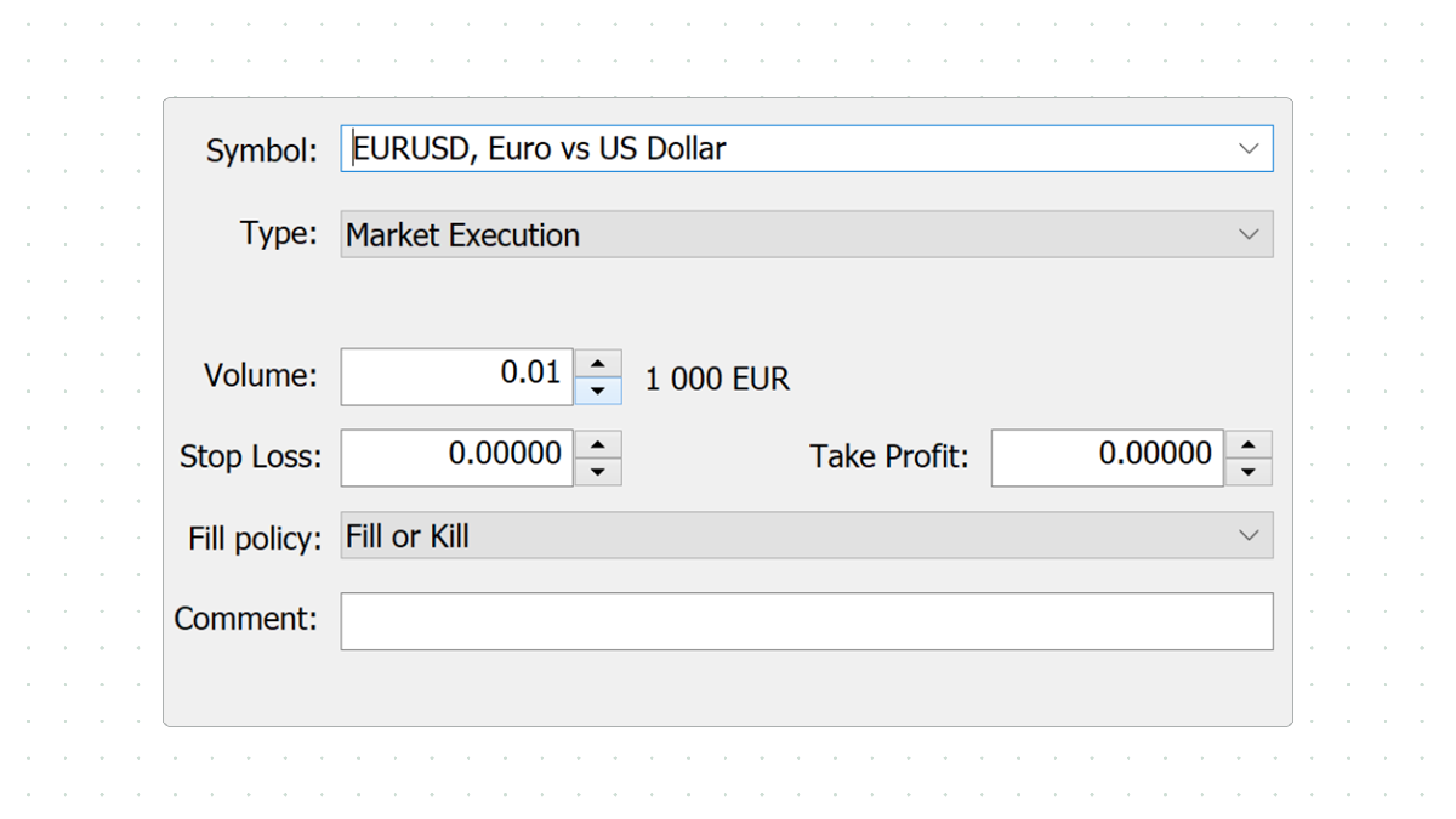

When you open an order in MetaTrader, you must choose your trade’s size or Volume. 1.0 stands for one standard lot. The minimal size of a trade is 0.01 lot (i.e. one micro lot).

Other terms you might come across are “leverage” and “point”.

What is leverage in trading?

You already know that to trade one lot of EURUSD, you need 100 000 euros. It can be a great amount of money. However, you don’t have to come up with all this money alone – you can borrow it from your broker. A Forex broker offers a way to benefit from Forex – leverage.

Leverage is borrowed capital for an investment provided by a broker. It helps amplify returns from a trade. For trading one standard lot without leverage, the deposit should equal 100 000 euros. With a leverage of 1:100, you must provide only 1% of the order size: you may deposit only 1000 euros, and the broker will cover the rest.

The smallest trade you can make is 0.01 volume (1000 euro), so with 1:100 leverage, you will need only 10 euros. With 1:1000 leverage, 1 euro is enough to open the trade.

The leverage size usually depends on the broker of your choice. Check the leverage from FBS to know your potential.

What are points in Forex?

A point is a well-known term in the field of trading, and you might have seen it in various analytical articles.

A point is the smallest currency pair change. It helps count the amount of money a trader can earn on trading.

Suppose USDJPY is quoted as 109.700. The last decimal of the price or quotation is a point. When USDJPY changes from 109.700 to 109.850, the amount of change will be 150 points.

You should look at the pair’s exchange rate to count one point.

Look at the counting process for one standard lot of USDJPY (volume = 1.0):

0.001 (a point in decimal form) / 110.80 (an exchange rate) * 100 000 (a standard lot) = $0.903 per point

If you trade a mini lot (volume = 0.1), the value of a point will change for you:

0.001 (a point in decimal form) / 110.80 (an exchange rate) * 10 000 (a mini lot) = $0.0903 per point

For a micro lot, the calculation will be the following:

0.001 (a point in decimal form) / 110.80 (an exchange rate) * 1000 (a micro lot) = $0.00903 per point

Let’s count a point for EURUSD, where the USD is not a base but a quote currency:

0.00001 (a point in decimal form) / 1 (an exchange rate) * 100 000 (a standard lot) = $1 per point

Point values made simple

You often don’t need to make calculations to estimate a point value. Notice that if your account is funded in USD, point values are fixed and don’t change when the USD is listed second in a pair: $1 for a standard lot, $0.1 for a mini lot, and $0.01 for a micro lot. These point values apply to such pairs as EURUSD, GBPUSD, AUDUSD, and NZDUSD. If the USD isn’t listed second, you must divide the point values above by the USDXXX rate.

For example, to get the point value of a standard lot for USDCHF when trading in a USD account, divide $1 by the USDCHF rate. If the USDCHF rate is 0.9700, the standard lot point value is $1.03, or $1 divided by 0.9700.

Overall, the point values are fixed in whatever currency the account is funded when that currency is listed second in a pair. In other words, the second currency provides the point value.

What is the connection between lot, point, and leverage?

To apply your knowledge in practice, you need to know how all these concepts are related. The most important questions for a trader are:

How much profit will they get in a trade in their account currency?

How much money do they need to make a trade with that profit potential?

To calculate the possible result of EURUSD trading with 1:100 leverage, use the following information:

Imagine you’re trading the EURUSD pair with a 100 000 lot size. You deposited $1000. Your leverage is 1:100. You made a buy trade at 1.15000, the pair went up, and you closed your position at 1.15500. That means you earned 500 points.

A buy trade opens at 1.15000 for EURUSD, and the lot size is 100 000.

One point is $1 because your trade volume is 1.0 (a standard lot).

The position closes at 1.15500. As a result, you have 500 points.

500 points bring you a $500 profit.

If you trade without leverage and deposit $1000 (i.e. you open a position of 0.01 lot), 1 point will bring you 100 times less – $0.01 instead of $1. As a result, when trading with micro lots, 500 points will bring you $5.

With this basic information on lots, points, and leverage, you can begin practicing. Open an account with FBS and start now!