Is there an ultimate successful day trader lifestyle that is easy and adaptable to both Forex traders, stock traders, and any other kind?

Dec 20, 2023

Trader's story

Is there an ultimate successful day trader lifestyle that is easy and adaptable to both Forex traders, stock traders, and any other kind?

Welcome to the realm of an FBS trader, where he managed to maintain his daily trading routine. With an arsenal of a mobile device in hand, essential trading tools, and an unwavering commitment to self-discipline, he reached impressive results month after month. This November, he closed 973 orders with a net profit of almost $9000.

In this article, we will discover his steps, hints, and advice to trade in a market. Whether you’re a stock trader or a regular Forex enjoyer, his tips on day trader lifestyle will come in handy.

Name: Ahmad

Occupation: freelance motion designer

Trading experience: 5 years

Trader’s style: part-time

Favorite instrument: GBPUSD

Hello, traders! I’m Ahmad. As an experienced trader, I strongly believe that discipline is the key to effectiveness, especially in the world of trading. Let me show you what I do to get the most out of forex daily trading.

I usually trade when the London market opens. It’s 3 p.m. my time, so I have plenty of time to get myself ready for work and prepare a strategy for trading.

7:00 a.m. I kick off my day by making breakfast, getting dressed, and even doing exercises if I’m in the mood. Then, I plan out my day: working, shopping, and trading.

8:00 a.m. I read the economic news over a cup of coffee. I try not to skip this part because it’s important to review market conditions, scan for opportunities, and plan my strategy for later.

9:00 a.m. I start working on my projects – no time to distract myself until the market opens.

2:00 p.m. It’s lunchtime! I usually eat in a hurry. That’s not healthy, but I want to focus on trading as soon as possible.

2:30 p.m. I plan my strategy and adapt it in case of upcoming economic events.

3:00 p.m. London trading session starts. I look for opportunities and open orders. When I open them, I go back to working on my projects and check my trades on my mobile phone from time to time.

6:00 p.m. I wrap up my work projects, prepare dinner, and do some of my hobbies. Maintaining a work-life is essential for me.

8:30 p.m. I finish trading. Now it’s time to analyze my trades, write a note in my trading journal, and reflect on my day’s performance.

9:00 p.m. Now it’s time to get some rest.

Then, I try to sleep at least 7 hours to be well-rested. I take care of my well-being to a serious extent.

I conduct two types of analysis:

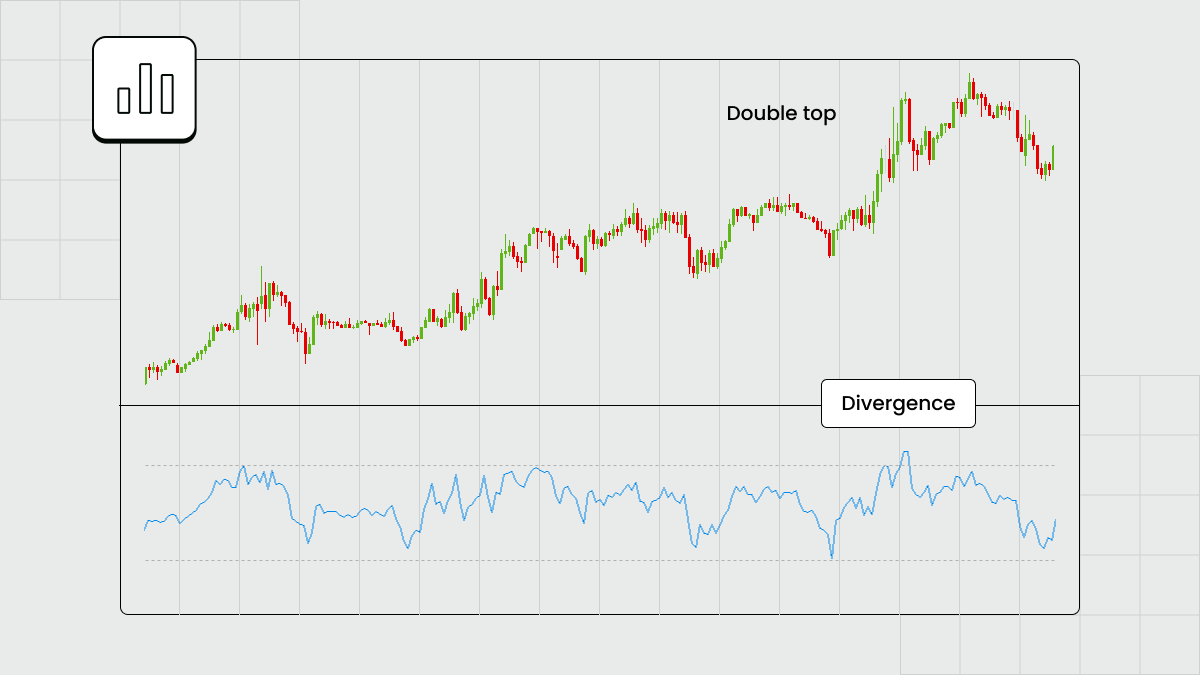

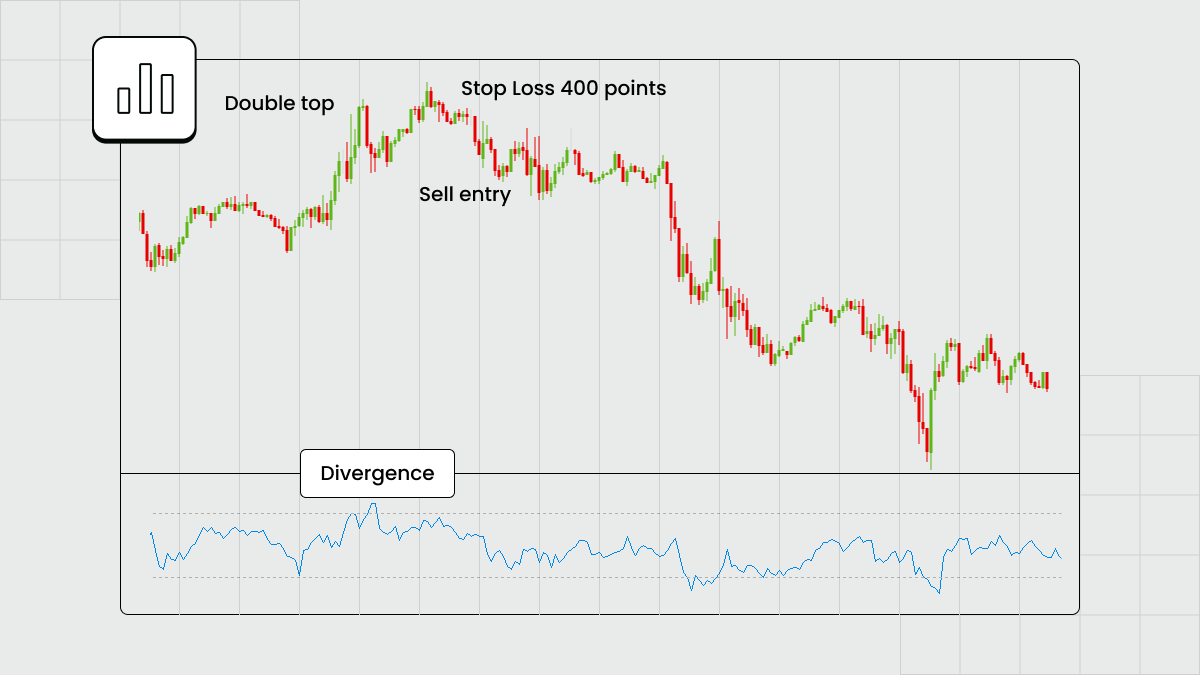

Technical analysis to forecast future price movements by using technical indicators, like moving averages and RSI, and identifying trend patterns, like head and shoulders or double tops.

Fundamental analysis to study the markets and focus on economic, financial, and geopolitical factors that could impact price movements.

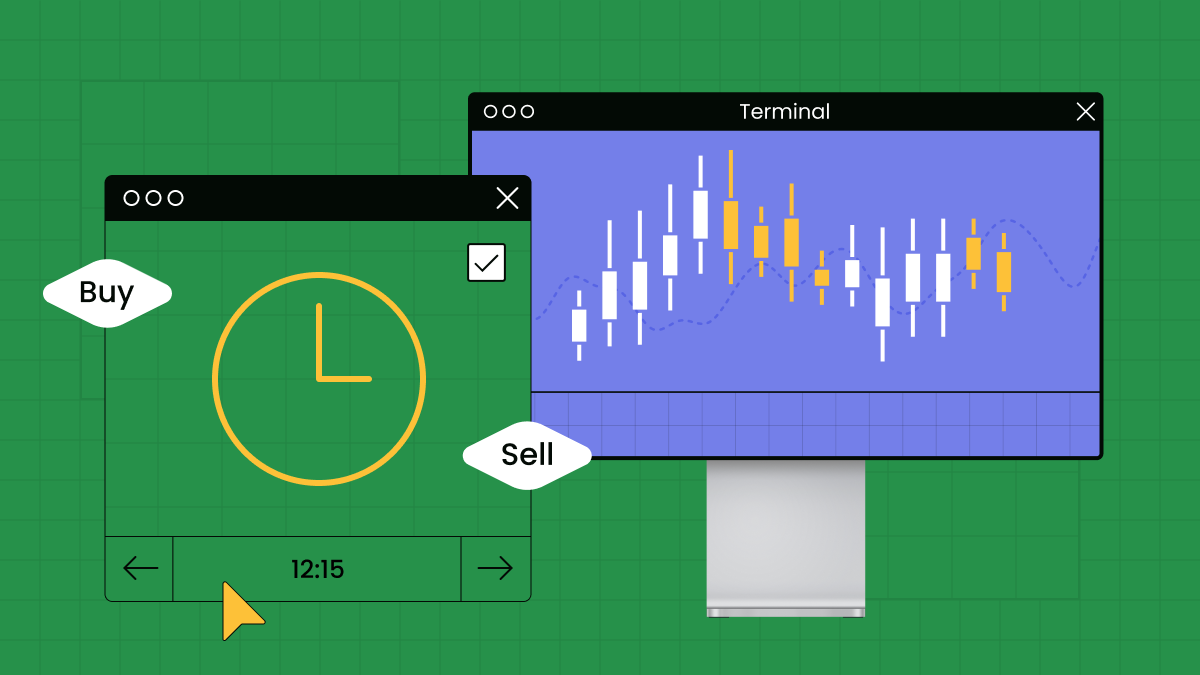

An example of my trading setup.

In the morning, long before I place trades, I analyze daily timeframes to understand a price direction, check a 4-hour timeframe to be sure of my strategy, and a 1-hour timeframe to open a trade.

Every trader has their own strategies and preferences to enter the market. But for me, it’s important to read the charts and identify trend patterns first.

To set up a trade effectively, I follow these steps:

Calculate a position size.

Identify a risk-reward ratio, which is a trader’s classic 1:3 for me.

Set up stop-loss and take-profit levels based on my risk-reward.

I open my trades on either a computer or mobile phone. However, I prefer using a mobile trading app to place orders on the go. When all is set and done, I monitor the progress from time to time, but I try to rely on my settings, strategy, and analysis. Setting stop-loss and take-profit levels is a must for me.

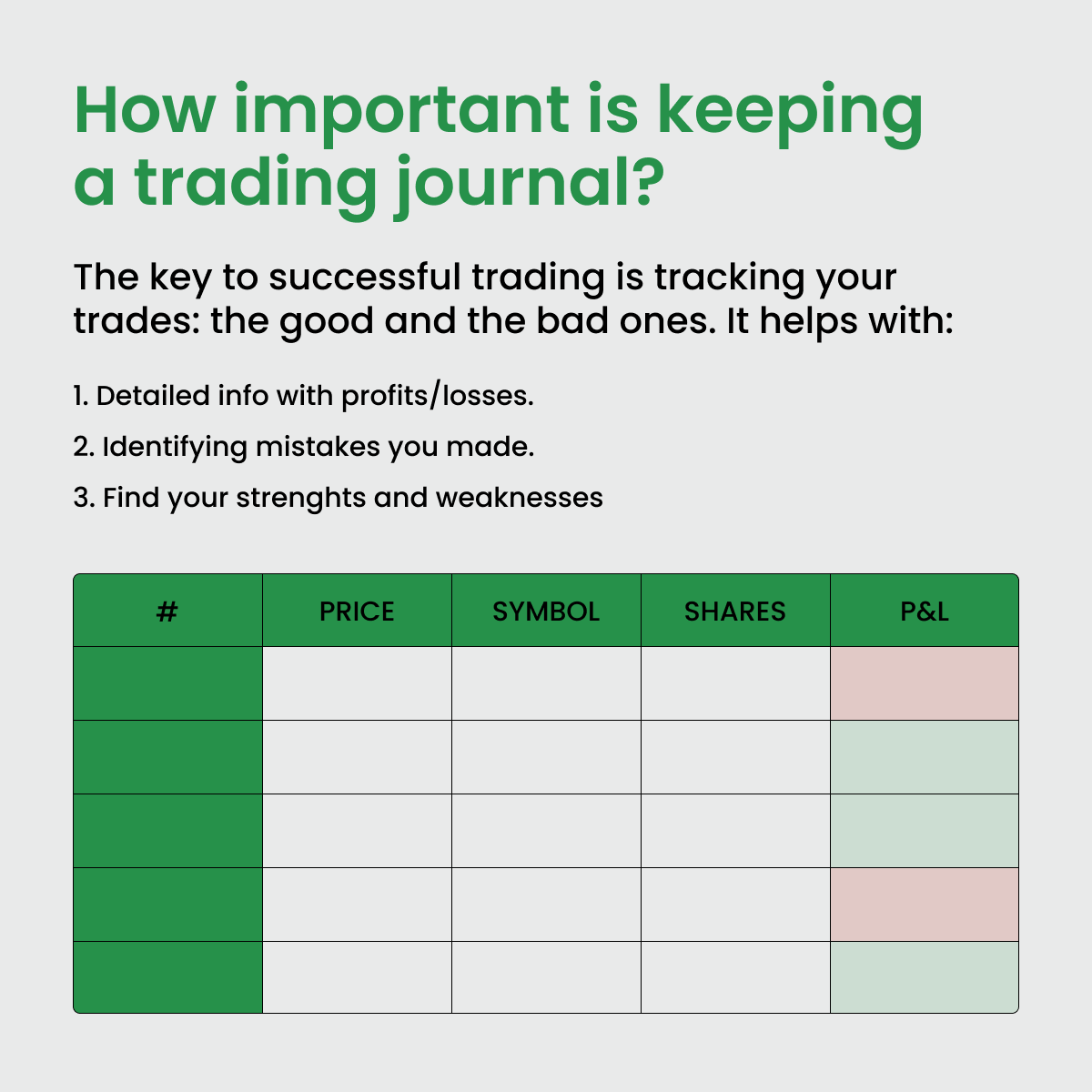

After my trades are executed, I write down every trade in my trading journal and analyze mistakes and achievements.

A trading journal is another self-disciplined tool I use after I execute all my trades. A lot of wise traders create templates to record all their trades, both winning and losing.

Record every trade. You can range the data by date, lot size, entry price, exit price, and points.

Note emotional responses. While it’s optional for me, acknowledging the emotional impact of trades is crucial, especially if emotions play a role in trading decisions.

Analyze results. I regularly review the outcomes to identify my growth points and patterns of success and mistakes.

Adjust strategies. My final step is to adjust and improve my strategies for better results.

Pros:

Objective analysis

Learning tool for self-improvement

Cons:

Time-consuming

Emotional impact

Despite its challenges with time and dedication, the trading journal provides facts, and I can clearly identify my growth points even though it’s hard to face mistakes sometimes.

Several common mistakes in trading can push back success and profitability. With FBS, I came up with some tips to avoid these mistakes.

Meaning: You execute too many trades because of impulsive decisions or the desire to recover losses quickly.

Impact: Increased transaction costs, higher exposure to risk, and potential emotional burnout.

How to overcome: Develop discipline with a trading plan and don’t trade more than you’ve planned.

Meaning: You avoid risk management strategies, especially setting stop-loss orders.

Impact: Exposure to losing money and no control over the daily trade results. No control over the results leads to no result at all.

How to overcome: Stop-loss order is a must, so always set it before you open a trade.

Meaning: You don’t know about fresh market trends, new trading strategies, and relevant economic events.

Impact: Missed opportunities and inability to adapt to changing market conditions.

How to overcome: Stay informed about market developments by following relevant media channels, attending educational webinars, or reading articles.

From what I shared today, I must say that it works for me but might not work for you. It’s important to listen to yourself first and find what suits you best. However, I believe discipline is a key not only to trading, and you might change your routines to achieve the best results in any sphere, too.

I wish all traders the best of luck on their journey!

In the dynamic world of trading, success hinges on a well-crafted routine. Here’s an example of how to improve your routine from an experienced day trader: discipline, journal, and breaking bad habits.

The trading journey comes with its challenges. Even the most seasoned and famous traders face them every day. With FBS, we’re ready to help you on the way. Stay educated, and see you next time.

Start your day with market analysis by reading news and related articles and monitoring the daily timeframes of the instruments you trade.

Plan your strategy ahead – write down your goals and set stop-loss and take-profit orders.

Don’t forget about economic events, as they affect the price and can change the game.

Keep your trading journal updated with all your actions during trading, as it will help you spot all the growth points for better results.

Successful traders exhibit a range of habits and practices that contribute to their accomplishments. They initiate their trades within the day, develop effective strategies, use risk management techniques practices, such as stop-loss and take-profit orders, manage their emotions while trading daily, and keep track of all their trades, both losing and winning.

What is more important is maintaining a balanced lifestyle for sustained success. Day traders, in particular, should prioritize their health and well-being, recognizing the impact of physical and mental fitness on their trading performance. By fostering a healthy lifestyle, they enhance their resilience, decision-making abilities, and overall effectiveness.

A successful trader never stops learning to get the most results out of daily Forex trading. They follow economic events, keep an eye on daily timeframes, and learn new strategies day to day.

Here are key practices that you can contribute to developing an effective Forex trader lifestyle.

Develop a trading plan with a set of rules.

Don’t go trading blindfolded. Instead, specify all your entry and exit points and determine your profit goal.

Backtest your strategy by using demo accounts.

Research and educate yourself to maximize your potential.

Trading includes negative emotions, so be aware of them and don’t make irrational decisions.

Risk only what you can afford to lose and always use stop-loss orders. The key is keeping the losses small enough to find more winning trades.

Every trader, even successful stock traders, experiences losing trades. Still, a wise trader makes sure that a losing trade is failing within their trading plan and isn’t affecting the capital for trading another day.