Catch a wave with swing trading strategy

While trying to find a perfect balance between day trading strategy and scalping, traders may discover an attractive in-between style. The name of the article speaks for itself: today we are going to talk about swing trading. So, what is swing trading?

Swing trading is a specific approach to trading, which combines fundamental and technical analyses. Trading swings reminds of surfing: you catch the swings when the price changes direction. If you choose this trading style, you hold your position for several days. Therefore, you should be familiar with the main principles of position size management and the mechanism of swaps.

You’ve probably guessed that swing trading works perfectly during sideways markets, as in that situation the price fluctuates within certain levels. At the same time, “swing-catching” is also possible when a price makes corrections within a trend.

If the swing trading sounds too complicated for you, we will be happy to reassure you with a good swing strategy called “H4 crossover”. Its rules are as simple as its name! Let’s look at the details.

First of all, let’s consider the basic conditions for the strategy. They are, as follows:

- Timeframe: H4

- Indicators: 89-period SMA, 21-period EMA (with application to close prices), and MACD oscillator with standard settings (12, 26, 9).

- Currency pairs: EUR/USD, GBP/USD, AUD/USD, USD/CAD, EUR/GBP, EUR/AUD, EUR/JPY, GBP/JPY, USD/JPY, GBP/CHF, USD/CHF, EUR/CHF.

Don’t forget about money management. Your maximum risk and profit target per trade should equal about 1-2% of the account balance.

The steps for the strategy will be, as usual, presented for both “sell” and “buy” scenarios.

Algorithm for the “buy” scenario

- Firstly, we wait for the 21-period EMA to cross the 89-period SMA to the upside.

- Price should go higher but then retrace with MACD going down.

- We place the “entry” order on the closing price of the first green candle after MACD turns back upwards. (Important notice: the price should be higher than the 21-period EMA. If it is not, you need to skip the trade.

- Stop Loss goes 4-10 pips below the previous significant support level.

- Take Profit is placed at the same distance as a Stop Loss.

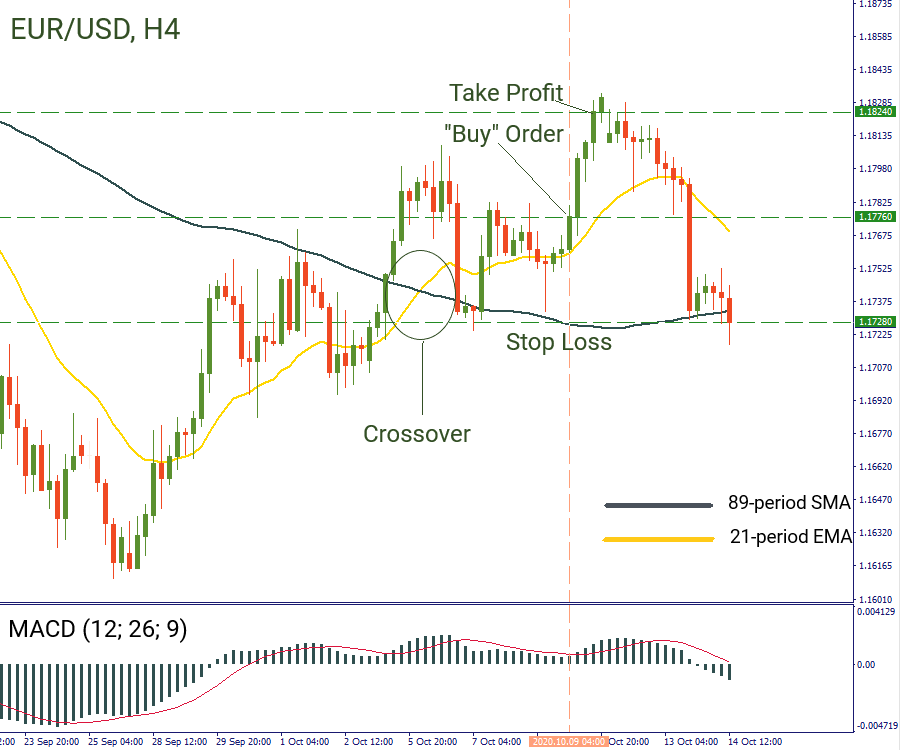

Below we provided an example of the strategy on the H4 chart of EUR/USD.

In the chart, we can see that the 21-period EMA (yellow line) broke above the 89-period SMA (grey line) on October 6. The price jumped higher, but then corrected downwards. At the same time, MACD was going down. We waited for the price to rise back above the moving averages and for MACD to go up. After that, we opened a position at 1.1776 (closing price of the bullish candlestick). We placed Stop Loss 5 pips below the support at 1.1728. The level of Take Profit was placed at the same distance between the “buy” order and the Stop Loss, which is 48 pips. As a result, our Take Profit went to: 1.1776+48=1.1824.

Algorithm for the “sell” scenario

- Alternatively to the “buy” scenario, we wait for the 21-period EMA to cross the 89-period SMA to the downside.

- Here, we expect the price to fall but then correct to the upside with MACD going up.

- We open a “sell” position on the closing price of the first red candle after MACD starts going down again. Important notice: the price should be lower than the 21-period EMA. If it is not, you need to skip the trade.

- Stop Loss goes 4-10 pips above the previous significant resistance level.

- Take Profit is placed at an equal distance as a Stop Loss.

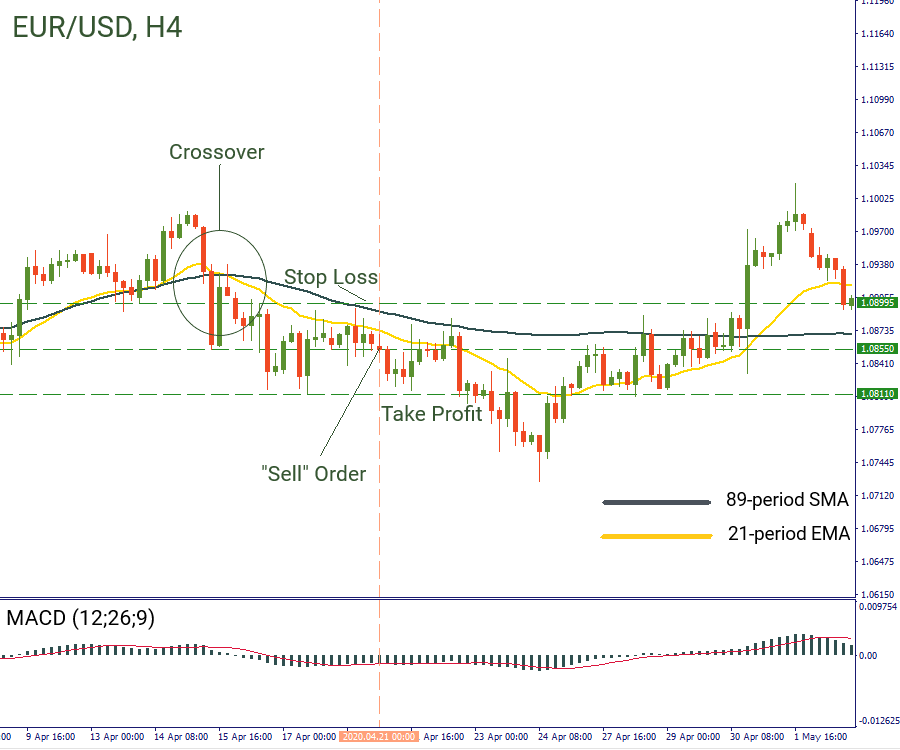

In the same chart of EUR/USD, we saw that that the 21-period EMA (yellow line) broke below the 89-period SMA (grey line). The price then moved down and up. MACD was moving higher as well. We waited for the oscillator to reverse and opened a “sell” order at the closing price of the red candlestick. Stop loss was located above the resistance level at 1.0899, while take profit was put at 1.0811 (1.0855-0.0044=1.0811).

This strategy seems pretty easy, right? By following the simple rules explained above you can master swing trading quite effectively. We recommend you to try it out on the demo account first for backtesting and then implement it in the real market environment.