Financial markets alternate between periods of decline and growth. They are related not only to the economy, but also to the psychology of investors. Many investors try to analyze market cycles to make more profit. Let’s take a look at what this is.

What are market cycles?

Market cycles are patterns or trends that tend to form over time in various markets. They represent the period of time between two minimum or maximum price points. Typically, new market cycles emerge when trends form in a particular sector or industry due to some kind of innovation, new product, or regulatory change.

The length of a market cycle can vary from a few minutes to several years, depending on the market. There are different aspects of the cycle: for instance, day traders focus on 15-60-minutes intervals, while real estate investors analyze periods of up to 20 years.

Understanding Market Cycles

Cycles in the markets exist primarily because there are cycles in the economy.

However, there are other reasons. The economic cycle affects not only the profitability of companies, but also the psychological mindset of investors. They rarely hold rational and stable positions. And when markets rise, investors are optimistic and willing to take risks. They buy stocks, and prices go up. However, the mood can change, then investors start selling and the price of securities falls.

Phases of a Market Cycle

There are four phases in each market cycle:

Accumulation Phase

This is the first phase of the market cycle. Accumulation begins after the market has bottomed in the previous cycle. As demand grows, prices can no longer form new lows. Consequently, the downtrend begins to lose its momentum. The market becomes bullish.

Mark-Up Phase

In the mark-up phase, the market begins to consolidate. Prices begin to rise and the market attracts a large number of buyers who want to join the new uptrend at an early stage. Bullish price trends push prices to new highs. First-time buyers take advantage of high prices to capitalize on their early investments. Traders also take advantage of the uptrend at this time.

Distribution Phase

In the distribution phase, the market experiences a sell-off. However, prices remain stable for quite a long period of time. This is due to the equal distribution of buyers and sellers in the market. The bullish sentiment at the markup stage begins to fade, and no new highs appear. Investors who have not entered the market are left out. This is a great time for investors to sell assets as prices have peaked.

Mark-Down Phase

This is the final phase of the market cycle. In this phase, large investors begin to sell their investments to lock in profits. The rest of the participants quickly follow. When prices fall in a downtrend, market sentiment becomes more bearish. Investors who entered the market when prices were at their peak will hold onto their investments in the hope that prices will rise. Unfortunately, prices continue to fall. This is a sign to investors who can determine the end of the downtrend to make new purchases. When that happens, the accumulation phase begins and a new market cycle is formed.

Types of market cycles

There are different types of market cycles. Let us consider the main ones: universal (Wyckoff market cycle), Wall Street market, forex market, and housing market cycles.

Wyckoff market cycle

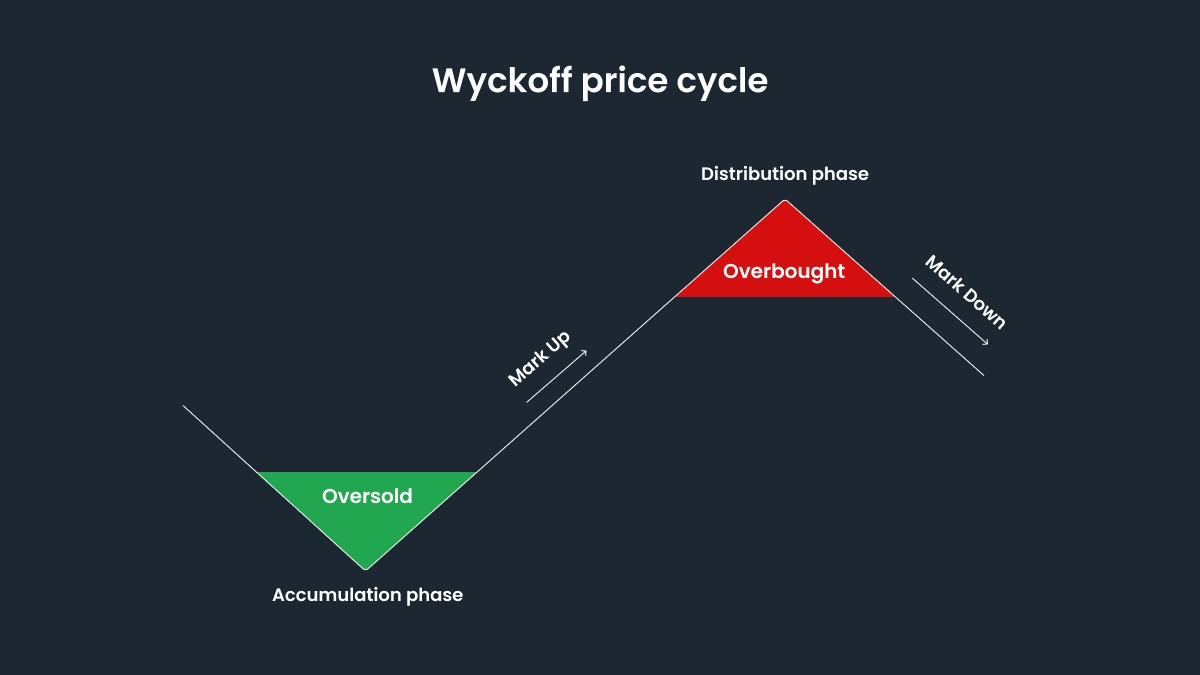

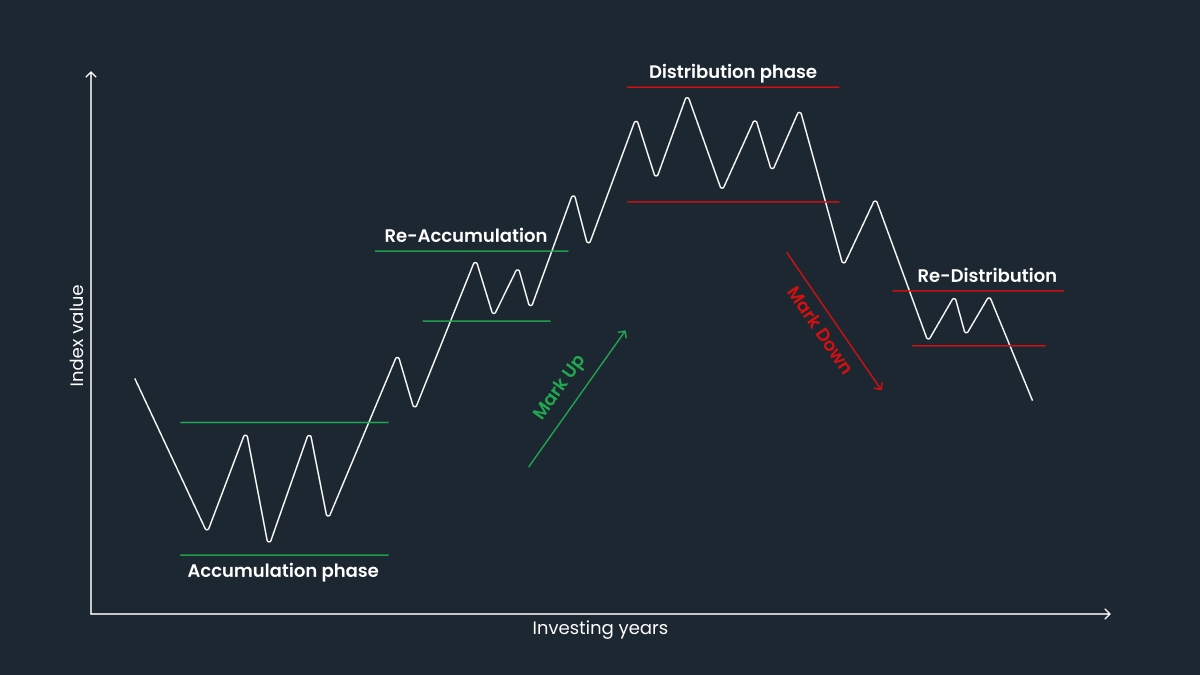

There are four stages of Wyckoff market cycle: accumulation, mark-up, distribution, mark-down

Wyckoff market cycle is based on observations of price, key moments of trend development, and periods of accumulation and distribution. Although the Wyckoff method originally focused only on stocks, it is now applied to all types of financial markets.

The Wyckoff market cycle consists of four main phases: accumulation, mark-up, distribution, and mark-down.

The accumulation phase establishes the trading range. So-called market makers accumulate assets before most investors do. This phase is usually marked by flat movement. Accumulation occurs in a gradual manner to avoid significant price changes.

In the mark-up phase, the market begins to grow upwards. A trend is formed, which gradually attracts more and more new investors, which subsequently leads to an increase in demand. As the market moves upward, other investors are encouraged to enter the market and buy assets. As a result, the excitement affects more people who want to participate. During such a period, demand is much higher than supply.

Then comes the distribution phase of purchased assets. Sellers sell their profitable positions to those who enter the market at a late stage. As a rule, the distribution phase is marked by a flat movement, which absorbs demand until it is exhausted.

The last phase of the price movement of the Wyckoff method is mark-down. At this stage, supply dominates and the price goes down almost nonstop. In other words, after a significant portion of stocks are sold, the market begins to move downward. Eventually, supply becomes much greater than demand, and a downtrend sets in.

Forex Market Cycle

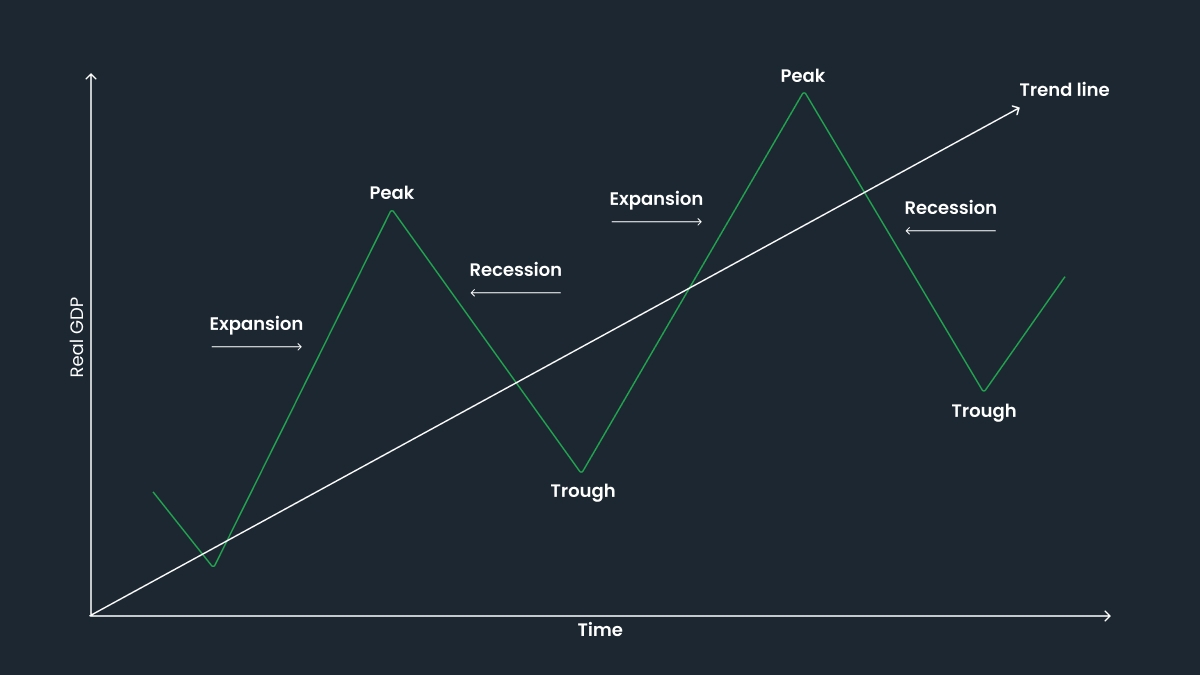

There are many types of forex cycles and their types and features are not limited to any one parameter or time frame. Let’s look at one of the most common forex tightening and easing cycle that has four phases: expansion, peak, recession (or contraction) and trough.

The first stage of the cycle is expansion. During this phase, the market recovers from previous bottoms. The interest of market participants in the asset increases. And they begin to act: they buy on an uptrend or sell on a downtrend. The more active participants act, the faster the trend develops.

Next one is the peak phase. Economic indicators such as production and sales volumes, employment, etc. are at their highest and no longer growing. At this stage, the trend has exhausted itself and its rapid growth or decline begins to stop.

Then comes the recession. Stocks are already falling, and commodities are also beginning to decline in anticipation of falling demand as the economy weakens. At this stage, investors close their deals.

The final stage of the trend cycle is trough. The peculiarities of this stage are relative market calm and insignificant price changes. During this period, the market is accumulating its strength and consolidating after the recession. Economic conditions are no longer deteriorating, but the economy is not yet in an expansion phase.

Wall Street Market Cycle

Wall Street’s market cycles are similar to Wyckoff's cycles. They are also based on accumulation phase, mark-up, distribution phase, and mark-down.

There are four emotional stages of the wall street market cycle on the chart: stealth, awareness, mania, blow-off.

The first phase is similar to the accumulation phase in the Wyckoff’s cycle and is called the stealth phase. On this stage the prices rise slowly and money makers identify the best buying opportunities.

The second phase is awareness. Prices are beginning to rise again, but investors are not letting their guard down. If they decide to enter the market again, they are cautious.

At the top of the market cycle is mania, the point of maximum financial risk. This is the time when investors think that nothing bad can happen. Thus, a self-sustaining cycle is formed: more and more investors enter the market hoping to make incredible profits, leading to further price increases, and capitalization reaches dizzying heights.

Then the bubble bursts and the market enters the blow-off phase. As bullish trends are replaced by bearish ones, investors lose hope and start to panic. They are no longer confident in their actions and are trying to minimize their losses. Some of them finally lose heart and no longer believe that the market will recover.

Housing Market Cycle

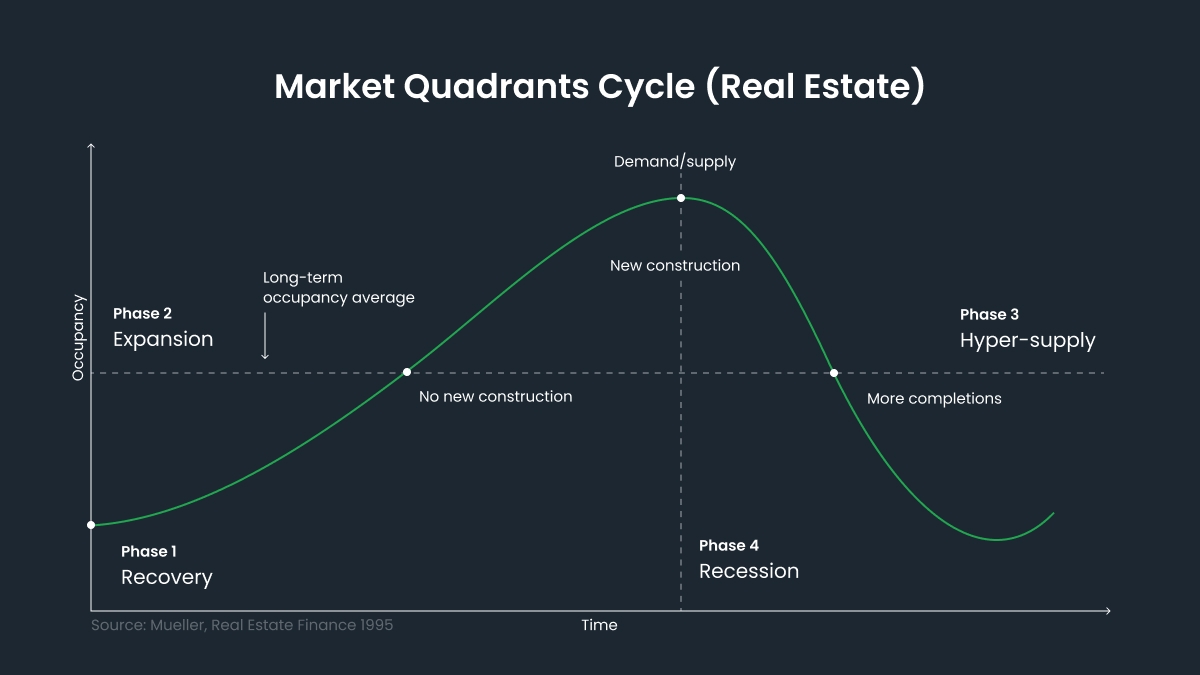

The real estate market is particularly cyclical because supply often fails to keep up with rapidly changing demand. The cycle consists of four main phases: recovery, expansion, hyper supply, and recession.

Recovery is where the market begins to revive after the recession. The number of transactions gradually grows and the share of unclaimed real estate decreases: demand begins to absorb the excess space created during the expansion phase.

Expansion is driven by economic growth and an increase in the purchasing power of the population. The market cycle enters this phase when the level of unclaimed real estate falls to a minimum and, on the contrary, buyer interest increases. At this point, investors begin to actively invest in the construction of new facilities to meet the increased demand.

At some point, investors stop paying attention to the inflated cost of land or the projects themselves, believing that further increases in prices and rental rates will recoup their costs. That is when prices for properties on the market begin to noticeably exceed the real purchasing power of the population and businesses, and the number of transactions begins to decline. At the same time, the construction of objects that started during the expansion period cannot be stopped overnight, and the market becomes oversaturated, which may lead to the formation of a bubble.

Recession manifests itself in a decline in prices and rental rates, which is influenced not only by reduced demand, but also by the growing share of unclaimed real estate. During a recession, investors freeze new projects and construction rates fall.