In trading, we can rely on a bunch of different entry signals.

2023-04-03 • Updated

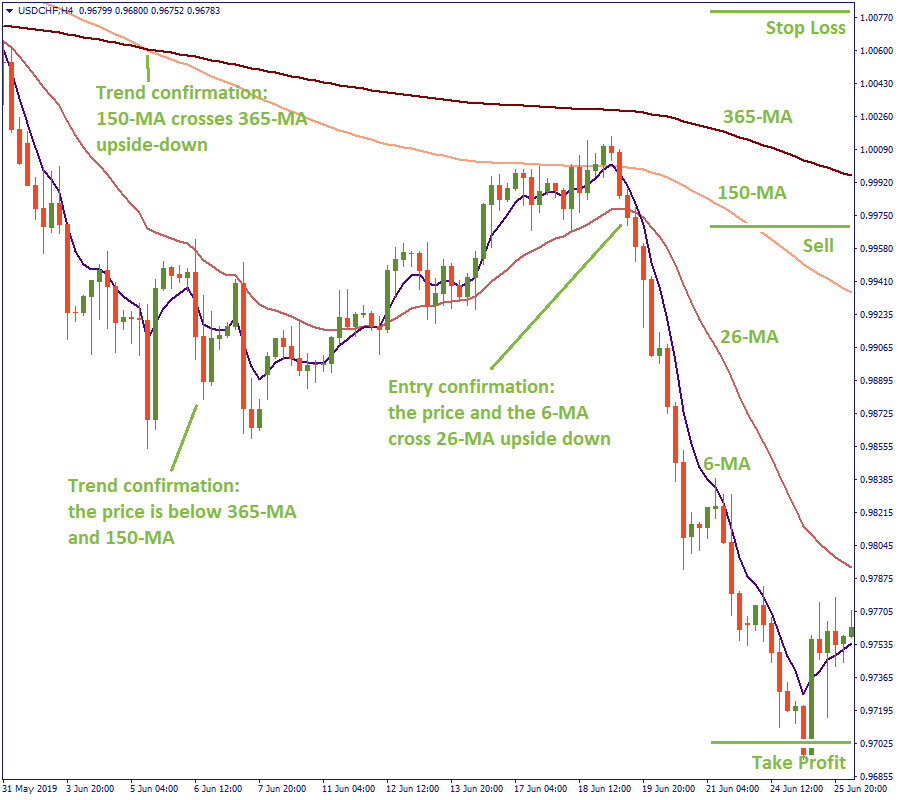

This is a trend-trading strategy. It allows determining trend and choosing entry points. Long-term Moving Averages are used to confirm the general market direction, and the short-term ones are used to indicate where to open a position.

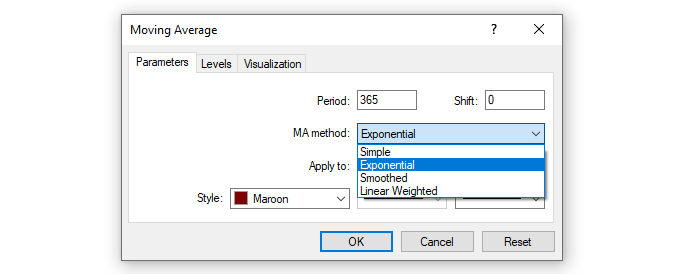

Long-term Moving Averages: 365-period and 150-period, both exponential.

Short-term Moving Averages: 26-period and 6-period, both exponential.

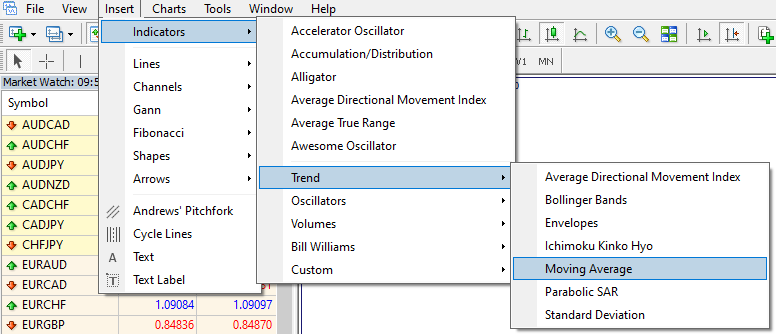

Below you will see where to choose the Moving Average indicators in the MetaTrader menu.

Right-clicking on the Moving Average line and choosing the Properties menu will offer you to set the required exponential method as below.

Daily, H4 and H1 are most convenient for this strategy.

You may trade any currency, stock or commodity using this strategy. However, to make regular profits, it would be more efficient with those currency pairs or items, which show more regular price movement patterns. Therefore, we suggest such EUR/USD, GBP/USD, GBP/CHF, and USD/JPY for this strategy.

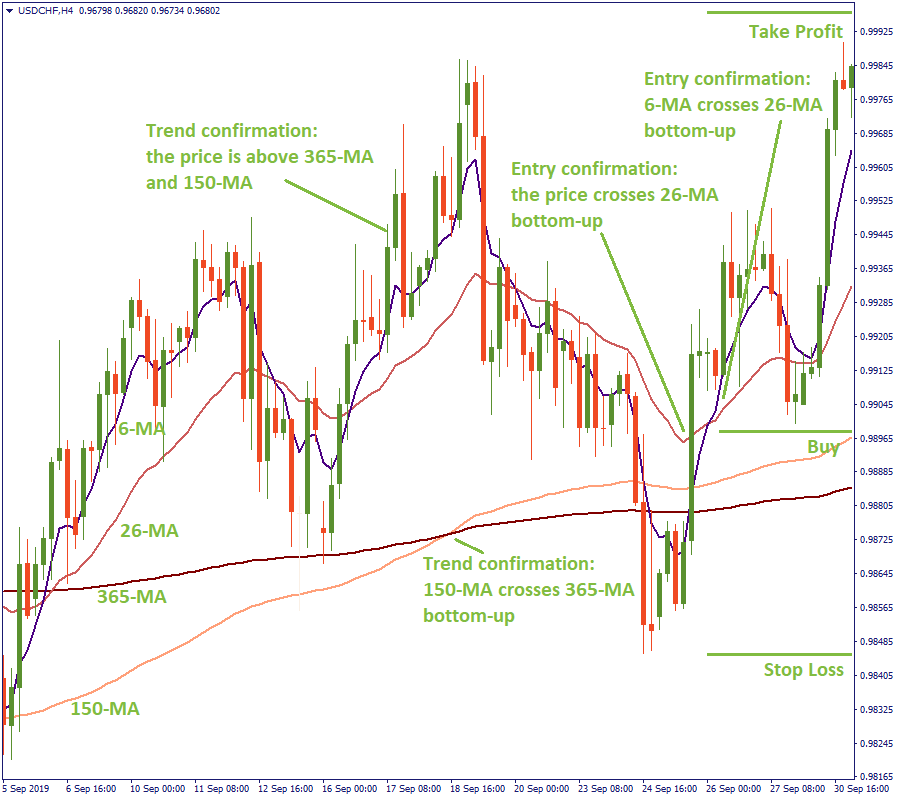

Essentially, we are not deviating from the trend-trading rule: buy on the rising market, sell on the decline. Therefore, firstly, you need to understand if the market is rising or falling. To do that more easily, plot 365-period and 150-period Moving Averages to the chart.

Now, if you see that prices are above the 365- and 150-MAs (or the 150-MA crosses the 365-MA bottom-up), that is a rising trend. Hence, you will buy. Otherwise, if prices are moving below both the long-term MAs (or the 150-MA crossed the 365-MA upside-down), that will be a downtrend. Thus, you will sell.

Now, find an entry point. To do that, you plot 26-period and 6-period MAs to the chart.

In an uptrend, wait for the price (or the 6-MA) to cross the 26-MA bottom-up – that will be a signal to open long positions.

In a downtrend, when you see the price (or the 6-MA) crossing the 26-MA upside-down – you sell.

It is recommended to set the stop-loss above the 365-MA for the sell trade, and below the 365-MA for the buy trade.

There is information in the media that this strategy enabled a group of traders to gain significant profits on 80 deals in a row. While that may be the case (we cannot deny the possibility of an effective trading strategy in use), we do not advise you to get obsessed with any single strategy to see if you actually hit 80 or 100 or any other number of successful deals based on this approach.

Sober risk-management and expectations from daily trading are always the best practice. See if this strategy works for you, take some time to reality-check it. If it is successful – well done; proceed with caution. If not – continue learning and try using other strategies.

In trading, we can rely on a bunch of different entry signals.

A triangle chart pattern is a consolidation pattern that involves an asset price moving within a gradually narrowing range.

Trading has several levels of complexity, starting from the easiest, like buying and selling random assets, to a more comprehensive one, with deliberate risk management, timing, and objectives.

Click the ‘Open account’ button on our website and proceed to the Personal Area. Before you can start trading, pass a profile verification. Confirm your email and phone number, get your ID verified. This procedure guarantees the safety of your funds and identity. Once you are done with all the checks, go to the preferred trading platform, and start trading.

If you are 18+ years old, you can join FBS and begin your FX journey. To trade, you need a brokerage account and sufficient knowledge on how assets behave in the financial markets. Start with studying the basics with our free educational materials and creating an FBS account. You may want to test the environment with virtual money with a Demo account. Once you are ready, enter the real market and trade to succeed.

The procedure is very straightforward. Go to the Withdrawal page on the website or the Finances section of the FBS Personal Area and access Withdrawal. You can get the earned money via the same payment system that you used for depositing. In case you funded the account via various methods, withdraw your profit via the same methods in the ratio according to the deposited sums.

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!