.jpg)

The RSI was developed by J. Welles Wilder in 1978 to measure the speed and change of price movements. The indicator also helps to determine whether the market is overbought or oversold in order to buy low and sell high.

How to implement the RSI

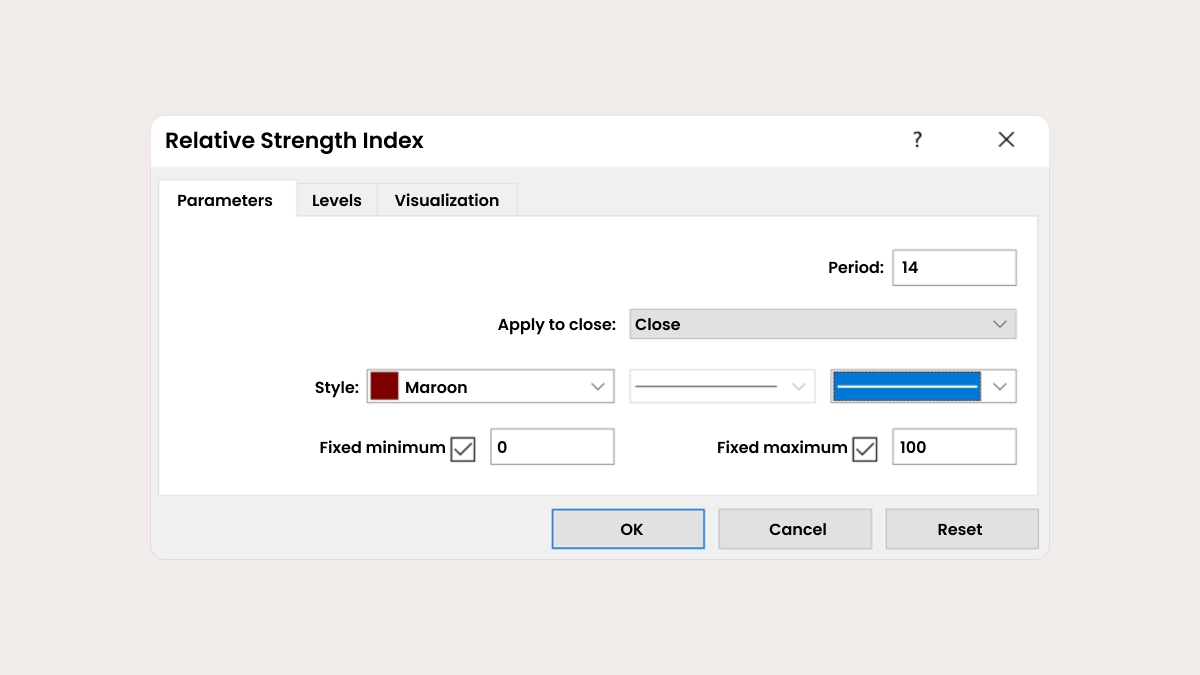

To add the RSI to a chart, click Insert – Indicators – Oscillators.

By default, MetaTrader sets 14 as the number of periods. You can change this parameter if you want to. Short-term traders normally use the 9-period RSI, while those who prefer longer-term trades choose the 25-period RSI. All in all, the smaller the period, the more fluctuations the indicator will make.

How to interpret the relative strength index

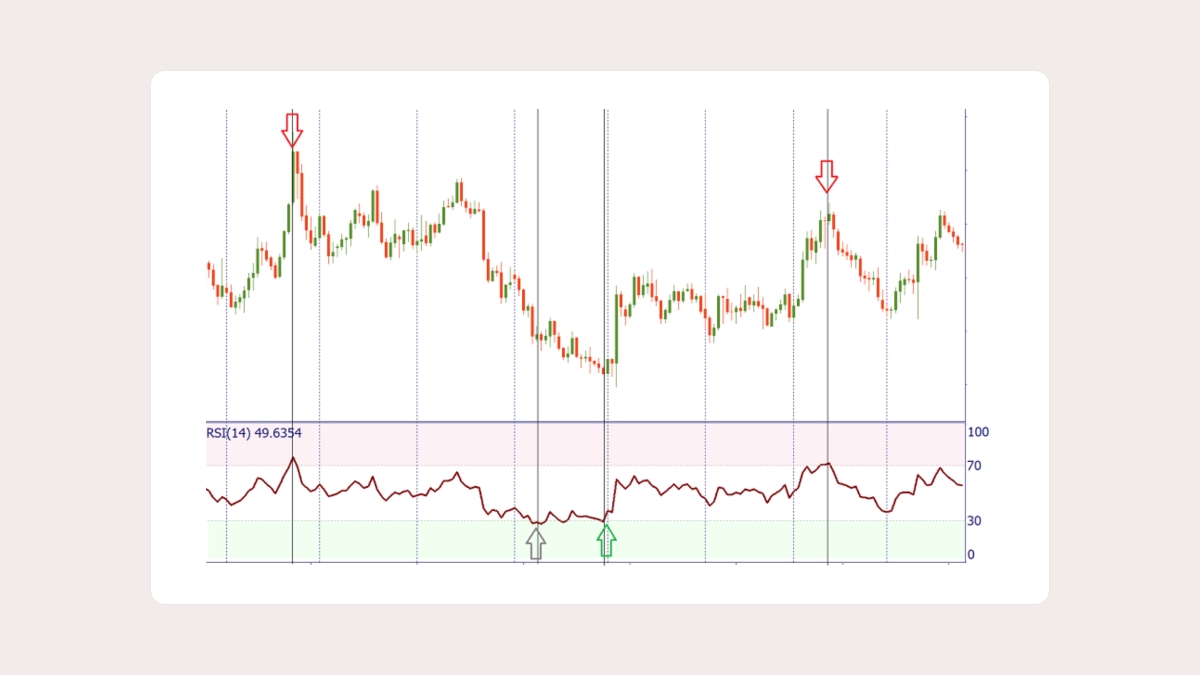

The readings of the indicator fluctuate between 0 and 100. You can also add a middle line at 50. If the RSI is above this point, momentum is considered up and it makes more sense to look for opportunities to buy. The RSI dropping below 50 is a sign of a new bearish market trend, so consider opening sell trades.

Whether the market is overbought or oversold

Like other oscillators, the RSI helps determine when an asset is overbought or oversold. Watch the levels of 70 and 30. If the RSI rises above 70 boundary, it means that the market is overbought and may correct down. If the RSI falls below the 30 line, the asset is oversold and may retrace to higher levels.

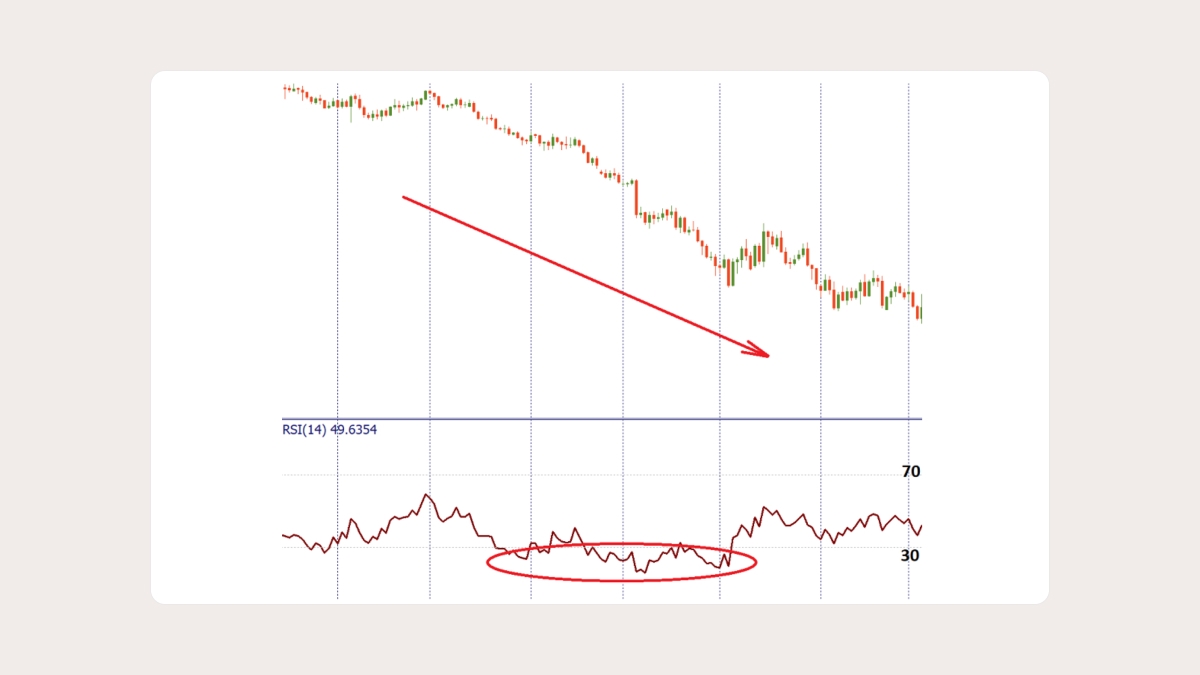

This approach is not suitable for trading in strong trends when the RSI may stay overbought or oversold for long periods of time. If you have evidence that there’s a strong trend on the market, consider selling when the RSI is oversold in a downtrend, and buying when the RSI is overbought in an uptrend.

All in all, the quality of RSI signals increases when you follow only those signals that are in the direction of the trend when the indicator leaves critical levels. For example, you can buy during an uptrend when the RSI gets above 30.

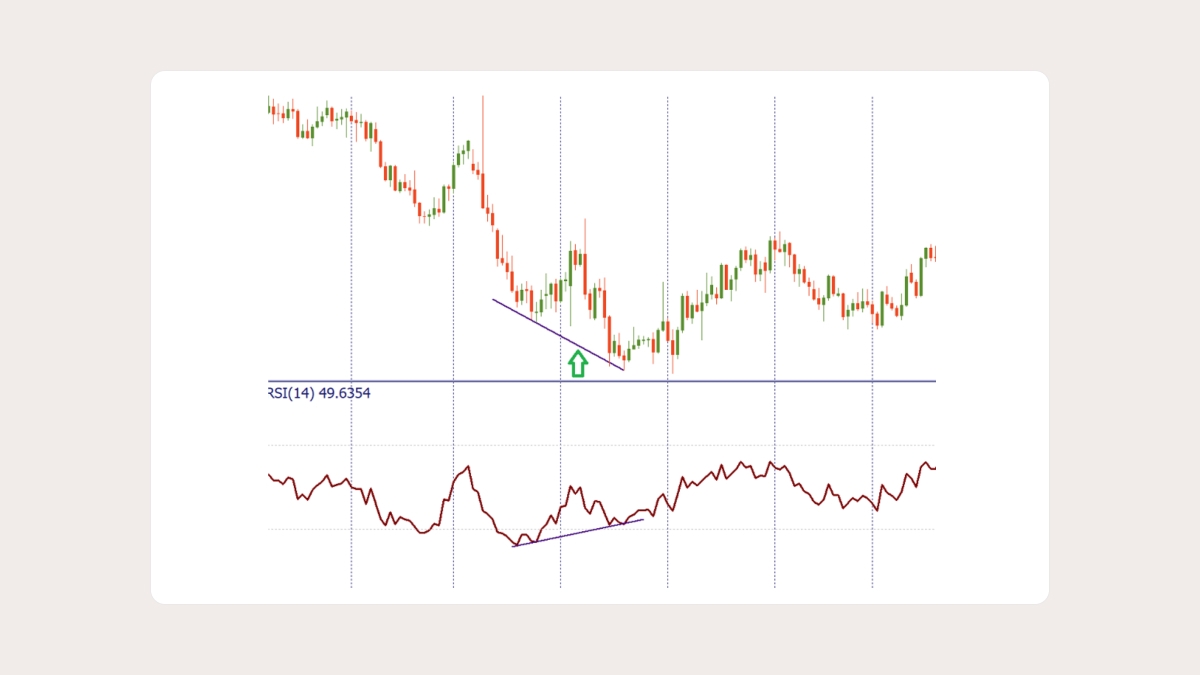

The market reversal

Moreover, the divergence between the RSI and the price may warn of a market reversal. When the new high of a price is not confirmed by the new high in the RSI, this is a bearish divergence, which is a negative signal. When the price forms a lower low but the minimum of the RSI is higher than the previous one, this is a divergence in the bulls’ favor.

The RSI is often used in combination with another oscillator, the MACD. While the RSI measures price change in relation to recent price highs and lows, the MACD measures the relationship between two EMAs. Together the RSI and the MACD represent a powerful combo.

Conclusion

A competent trader should know what the RSI is and how to use it. Make sure that your analysis isn’t built solely on RSI but comprises the study of price action as well as other technical indicators. Remember that the signals of the relative strength index are most reliable when they conform to a long-term trend.