Where to find CPI data?

Consumer prices account for a majority of overall inflation. You might notice we use the term “inflation rate” instead of CPI in our economic calendar. These terms are interchangeable and both refer to the same data.

There are two versions of this report: inflation rate and core inflation rate. The difference is simple: the core indicator excludes food and energy prices due to their volatility.

Additionally, there are other indicators of inflation such as the producer price index (PPI), the wholesale price index (WPI), and the retail price index (RPI). Still, the CPI tends to be more impactful in terms of forex trading.

How is the CPI used?

As we said, the consumer price index is the most common gauge of inflation. It shows governments, businesses, and citizens how prices have changed in their country’s economy over some period. Based on the CPI, retailers predict future price increases, employers calculate salaries and the government defines cost-of-living increases.

When inflation rises, purchasing power declines, meaning a consumer can buy fewer goods and services for the same price in their currency than before. When inflation falls, purchasing power increases, and a consumer can buy more goods and services for the same price, which means each unit of currency (e.g. one dollar) is worth more.

Most relevant for traders, central banks make policy decisions based on the consumer price index. Thus, not only the actual CPI data, but even traders’ expectations for the CPI release increase volatility on the forex market.

Rising prices can lead central banks to increase interest rates, which will result in appreciation (increase in value) of the national currency.

Alternatively, when inflation becomes too low, the central bank is likely to reduce interest rates, which will inevitably lead to depreciation (decrease in value) of the domestic currency.

How does the CPI impact forex trading?

The release of the consumer price index tends to cause massive movements on the forex market. Note that it refers only to countries whose currencies are liquid.

Based on liquidity, there are three currency categories in global forex trade: major currency pairs, minor currency pairs, and exotic currencies. Major currencies are the most popular and liquid. These include the US dollar, the British pound, the euro, the Japanese yen, the Australian dollar, and the Canadian dollar. Thus, it’s important to pay closer attention to the CPI releases of the US, UK, Canada, EU, Japan, Australia, and New Zealand.

How to trade on the CPI

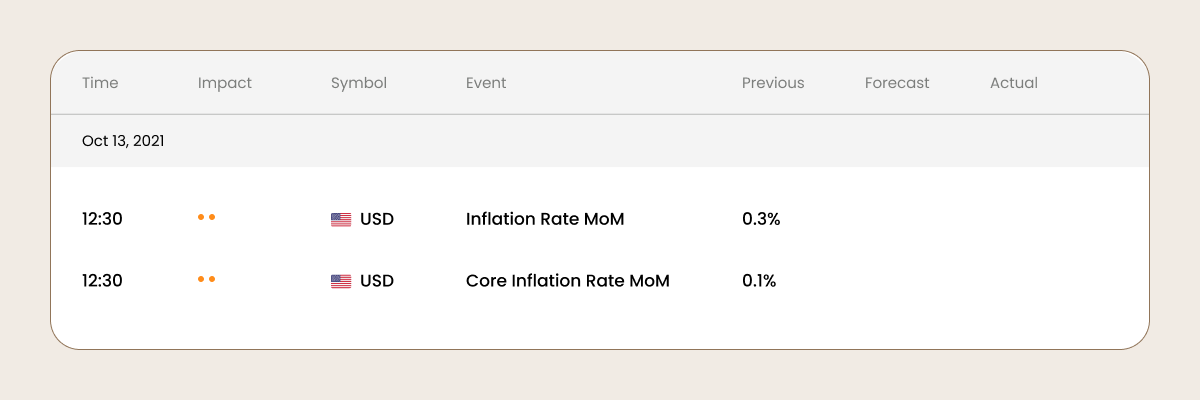

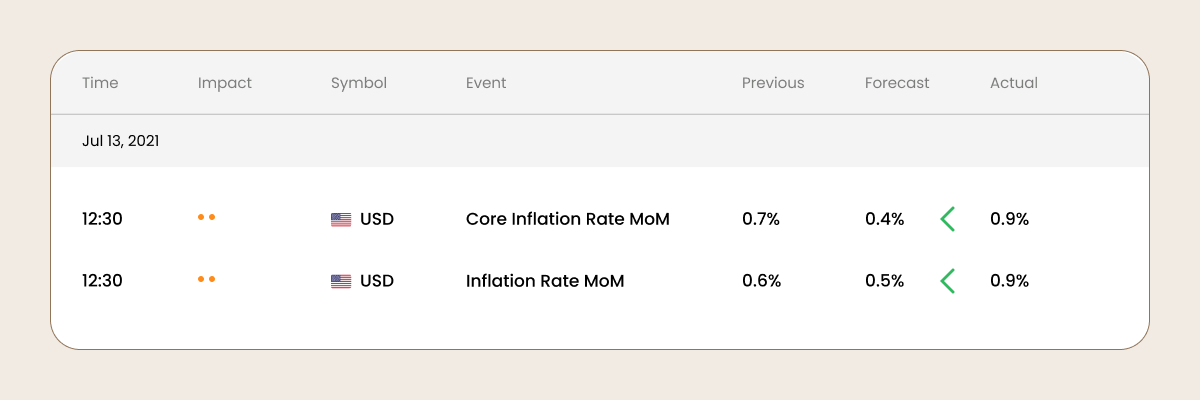

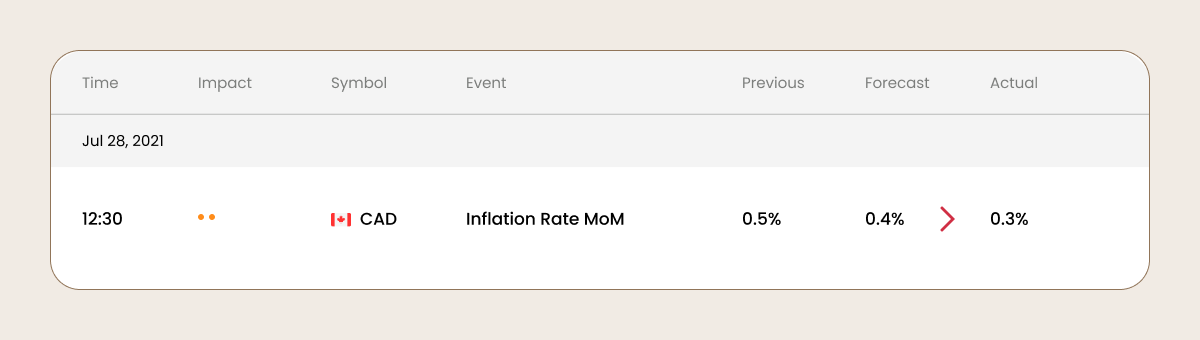

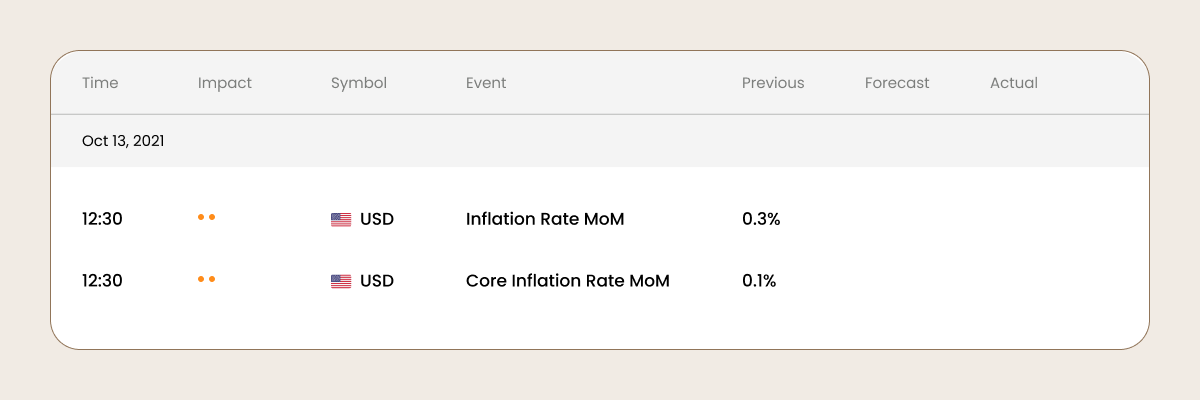

Traders compare the forecast with the actual CPI data, which you can check in the economic calendar.

If the actual CPI data is greater than expectations, the currency will rise.

If the actual CPI data is lower than forecasted, the currency will drop.

It’s a good idea to check the time of the next CPI release in advance, open the charts showing the currency of the country issuing the CPI, and monitor price movement. That way, once it’s out, you’ll be fully prepared, with your finger on the proverbial trigger.

What about stock markets? Are they affected by the CPI? Stock markets generally aren’t driven as much by CPI numbers, but sometimes they can be! Higher inflation and consequently higher interest rates can force economic activity to slow. Therefore, as a rule, stock markets favor a lower CPI that lets consumers keep spending and businesses to continue investing even more.

If the concept of CPI feels a bit abstract, don’t worry! It all starts to click once you grasp the trading basics. Our beginner course breaks things down in a practical way, so you can connect economic data like the CPI to real trading decisions.