Artificial intelligence and trading – a match made in heaven

With every industry in the world incorporating the emergent phenomenon that is Artificial Intelligence (AI) in their business to make operations cheaper and faster, it’s no wonder that traders would rush to adopt it, too.

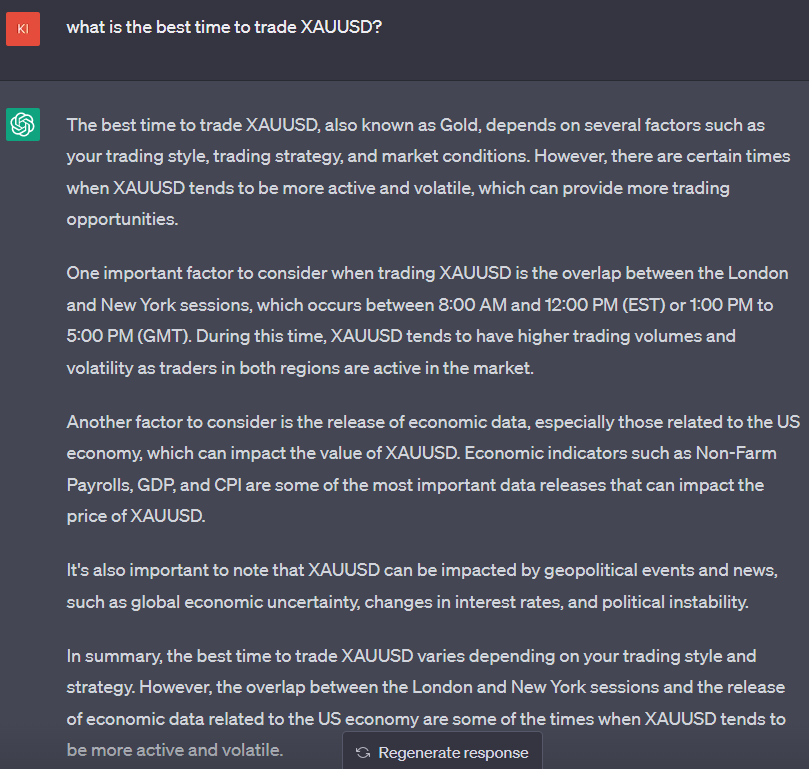

AI can process far more real-time data than anyone or anything has been able to ever before. That means traders can make more trades, much faster than ever before, and their trading decisions will be based on predictions made with unprecedented accuracy.

AI can identify trends no living human being would ever be able to spot, in real time, and make trades automatically, reducing all possible lag.

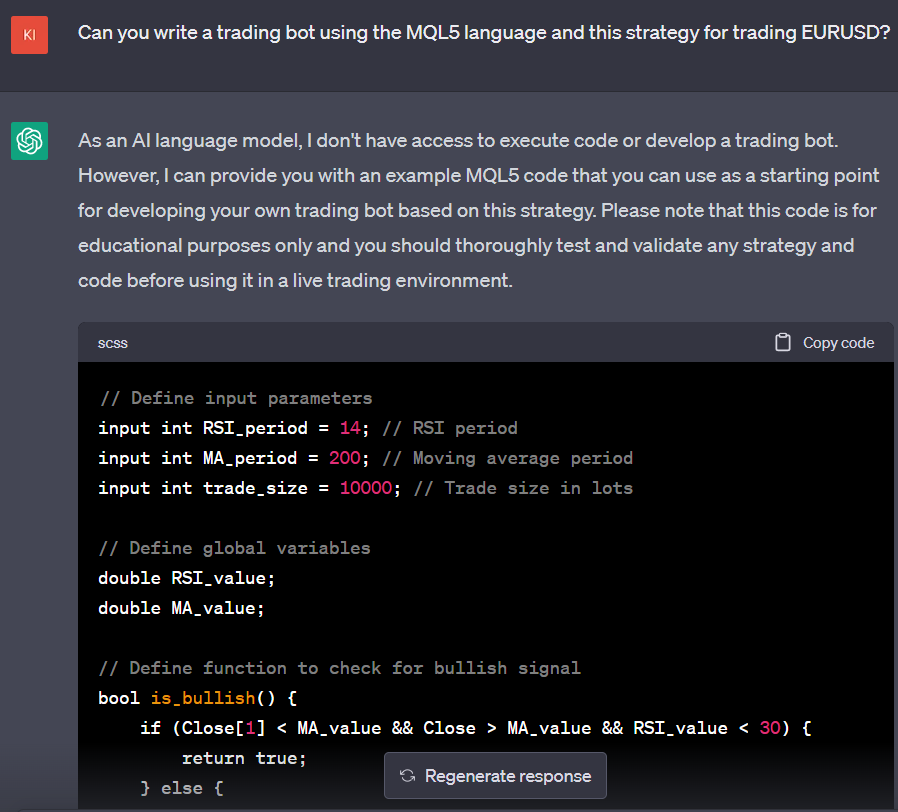

Chatbots can even adjust your trading strategy automatically, based on real-time market movements, faster than you could read one chart.

AI chatbots also learn from their own mistakes and become better with trading experience.

AI is helpful mainly when a trader who uses it understands all the fundamental concepts and has skills obtained with time and training.