MACD trading strategies

To fully leverage the potential of the MACD indicator, traders can employ a few sophisticated strategies described below.

Signal line crossovers

A signal line crossing happens when the MACD line cuts through the signal line. These crossings can have two different meanings:

Buy signal

When the MACD line rises and crosses the signal line, it shows a bullish momentum.

Sell signal

Conversely, if the MACD line crosses the signal line going downward, it is a bearish impulse and a potential selling opportunity.

However, in volatile or sideways markets, these intersections can give false signals. It’s always a good idea to add more technical indicators or confirmation signals to increase the crossovers’ reliability.

Zero line crossovers

A zero line, also known as a center line, divides a chart into a positive and a negative area. It is formed by a combination of fast and slow EMA lines. The MACD line moves around this line. When the MACD line crosses the zero line, traders can confirm the direction of the prevailing trend.

When the MACD line crosses the zero line upwards, negative momentum switches to positive, which may indicate a potential uptrend.

Simply put, a trader can buy when MACD rises above the zero line and hold the position until the price returns below 0.

Crossing the zero line downwards indicates the move gives a potential downtrend.

A trader can sell when MACD drops below the zero line and close the trade when the price rises above zero again.

Remember, this approach works best for strong market movements and is less efficient in a sideways market, where it may cause losses.

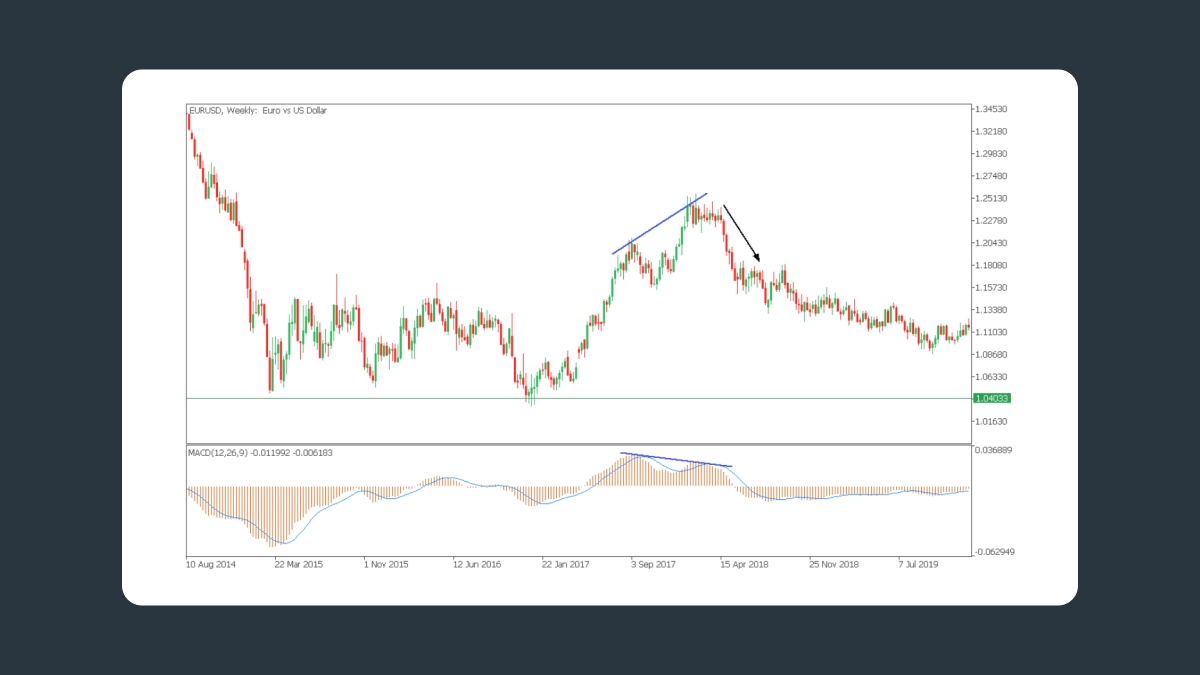

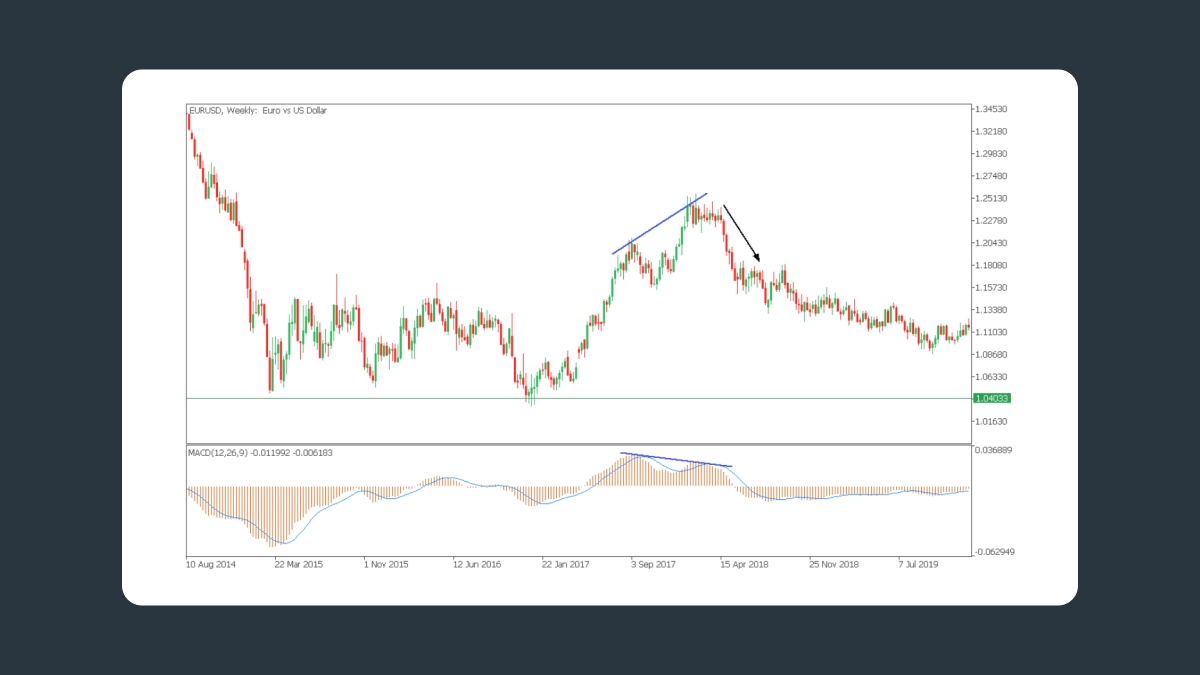

Divergence analysis

The divergence between the MACD indicator and the asset price can be an early signal of an upcoming trend reversal. Finding such divergences can be very informative when you want to understand the underlying market dynamics.

Buy signal

A bullish divergence occurs when the price shows lower lows, while on the MACD, these values represent higher lows. This demonstrates that the bearish momentum is weakening, and an upward reversal may be possible.

Sell signal

A bearish divergence happens when the price reaches higher highs while the MACD indicator captures lower highs. This divergence signals that bullish momentum is weakening, and an downside reversal is possible.

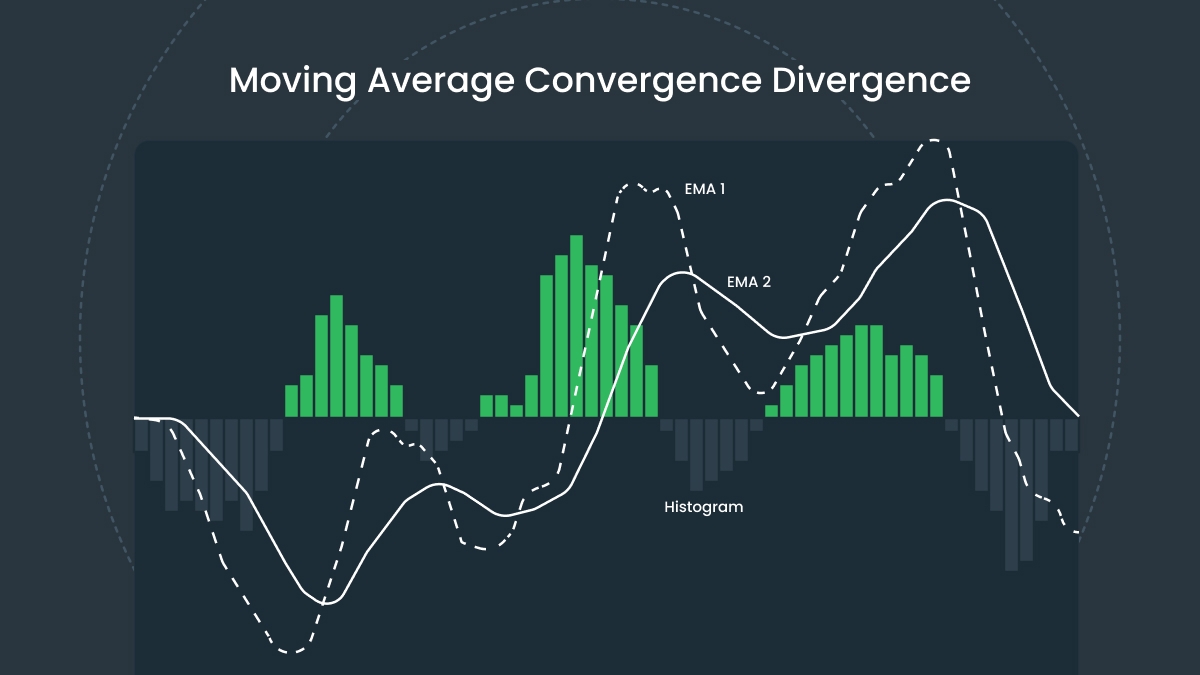

MACD histogram analysis

The histogram visually illustrates the difference between the MACD and signal lines. Its behavior helps traders interpret the strength of momentum and possible changes to make better decisions about their entry and exit points.

Combining MACD with other indicators

While MACD is a potent tool, it can be even more effective when combined with other indicators.

Relative strength index (RSI)

While the MACD defines the direction and momentum of a trend, the RSI demonstrates overbought and oversold conditions. Combining these two indicators will help you better analyze the market by filtering out fake signals and confirming promising opportunities.

Exponential moving averages (EMAs)

Incorporating longer-period EMAs, such as a 200-day EMA, can help you better determine the overall trend direction. Traders might consider MACD signals that align with the direction indicated by these EMAs to increase the probability of successful trades.

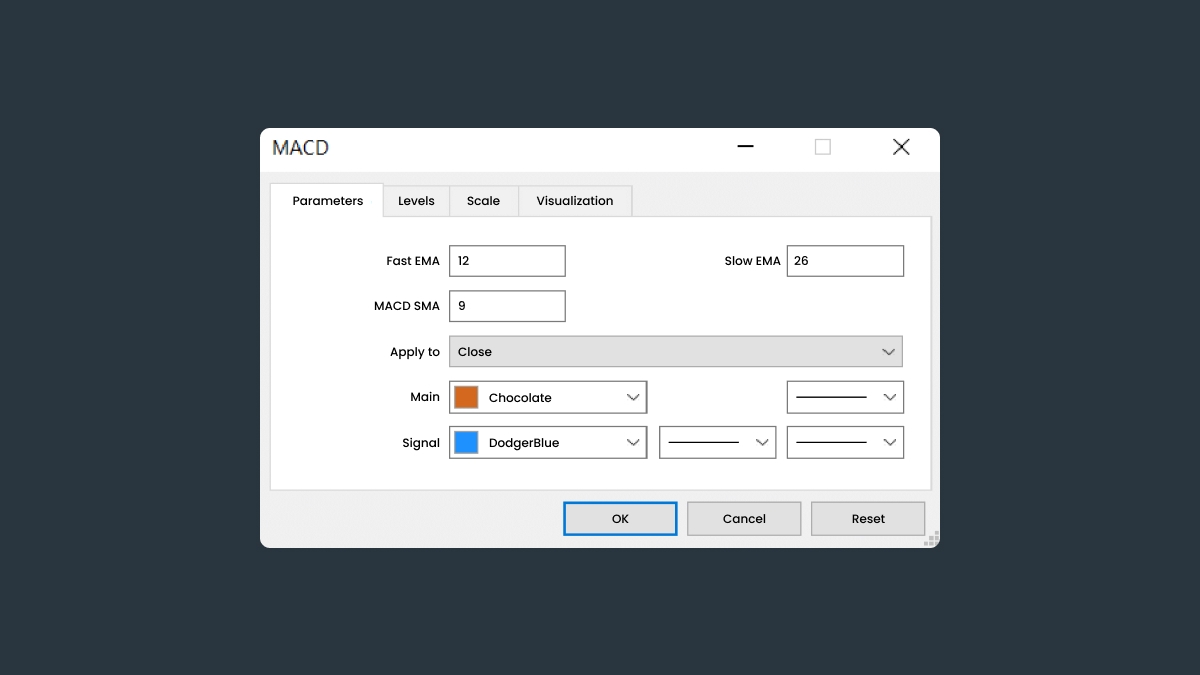

How to optimize MACD settings

The default MACD settings are 12, 26, and 9, which work well in most situations. However, you may edit these values to tailor the indicator for your specific trading style and timeframes:

Short-term trading

If you choose settings like 5, 35, and 5, you will get more responsive signals, suitable for intraday trading.

Long-term trading

Conversely, if you choose higher settings, you can smooth out noise and align with extended investment horizons.

You may want to test different values on a demo account to identify those that will work for your specific trading instruments and strategies.