The news represents great profit opportunities for Forex traders. By news, we mean various economic data releases. Every major economy regularly publishes statistics like GDP, inflation, unemployment rate, etc. If you trade Forex during the times of these releases, you have a chance to catch a price swing, making a profit.

However, we must warn you that potentially big profits always come hand in hand with bigger risks – volatility spikes during these periods. If you don’t have a solid trading plan for a particular event, it’s better not to engage in any trades and wait for a calmer moment.

In this tutorial, we will get to the bottom of trading news and economic releases.

How to read the economic calendar

The markets tend to price in the economic outlook. As a rule of thumb, economic growth means future prosperity, which equals strengthening the country’s currency. Traders look for these upticks in economic growth (positive economic releases) as they usually offer opportunities to jump on an uptrend. In contrast, economic reports showing a slack in economic growth result in the weakening of the country’s currency.

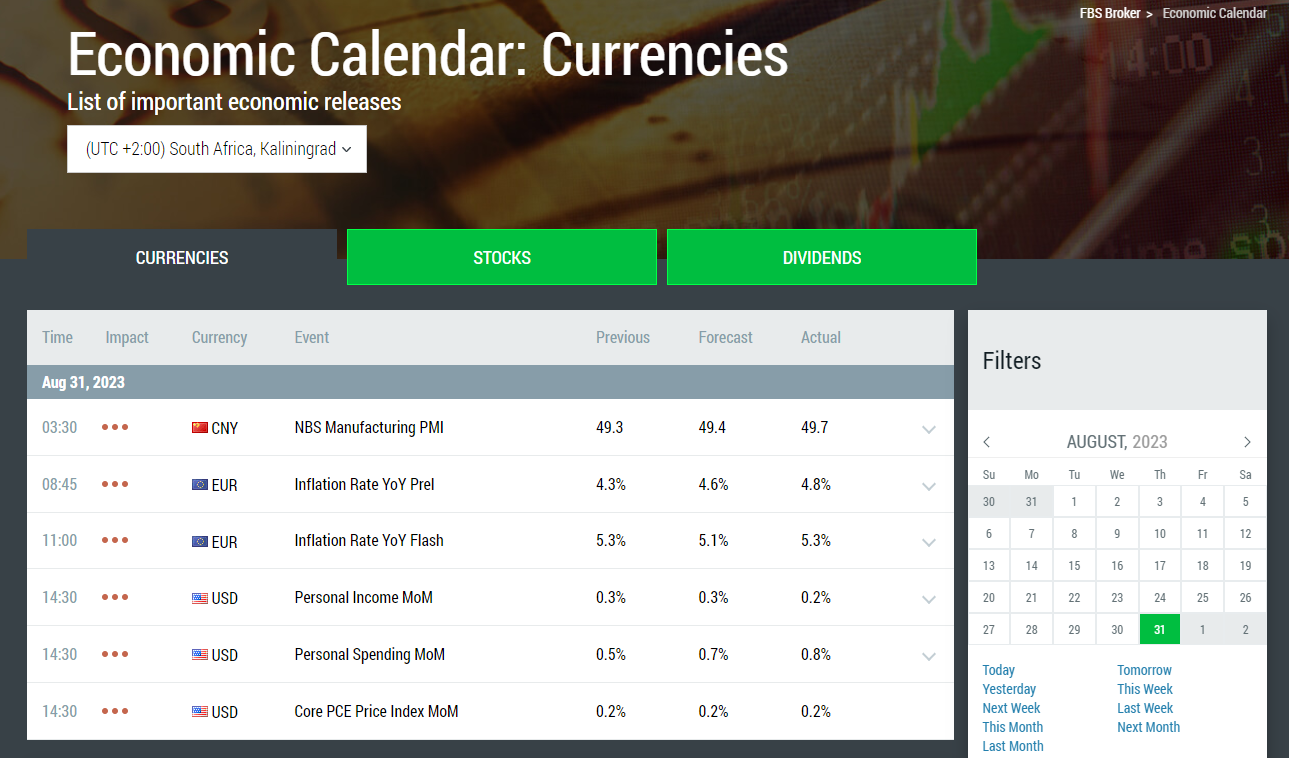

An economic calendar is a key tool that helps traders not to miss important events. Its structure is simple. Economic indicators are listed in a table for a chosen period of time. You see three data columns next to a particular indicator: previous reading, forecast, and actual reading. Before the release, the calendar contains only the previous reading and the forecast. The actual reading appears at the time of the release.

The forecast is a so-called “consensus” forecast, which is the expectations of the market (banks and high-profile investors). If the actual data is better than the forecast, the currency appreciates. The currency tends to depreciate if the actual figures are worse than expected.

In most cases, “better” means higher than forecast, and “worse” means lower than forecast. However, this rule has several exceptions, such as unemployment claims and unemployment rate: the lower these indicators are, the better for the currency in question.

We should also note that a number that is close to the forecast level usually has negligible effect. The bigger the divergence between the actual and the forecast number, the bigger the impact on the market.

Previous readings are not as important as forecast ones.

Important tips

Focus on the most important news that could affect the market most;

Wait for the publication of the chosen release, and then dive into trade according to the plan;

Remember that the market’s reaction to a news release usually lasts from 30 minutes up to 2 hours;

If your fundamental reasoning and technical analysis fail and the market’s reaction to the news doesn’t match your expectations, do not go against the market. The market is always right;

Don’t rush into a trade. Wait for strong signals and their confirmation.

And now, let’s study three strategies you can use to trade the news.

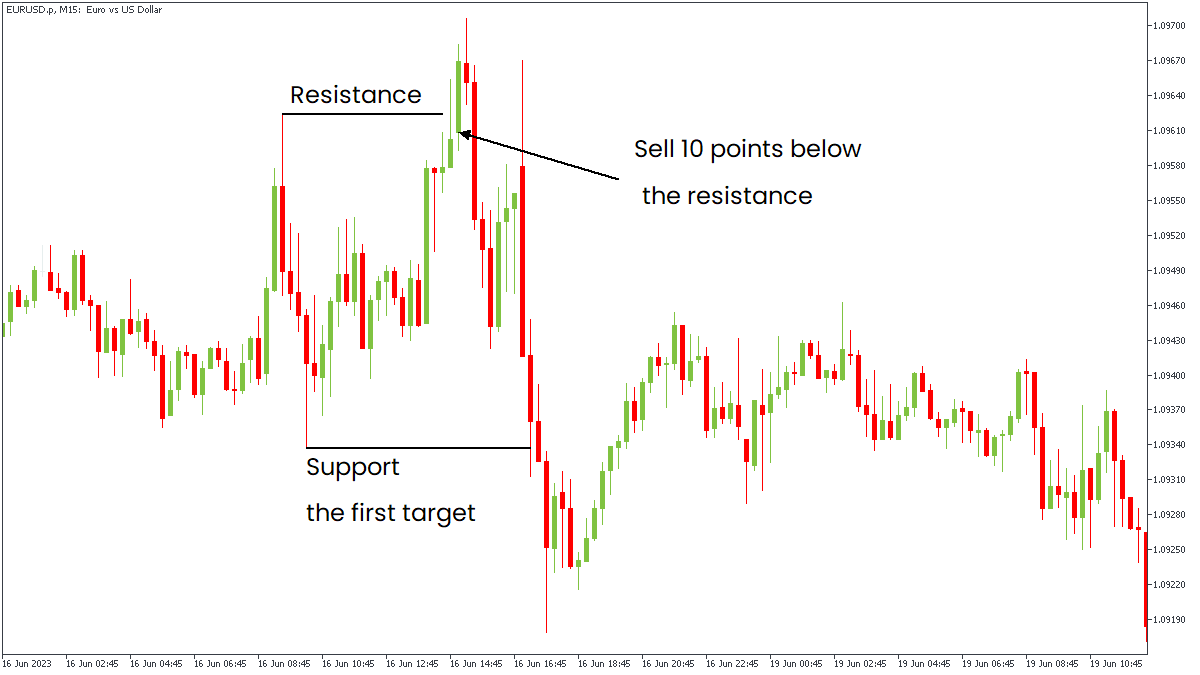

Slingshot strategy

Before opening a position, identify support and resistance. These are your “cut points”: you can close the position at these levels if prices go against you. Define Stop Loss distance before the publication of the news report.

To reduce the risks during the highly volatile period of news releases, you can do the following: once you notice on an H1 chart that the price is 10 points below the key support, put a BUY STOP entry order 10 points above that key level. This way, you can benefit from the market’s reversal after some initial swing.

The same is true with a short position (Selling): once you notice on an H1 chart that the price is 10 points above the key resistance, put a SELL STOP entry order 10 points below that key level.

If prices go in your favor, but you’re not sure how long such a move will last, you may scale out your position (partially close it). If the prices keep going in the same direction, you can close part of the trade every 50-100 points or put a Trailing Stop.

Trading on expectations

The idea is very straightforward: buy the rumor, sell the fact. You should understand the market’s sentiment in relation to a particular currency and open position according to the direction of this sentiment.

Short-term sentiment is defined by economic news. If market participants expect the data to exceed the consensus forecast, they will consider this. For example, if market participants wait for the Reserve Bank of Australia (RBA) to raise its interest rate, the exchange rate of the AUD will rise before the bank’s meeting (the probable rate hikes will be well priced in by the time the actual RBA meeting takes place). Once the RBA raised its interest rate, those market participants who had been ready for such a turn of affairs would probably start selling AUDUSD, and the pair would actually decline after the rate hike.

To be better off in such a situation, you need to:

Be up-to-date on forthcoming events and economic releases;

Keep track of the recent economic releases and watch for the market’s reaction;

Know the correlation between various news releases (for example, how retail sales may influence GDP, PPI, and CPI. If retail sales surpass the market’s expectation, we may wait for a strong GDP release).

Trading spikes

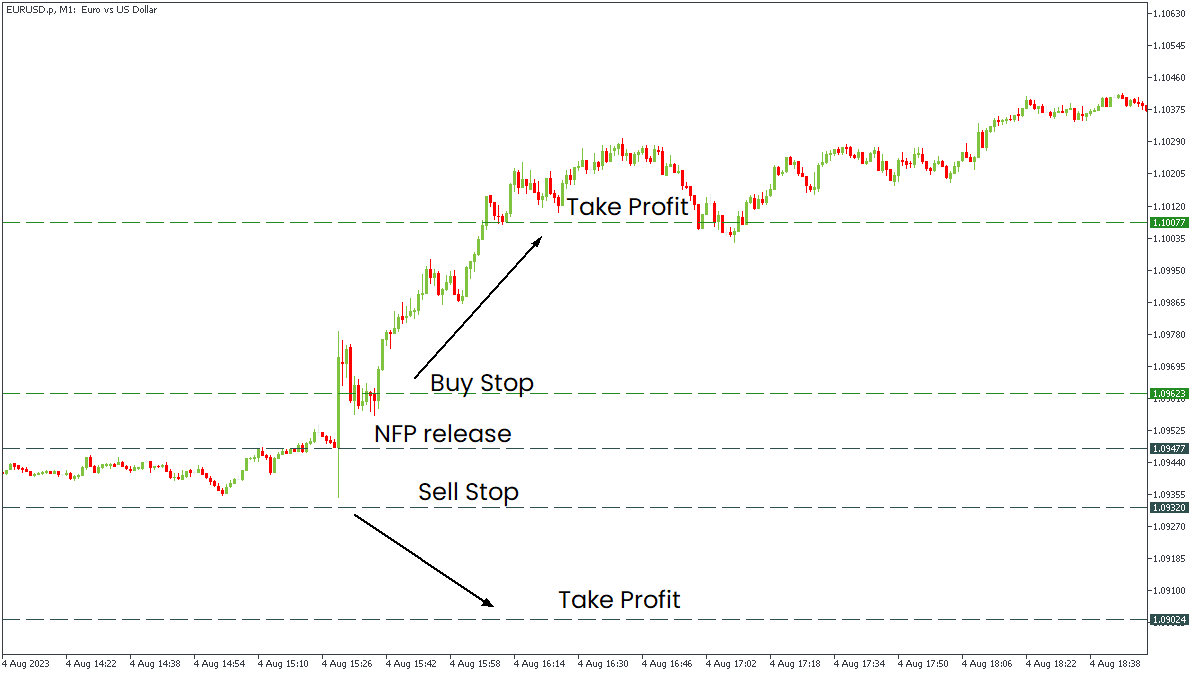

This strategy can be applied when trading on important news or economic releases such as Nonfarm Employment Change (Nonfarm Payrolls – NFP). It’s one of the most influential statistical indicators published by the Bureau of Labor Statistics. It measures the number of jobs created in the nonfarm sector in the US in a month. NFP is usually released on the first Friday of every month.

Nonfarm Payrolls may send lots of shockwaves to the charts. That’s why many traders prefer to wait for the dust to settle (they don’t rush into the trade right after the announcement) and trade when they grasp a better idea of the effect the release has produced.

Your actions before the release:

Look at the range in which the pair is trading at the present moment, then 5 minutes before the release, place two pending orders (BUY STOP – 150 points above the current price and SELL STOP – 150 points below the current price);

Place Take Profit orders 300-450 points above and below the current price. You can place your Stop Loss at the current price after one of your trades opens.

In case of a favorable outcome, you can close the deal with profit (don’t forget to cancel another order). If you are lucky, you can make money from both your bets (if prices change their direction and go higher before falling or go lower before rising).

If the outcome is negative, the prices will move in one of the directions: open the first order but fail to reach your take profit. Then, prices will move in the opposite direction, opening another order but won’t reach the Take Profit level either. If you have a Stop Loss, your risks will be limited.