It is time to unravel the mystery behind the two powerhouses of finance: traders and investors. Many people mistakenly use these terms interchangeably. However, understanding the fundamental differences between them is crucial for anyone navigating the labyrinths of financial markets.

This eye-opening article reveals how traders make lightning-fast moves to capitalize on short-term gains while investors strategically build long-term portfolios for lasting prosperity.

Key takeaways

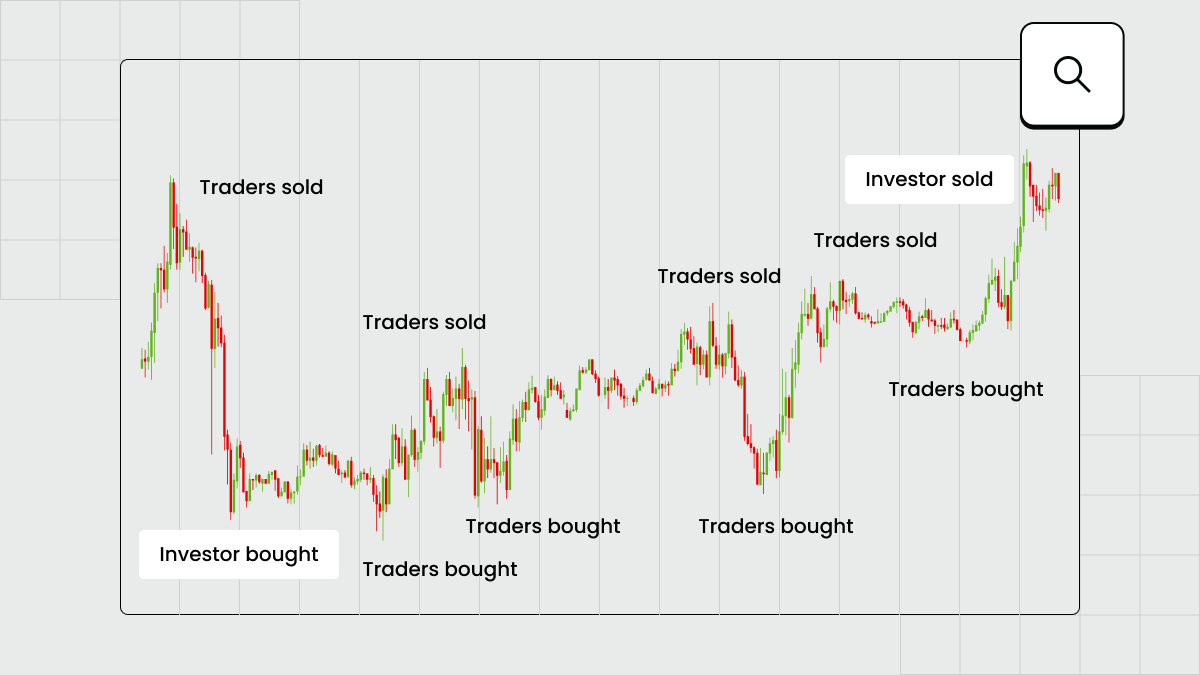

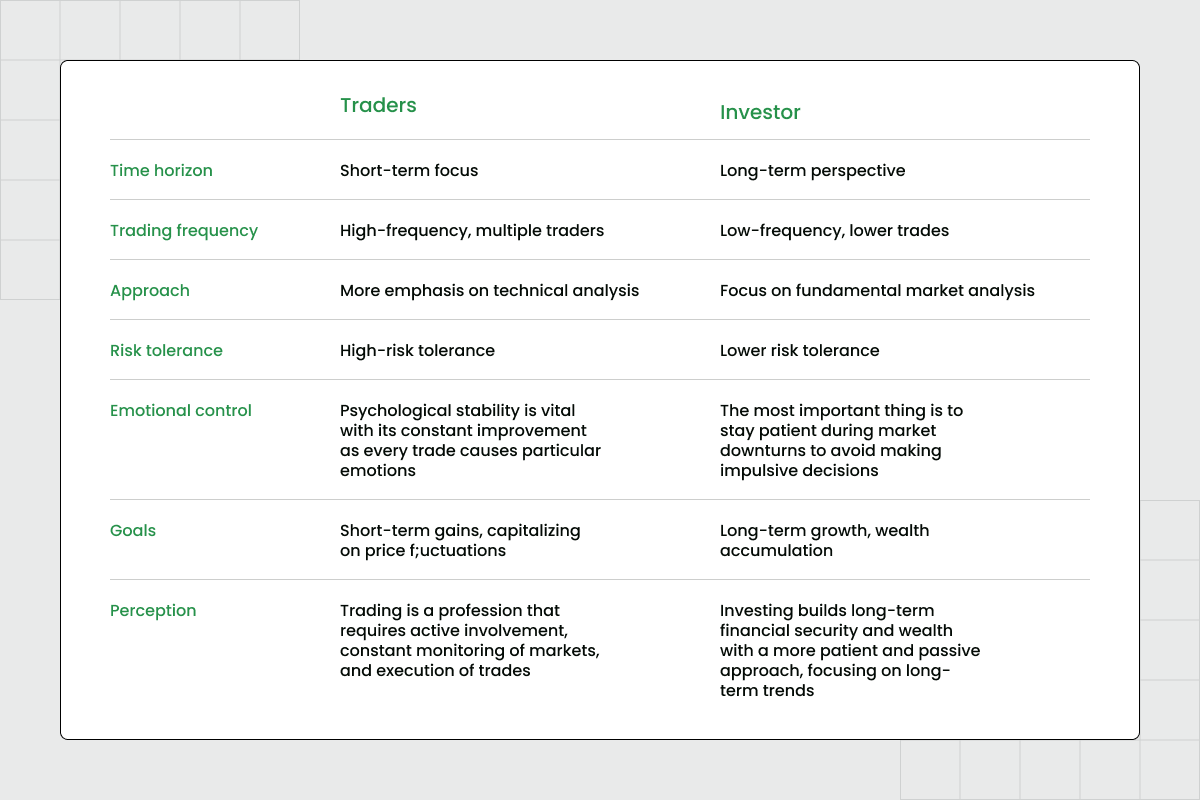

- Time: Traders profit from short-term price fluctuations by actively buying and selling securities. Investors take a long-term approach and focus on the fundamental value of assets.

- Strategy: Traders rely on technical analysis, charts, and market indicators, while investors analyze a company's financial health, growth potential, and industry trends.

- Emotional control: Traders need to be emotionally stable to handle the pressure of short-term market fluctuations. Investors can take a more relaxed approach, as their focus is on long-term trends.

- Risk management: Traders use leverage and derivatives to amplify potential gains (and losses), while investors prioritize diversification, asset allocation, and a balanced portfolio.

- Monitoring: Traders constantly analyze the market, price movements, and news events throughout the day. Investors take a more hands-off approach, monitoring their investments periodically.

Traders – seekers of financial opportunities

Let’s explore the definition and characteristics of traders, their roles in the financial markets, and the tools and technologies they employ in their activities.

Definition and characteristics of a trader

Traders are individuals or entities that actively operate in the financial markets by buying and selling various financial instruments with the primary goal of generating profit. They focus on short-term transactions that align with market trends.

Traders possess a variety of distinctive characteristics that set them apart as unique participants in the market and enable them to thrive in this dynamic and competitive environment:

Risk taking. Traders consistently face high levels of risk in their practice. They are ready to take on these risks and use calculated chances to take advantage of market opportunities as they appear.

Quick decision making. To effectively navigate the constantly changing market conditions, traders must be ready to make prompt decisions. This ability to analyze information swiftly and take decisive action is crucial for capitalizing on time-dependent opportunities.

Adaptability. All successful traders demonstrate an outstanding level of adaptability. They adjust their trading approaches in response to changing market conditions. Such flexibility allows traders to stay ahead of market trends and make profitable trades.

Emotional control. Every day, traders face a rollercoaster of emotions as they navigate the ups and downs of the financial markets. Professional traders have exceptional emotional control that enables them to make wise decisions even in situations of uncertainty.

Risk management. Traders skillfully manage risks, recognizing capital protection’s importance in market volatility and unpredictability. They employ various techniques and develop comprehensive risk management plans to adhere to.

Regular market analysis. Successful trading means a commitment to regular market examination. To make reasonable decisions, traders analyze news, economic indicators, geopolitics, technical indicators, price patterns, and market trends.

Trading discipline. Trading is a process that demands strict discipline and a structured approach. Traders view it as a profession that requires stability and adherence to a specific schedule in order to be successful.