Introduction

To successfully execute trades and control risks in a volatile market, every trader needs to know about limit orders. A limit order allows traders to set a specific price at which they are willing to buy or sell an asset. By defining price levels, traders can maintain control over their trades and avoid unfavorable price movements. Understanding the different types of limit orders is essential to implementing well-planned trading strategies. Limit orders allow control over the price of an execution, but they do not guarantee that the order will be executed immediately or even at all.

What are limit orders?

A limit order is a type of order that allows traders to buy or sell an asset at a predefined price or better. Unlike market orders, which execute at the best available price, limit orders ensure price control, making them an essential tool in volatile markets.

Types of limit orders:

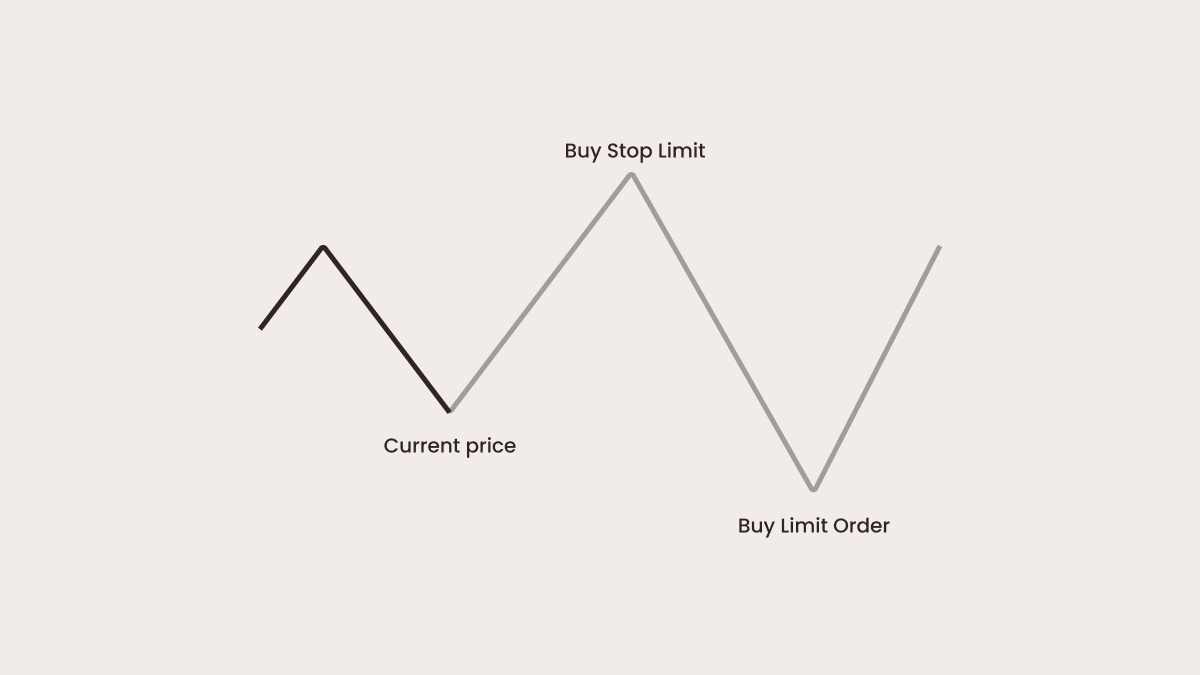

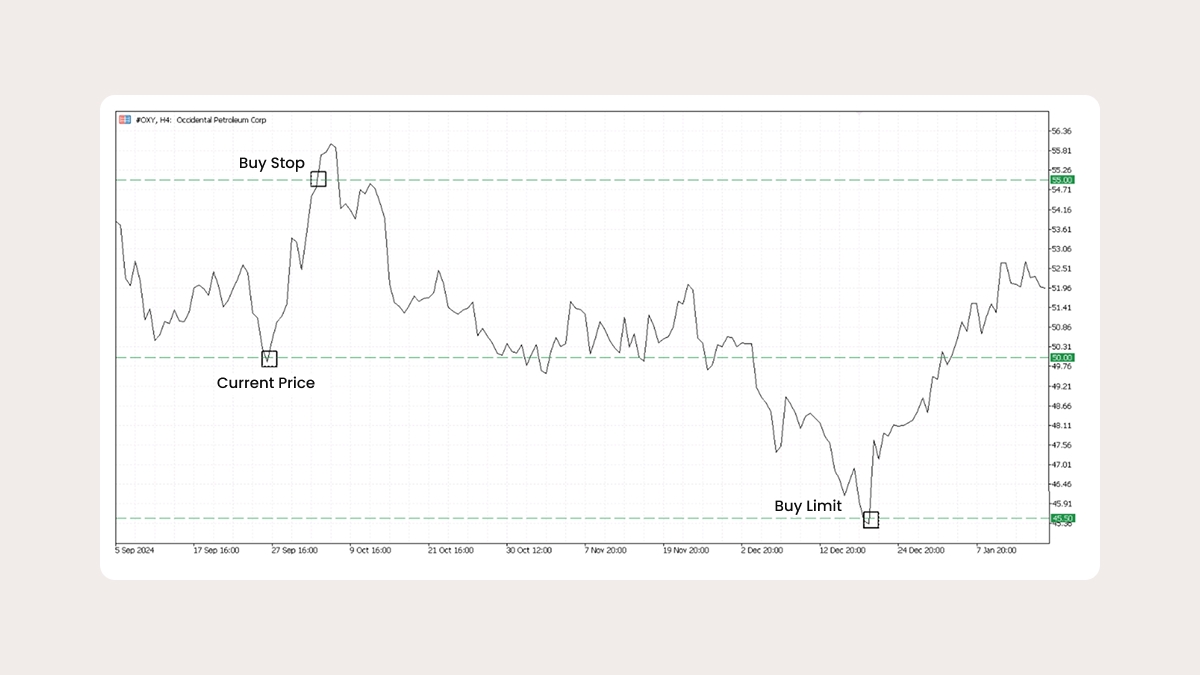

Buy limit order – This order is placed below the current market price. It ensures that the trader buys the asset only at the specified price or lower.

Sell limit order – This order is placed above the current market price. It ensures that the trader sells the asset only at the specified price or higher.

Stop limit order – A combination of a stop order and a limit order, this type allows traders to specify both a stop price (trigger point) and a limit price (execution price).

Understanding these different types of limit orders helps traders optimize their entry and exit strategies, ensuring better risk management and improved trade execution.